Making Value for America: Embracing the Future of Manufacturing, Technology, and Work: Summary (2015)

Chapter: MAKING VALUE FOR AMERICA

SUMMARY

|

MAKING |

|

Embracing the Future |

NATIONAL ACADEMY OF ENGINEERING

OF THE NATIONAL ACADEMIES

THE NATIONAL ACADEMIES PRESS

Washington, D.C.

Concerned about the challenges facing US manufacturing—and excited about the prospect of dramatic change in this sector—the National Academy of Engineering (NAE) undertook a study to identify best practices along the manufacturing value chain and to recommend public- and private-sector actions to make the United States an effective environment for value creation. The NAE was joined in supporting this study by Gordon E. Moore, Robert A. Pritzker and the Robert Pritzker Family Foundation, Jonathan J. Rubinstein, Edward Horton, and by a number of US companies—Boeing, Cummins, IBM, Qualcomm, Rockwell Collins, and Xerox.

In conducting the study, the NAE committee reviewed economic statistics, gathered extensive information from experts and published research, and sought input from nearly 100 research managers, directors of manufacturing operations, entrepreneurs, policymakers, and others. The committee’s report, Making Value for America, explains its findings and the actions it recommends. This booklet summarizes those findings and recommendations.

Globalization, developments in technology, and new business models are changing the way products and services are conceived, designed, produced, and distributed around the world. These forces are also transforming work and operations in manufacturing. Increasingly, business is not simply about “making things” but about “making value.” Companies engage in an entire system of activities—conducting research and development, integrating software into products, and offering services across a product’s lifecycle—to ensure that they are delivering value to their customers.

To prosper in the face of these changes, US companies must take action to strengthen our nation’s ability to make value—by adopting best practices to improve innovation and productivity, by training their workforces, and by examining their business models to identify ways to add value. Communities, governments, and educational institutions also have roles to play. By improving the skills of current and future workers, strengthening local innovation networks, and encouraging the long-term investments that lead to new products and businesses, they can help ensure that the United States thrives amid global economic changes and remains a leading environment for innovation.

Concerned about growing competition from companies and workers overseas, American business and government leaders have focused considerable attention on the need to strengthen US manufacturing in order to support innovation and job creation. But framing the debate on manufacturing only in terms of whether it is done in the United States or overseas misses the big picture.

The way that products and services are conceived, designed, produced, and distributed is changing. Increasingly, it is important not just to “make things” but to “make value.” Making value is the process of using ingenuity to convert resources into a good, service, or process that contributes additional value to a person or a society. Businesses are focusing on their entire value chain of activities—from research and development to product design to services offered over the lifetime of a product—to ensure that they are making value for their customers.

The concept of making value is an effective way to examine the success and the failure of individuals, businesses, communities, and nations. And it is an important concept for Americans to keep in mind today, as the economy faces a number of disruptive changes. Advances in technology and changing business practices in manufacturing and across the economy are continuing to reshape the labor market in dramatic ways. Automation and streamlined operations are likely to supplant an increasing number of workers in a variety of occupations. The effects on society could be severe unless new types of jobs are created to replace the ones that have been lost. By some estimates, almost 50 percent of US jobs are at risk. Meanwhile, increased globalization and the development of emerging economies have intensified competition. While US-based businesses remain among the best in the world in terms of research and output of many high-tech manufactured goods and services, several other countries are catching up quickly.

Developments in 3-D printing, digital manufacturing, and crowdsourcing are allowing entrepreneurs to respond to customer needs more quickly and to design and build prototypes at lower cost.

The same forces that are causing these disruptions—technological advances, reorganized business processes, and shifts in growth throughout the global economy—also open up new and exciting opportunities for making value. Even as technological advances eliminate some jobs, they create others and offer companies new ways to understand their customers’ needs and increase the demand for their products in response. Emerging economies offer not just competition but also new markets for US exports.

The individuals, companies, and countries that understand these changes and act on them—responding to the challenges they present and taking advantage of the opportunities they offer—will be the ones best able to prosper in the 21st century. If the United States wants to retain and attract facilities along the manufacturing value chain, as well as the jobs that come with them, it needs to ensure it has an environment that supports continuous development of capacity for innovation, manufacturing, and services across the lifecycle of products.

For business and policy leaders to take effective action in response to a changing manufacturing sector, it is important to start with a holistic understanding of the value chain. The value chain refers to the full range of interlinking activities that businesses and workers perform to bring a product from its conception to the end of its life—conducting research and development (R&D), designing the product, manufacturing it, integrating software, and offering services throughout its lifecycle. The value chain for a single product may span many locations and economic sectors and involve work by multiple companies. The “value” in value chain signifies that at each step in the chain of activities, companies take the opportunity to add value to a product.

The story of the iPod, one of the most successful consumer products in recent history, illustrates how Apple, its suppliers, and many other companies maximized value at all points along the value chain. Although the iPod was built with the capacity to store far more songs than other music players available at the time, that was not the only way Apple created value. In conceiving of and designing the iPod, Apple thought carefully about what was most important for listening to music and created a simple, intuitive interface that made it easy for users to hear exactly what they wanted. The designers created value by connecting users with their music in a way that was almost primal.

Another way Apple added value was by developing software that integrated the device with computers. Suddenly it was simple to load music on to the player; the music library on the iPod was automatically synced with the music library on the computer just by connecting the two devices. Yet another way Apple added value was by developing the iTunes music store. By integrating the music player with a music listening and buying service, Apple amplified the iPod’s usefulness considerably. Other companies were also part of the iPod’s value chain. For example, the development of Toshiba’s 1.8-inch hard drive—the smallest at the time—was a critical component in bringing the iPod to life.

These features and functionality live on in the family of successful products—including the iPhone and the iPad—that Apple built on the foundation laid by the iPod.

The Manufacturing Value Chain in Transition

Three forces are transforming businesses and work in manufacturing value chains: presenting new challenges, offering new opportunities, and demanding increased agility.

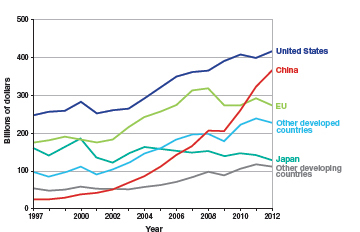

Globalization. Perhaps the defining feature of the US and world economy during the past several decades has been globalization. Globalization has increased competition as companies from around the world contend in the same markets as US-based companies. Chinese-based businesses now lead the world in total output of manufactured goods, with $2.3 trillion compared to $1.8 trillion from US-based businesses. In high-tech manufacturing, US-based businesses still lead, but competitors in developing countries are rapidly increasing their output. As a result, the global share of high-tech manufacturing output contributed from US-based businesses dropped from 34 percent in 2002 to 27 percent in 2012.

Output of High-Tech Manufacturing Industries for Selected Countries, 1997-2012

SOURCES: Data HIS Global Insight, World Industry Service database (2013); National Science Board, Science and Engineering Indicators 2014, National Science Foundation.

Because globalization allows companies to distribute activities along the value chain in locations around the world in search of efficiencies and profit, it has also had consequences for American jobs. As foreign countries develop their supply chains and R&D and technological capabilities, more value chain activities are likely to migrate abroad. If the United States wants to retain and attract facilities along the manufacturing value chain, it needs to ensure that it has an environment that supports continuous development of its innovation and manufacturing capabilities as well as its ability to offer lifecycle services for products.

Globalization also offers great opportunity in the form of expanding overseas markets for US products. As the rest of the world—especially the emerging economies—continues to develop, the demand for innovative goods and services will steadily rise. This export market will offer tremendous potential for US companies in coming decades, but only if companies and policymakers recognize this potential and develop the capabilities to take advantage of it.

Advances in digital technologies and automation. The ongoing digital revolution is a second major factor driving change in the US and global economy. Perhaps no sector has been more deeply affected by this revolution than manufacturing. Developments such as automation and computer-aided design, and other enhancements in engineering and production, have dramatically increased productivity, reduced lead time, and improved responsiveness to customer needs and preferences. An automobile manufacturing plant can now be run by one-third as many people as it took in 1965, while the quality, sophistication, timely delivery, and variety of vehicles have all dramatically improved.

New technologies and capabilities are helping companies reduce expenses and add value all along the value chain. Digital simulation is used to represent and analyze prototypes, saving time and money on the testing of physical models and specimens. Additive manufacturing—also known as 3-D printing—is reducing prototyping costs by enabling production in smaller runs. Virtual reality immersion labs let customers try out possible designs before they are finalized. And crowdsourcing and developments in data collection and analytics have opened up a wealth of possibilities for companies to better understand customer needs and desires and discover new market opportunities.

In addition, many businesses are creating new offerings by integrating software systems, data, and manufactured products. In the automotive industry, for example, the software and information content incorporated into vehicles—such as global positioning systems, vehicle-to-vehicle communications, and automated parking—has greatly expanded to improve performance and provide additional services to customers. In the pharmaceutical industry there is great opportunity to provide apps and services to help patients take their medications correctly.

The reengineering of business. A third factor transforming manufacturing in the United States and around the world is the use of new ways of operating that improve productivity and speed. One such change has been design for manufacturability: the idea that engineers should pay more attention to manufacturing considerations when designing new products. An even more profound change has been the transition from mass production to lean production. Important principles of lean production are “just in time”—meaning that people and things move through the operations at the exact time

In 2012, GE Appliances became a dramatic example of “reshoring”—bringing back to the United States manufacturing that had been offshored. At the company’s new assembly lines in Kentucky, labor and management have worked closely together to make the reshored operations a success by implementing lean manufacturing principles, such as empowering operators to solve problems that arise during manufacturing. In a recent announcement that GE is entering into an agreement with Electrolux to take ownership of the reshored appliance manufacturing facility, GE executives credit the American siting of the business and its adoption of lean production processes as adding greatly to its appeal to the purchaser. (Photo courtesy of General Electric Company.)

they are needed with very little waiting—and instant diagnosis and resolution of any production problems. However, despite the benefits of lean production—a recent study of 30,000 manufacturing establishments found that those following all lean principles were more successful by a variety of measures—a relatively small percentage of US manufacturers have adopted most of these principles.

Another shift that offers potential benefits to companies and customers is the movement toward integrating hardware, software, and data. For example, Fitbit makes devices that keep track of users’ activity throughout the day, communicating that information to a website where the data are analyzed. The devices integrate hardware with software, but their real value arises from the data they collect. The data help users track their progress toward fitness goals, the quality of their nightly sleep, and the effectiveness of their diet and nutritional plans. And as more and more users deposit data on activity patterns and related factors, it will be possible to use the information in new ways, which will in turn increase the value of the data. Interconnected systems of hardware, software, and data offer a whole new area in which innovation can grow and evolve, presenting countless opportunities for creating value.

FINDING NEW WAYS TO MAKE VALUE

For decades Kodak and Fujifilm created products —mainly film and the materials needed to develop it—that had great value for individuals and society. But the rise of digital photography changed the value of film; and if the companies were to continue to thrive they had to find new ways to make value. Kodak and Fujifilm responded to this challenge in different ways, with very different results.

Throughout the 1970s and 1980s, Kodak increased its focus on film and either exited or failed to enter other areas that could have helped it adapt to the coming crash of the film market. As digital photography continued to rise, the company experimented with products to augment its film business, but nothing developed into a major market. After filing for bankruptcy in 2012, Kodak shed many of its product lines and emerged in 2013 as a much smaller firm. Kodak’s decline had damaging economic effects on its home city of Rochester, New York, as the number of people employed by the company dropped from 62,000 in the 1980s to fewer than 7,000 in 2012.

In contrast, Fujifilm moved much more decisively into different product lines. It harnessed its expertise in dealing with the antioxidant chemicals used in photography to develop antioxidants for cosmetics. And it developed optical films for use with flat-panel screens. Fujifilm became so accomplished at developing new technologies that in 2012 and 2013 Thomson Reuters named it one of the 100 most innovative companies in the world. The company remains strong and profitable, even though film now accounts for only a tiny percentage of its sales.

It is not only companies that fare better or worse depending on how well they succeed in making value, but also individuals, communities, states, and nations. Consider North Carolina, which had to find new ways to make value when its textile and tobacco industries relocated many jobs overseas. Instead of stagnating, the state has been generating new high-tech jobs in analytics, electronics, and pharmaceuticals. In a sense, the state had been preparing for this transition since the 1950s, when it established Research Triangle Park to foster

Durham, North Carolina, one of the metropolitan centers in the state’s Research Triangle region.

innovation in the region. Local government worked with industry and academia to create an environment for innovation that could attract high-tech companies and take advantage of the crop of talented students graduating from nearby universities. Now the Research Triangle area is home to a rapidly growing number of companies making electronics components, designing software, and developing nanomanufacturing techniques.

Globalization, technological advances, and reengineered operations have dramatically changed employment across the manufacturing value chain. Manufacturing has become more efficient and productive, reducing the demand for production workers. According to the Bureau of Labor Statistics, total manufacturing employment in the United States dropped from approximately 19 million in 1980 to 11.5 million in 2010. The overall employment decline during the past three decades is due in part to jobs being shipped overseas and in part to increasing efficiency that allows fewer workers to produce more.

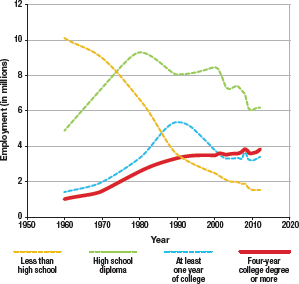

But the decrease in production jobs does not tell the whole story of employment in manufacturing or in the larger value chain. Manufacturing job losses were concentrated in the portion of the workforce without a high school diploma. Indeed, while manufacturing employment in this part of the workforce declined from 10 million to less than 2 million between 1960 and 2010, manufacturing employment requiring at least a college degree increased by more than 2 million jobs during the same time.

Trends in Employment in the Manufacturing Sector by Education, 1960-2012*

*Employment data points between 1960 and 2000 are decadal. From 2000 to 2012, data are annual. SOURCE: IPUMS-USA, University of Minnesota, www.ipums.org.

In short, the nature of work across the value chain is changing, shifting the education and skills that are in demand. Manufacturing jobs that consist of handling and attaching parts by hand or other repetitive tasks are largely disappearing. Production work in the United States is shifting to require more specialized skills in such areas as robotics-controlled maintenance, advanced composites, and radio-frequency identification of parts. Similar trends are occurring in other areas of the economy—such as transportation, retail, education, and health care—and are

Advances in computing power, machine learning, and robotics are enabling machines to scan a scene, discover patterns, and manipulate objects, making possible the development of Google’s self-driving car. In the next 20 years innovations such as truck-packing robots will start to displace the jobs of workers who perform this and other manual tasks. Unless these workers advance their skills, they are likely to see lower wages and declining job prospects.

likely to continue as advances in robotics and software enable machines to perform more complex tasks.

Given the trend toward the integration of hardware, software, and data, individuals who know how to design software and write code will find their skills in heavy demand. Another skill set likely to be in demand is machine learning—the ability to design software and systems that can “learn” from the data collected. Those who work at various intersections of fields—such as designers of user interfaces, who must understand both the engineering aspects of products and user psychology—are also likely to be well-positioned.

The best bet to aid the workforce that has been left behind by changes in manufacturing and the broader economy is to advance their skills and to attract and create skilled jobs. Access to higher education and training, including certification programs and flexible pathways to degrees, is especially important for lower-skilled workers who are most affected by the changes.

The United States has many strengths that can support innovation along the manufacturing value chain, including a world-leading higher education system, a diverse workforce, and entrepreneurial spirit. But it also faces challenges that need attention in each of these areas.

Higher education. As the nature of work changes across the value chain, access to higher education and training is important, especially for lower-skilled workers who are most affected by technological developments and changing business models.Unfortunately, this part of the workforce also faces greater barriers to acquiring higher degrees. The rising cost of college puts a strain on low-income families, and students from these families often lack the social supports to help them complete degree programs. Only 30 percent of college students in the lowest income quartile complete their degrees—less than half the completion rate of the average student.

Diversity. A growing body of evidence supports the notion that diversity, in terms of demographic characteristics, thought, and culture, is important for team performance and overall business outcomes. Currently, however, women and members of many minority groups are underrepresented in manufacturing, high-tech services, and entrepreneurships of all types. Improving the participation of women and people of diverse races and socioeconomic backgrounds in science, technology, engineering, and mathematics (STEM) education and hiring will be important to create innovative teams in businesses. In addition, while historically one of the nation’s great strengths has been its ability to attract talented students and workers from around the world, there is evidence that many foreign students are now choosing to return to their home countries—a loss of cultural diversity that is not favorable for the US economy.

Access to long-term, low-cost capital. Entrepreneurial activity in the United States has been declining for the past 30 years, a worrisome trend because new businesses are critical for job creation. Research has found that entrepreneurs face a critical stage of growth once they are ready to move into early commercialization where significant capital investments are needed but are not available in the United States. As a result, many potential startup companies with valuable technologies cannot bring them to market. In addition, venture capitalists have largely shifted away from investing in fields with longer time horizons. Lack of long-term, low-cost capital is especially damaging for innovation in areas such as energy, biotechnology, and materials science.

To prosper in the 21st century, US companies and communities must take action to face these challenges and to strengthen the country’s capacity for innovation along the manufacturing value chain. Businesses can take individual action to improve their competitiveness, and a variety of stakeholders have important roles to play to ensure that the United States has a robust innovation ecosystem—including federal, state, and local governments; economic development organizations; educational institutions; and research organizations.

ADOPT BUSINESS BEST PRACTICES

Individual businesses can create value by coordinating their value chains and optimizing their operations to improve innovation, productivity, and speed to market.

- Businesses should examine their business models to search for missed opportunities to leverage distributed tools and coordinate manufacturing and product lifecycle services. Radical gains come from producing new solutions not provided by others. The ability to provide such solutions requires understanding customer needs and desires and developing an innovation strategy that differentiates a business’s offerings from those of its competitors.

- Manufacturers should implement principles and practices, such as lean production, that enable employees to improve productivity and achieve continuous improvement.

- Researchers should further investigate and codify best practices for innovation and develop effective methods of teaching them.

ENSURE THAT AMERICA HAS AN INNOVATIVE WORKFORCE

The education and skills of the US workforce must be improved. Higher education and training are increasingly important to create an effective ecosystem for value creation.

- Businesses should establish training programs to prepare workers for modernized operations and invest in advancing the education of their low- and middle-skilled workforce. Employers gain large returns from such investments, in some cases as high as 100 to 200 percent.

- Businesses, local school districts, labor, community colleges, and universities should form partnerships to help students graduate from high school, earn an associate’s or bachelor’s degree, and take part in continuing education in the workplace.

- Congress and state legislatures should create tax credits or other incentives for businesses to invest and be involved in education programs that provide students and displaced workers with the knowledge and skills needed for higher-paying careers.

- Middle schools, high schools, universities, and local communities should provide opportunities for students to participate in team-based engineering design experiences and to learn to use emerging digital and distributed tools that facilitate entrepreneurship.

- Universities and community colleges should improve the cost-effectiveness of higher education. Universities and colleges should facilitate students’ transfer from two-year community college programs, thus reducing the costs of a four-year degree. They should also seek opportunities to adopt new methods of teaching—for example, online tutorials and credit-by-examination approaches—to support learning while reducing students’ costs.

- University rating organizations should track and make transparent the cost-effectiveness of degrees at higher education institutions.

- Businesses, industry associations, and higher education institutions should work together to (1) establish national skills certifications that are widely recognized by employers and count toward degree programs, and (2) improve access for students and workers to gain these certifications.

- Businesses should implement programs to attract and retain diverse workers with respect to gender, race, and socioeconomic background.

- Universities and community colleges should act to improve the inclusion of traditionally underrepresented groups in science, technology, engineering, and mathematics (STEM) fields as well as other disciplines required for value creation, such as market analysis and design.

- Congress must reform immigration policy to welcome and retain high-skilled individuals with advanced STEM degrees, especially those educated in the United States. Currently these potential innovators are being turned away by a counterproductive immigration system.

STRENGTHEN LOCAL INNOVATION NETWORKS

The United States needs to encourage new business creation to stimulate innovation and job creation. Local innovation networks are needed across the nation to foster the creation of new businesses and to connect entrepreneurs and new businesses to the individuals, investors, tools, and institutions in their region and around the world that they need to grow. In addition, federal programs that contribute to innovation should be directed to facilitate the adoption of best practices and to help young businesses grow.

- Researchers, the National Science Foundation, and other research funders should put a priority on understanding why the rate at which new businesses are created has declined in the United States during the past three decades.

- Metro area and state governments, industry, higher education, investors, and economic development organizations should partner to create local innovation networks. Any one of these stakeholders can spearhead the creation of such a network. In addition to providing resources for innovators, these networks should support them by sharing best practices and helping small businesses learn how to export.

- Metro area and state governments should optimize their decision-making process for urban development investments and siting to facilitate the creation of innovation networks. Currently in most metro areas, these decisions are the responsibility of individual units with different missions, such as transportation or housing. To nurture innovation networks these units need to coordinate their decisions.

- Federal agencies and interagency offices such as the Advanced Manufacturing National Program Office should convene stakeholders to identify and spread best practices for value creation, particularly for software, user interfaces, and high-tech services where best practices are less developed than production.

- The Small Business Administration should focus on helping young businesses become globally competitive. In particular, it should help new businesses connect with a local innovation network; if one does not exist, it should encourage the formation of one.

EASE THE FLOW OF CAPITAL INVESTMENTS

US fiscal policy must offer incentives for long-term capital investments. Increasing emphasis on short-term returns on investment has led to a decrease in the long-term planning and funding necessary to support many promising innovations.

- Congress should modify the capital gains tax rates to incentivize holding stocks for five years, ten years, and longer. The current tax structure, which does not provide incentives for investments longer than one year, encourages a preference for quicker returns over the long-term investments needed to create new products and businesses.

- Congress should make the research-and-development tax credit permanent to allow businesses to have longer-term horizons in their investment decisions.

- Federal agencies should facilitate industry and government cooperation to identify shared opportunities to invest in precompetitive research in long-term, capital-intensive fields such as next-generation batteries and biotechnologies, for which low-cost capital is scarce.

PROVIDE AN INFRASTRUCTURE THAT ENABLES VALUE CREATION

US infrastructure must be upgraded, for both traditional systems—such as electricity and ports—and modern information systems. A world-leading infrastructure will attract businesses and facilitate the creation of new ones in the United States.

- Local governments, state legislatures, and Congress should invest in a world-leading wireless infrastructure. Infrastructure that makes it easier for individuals and machines to communicate and process information is essential for future innovation along the value chain.

- Federal information technology and computing programs should facilitate access to a world-leading infrastructure for high-performance computing, which can drive improvements across the value chain and enable entirely new types of products and services.

IMPROVE WAYS TO MONITOR AND SUPPORT MANUFACTURING VALUE CHAINS

Federal programs and statistics should be modernized to account for the complex relationships among manufacturing, information, and services across value chains. As businesses traditionally known for manufacturing move into software and service production, and as companies known for creating software and online services produce manufactured goods, it is increasingly difficult to meaningfully delineate operations as providing mainly goods or services.

- Federal agencies should develop methods of accounting for the complex relationships among manufacturing, services, and information and consider multiple ways of collecting and organizing national statistics. The current method—classifying manufacturing, services, and information activities in distinct industries based on the primary activity at an establishment—is an increasingly unrealistic depiction.

- Federal programs that contribute to innovation, such as the Advanced Manufacturing National Program Office, the Manufacturing Extension Partnership, and the Advanced Manufacturing Partnership, should be directed as appropriate to partner with software and service providers as well as manufacturers. Software and service providers are an integral part of manufacturing value chains. The administration and agencies should optimize current programs to ensure that they support all activities across the value chain.

MAKING VALUE FOR AMERICA FOUNDATIONAL COMMITTEE

NICHOLAS M. DONOFRIO, Chair [NAE]

Fellow Emeritus, IBM Corporation

Principal, NMD Consulting LLC

ASHOK AGRAWAL

Managing Director, Professional Development and Director, Education and Career Development

American Society for Engineering Education

ERIK K. ANTONSSON

Corporate Director of Technology

Northrop Grumman Corporation

LAWRENCE D. BURNS [NAE]

Professor of Engineering

Practice University of Michigan

STEVE HOOVER

Chief Executive Officer

Palo Alto Research Center (PARC)

CHRISTOPHER JOHNSON

Management Sciences Lab Manager

General Electric Global Research

DEAN KAMEN [NAE]

President

DEKA Research & Development Corp.

LINDA P.B. KATEHI [NAE]

Chancellor

University of California, Davis

THERESA KOTANCHEK

Chief Executive Officer

Evolved Analytics LLC

ANN L. LEE [NAE]

Senior Vice President, Genentech

Head, Global Technology Development, Roche

ARUN MAJUMDAR [NAE]

Jay Precourt Professor and Senior Fellow

Precourt Institute for Energy

Stanford University

BRAD MARKELL

Executive Director

AFL-CIO Industrial Union Council

J. JERL PURCELL

Executive Director, HD Growth Program Cummins Inc.

JONATHAN J. RUBINSTEIN [NAE]

Former Executive Chairman and CEO Palm, Inc.

DAN SWINNEY

Executive Director

Manufacturing Renaissance

CHAD SYVERSON

J. Baum Harris Professor of Economics

Booth School of Business

University of Chicago

JOHN J. TRACY [NAE]

Chief Technology Officer Boeing

SHARON J. VOSMEK

Chief Executive Officer Astia

NAE Staff

KATE S. WHITEFOOT, Senior Program Officer

AMELIA S. GREER, Associate Program Officer

PENELOPE J. GIBBS, Senior Program Associate

CAMERON H. FLETCHER, Senior Editor

More information about this report can be found at www.nae.edu/Projects/mdi/mva.aspx.

Copyright 2015 by the National Academy of Sciences

THE NATIONAL ACADEMIES™

Advisers to the Nation on Science, Engineering, and Medicine

The nation turns to the National Academies—National Academy of Sciences, National Academy of Engineering, Institute of Medicine, and National Research Council—for independent, objective advice on issues that affect people’s lives worldwide.