Financial Incentives to Encourage Development of Therapies That Address Unmet Medical Needs for Nervous System Disorders: Workshop Summary (2015)

Chapter: 2 Improving Market Protection

Highlights

- Companies consider many elements when deciding whether to pursue a given drug development project, including the likelihood that the drug will work, costs, and projected financial returns (Meeker and Reddy).

- Decision-making paradigms require that companies calculate the relative value of each potential drug, but this process is not straightforward and contains many uncertainties. Drug-related patents are typically filed early during the discovery period, before clinical testing and the regulatory approval process. In addition to long development times, patents could be found invalid if later challenged, all of which may result in little patent protection time when a drug reaches the market (Longman, McLeod, Reddy, and Roin).

- Numerous pieces of legislation have added market protections to compensate for large amounts of clinical trial and regulatory review time or to encourage companies to invest in areas of particular medical interest, such as orphan diseases, antibiotic-resistant bacteria, or pediatric use (Armitage, Engelberg, and others).

- There is a difference between biologics and small molecules in the data exclusivity period afforded to them. Small molecules receive 5 years of data exclusivity, whereas biologics receive 12 years and may have added protection from the competition of biosimilars because of the trade secrecy involved in biologics manufacturing processes (Paul, Rai, and Reddy).

NOTE: These points were made by the individual speakers identified above; they are not intended to reflect a consensus among workshop participants.

Having an understanding of the elements that contribute to the biotechnology and pharmaceutical industry’s decision-making processes to pursue a specific therapeutic area is critical to knowing how best to incentivize R&D that addresses unmet medical needs for nervous system disorders. Individual workshop participants explained how lengthy drug development times drain market protections and discussed existing as well as potential legislation that aims to counteract that problem. Many participants also pointed out that uncertainties about markets and changing policies complicate the ability to assign value to drugs.

To inform the discussion about what might encourage companies to embrace CNS programs, several speakers outlined how drug pipeline decisions are made. Such determinations are complicated and depending on the vantage point may not seem to conform to strict logic, said Kiran Reddy, senior director of Corporate Strategy at Biogen Idec. Many groups within a company contribute, he added. R&D, for instance, has a large voice in influencing prioritization, and that voice speaks from the science and addresses issues such as whether the drug is likely to work. Corporate finance attempts to rank order possible drug development programs by assigning a value to each one.

Finance departments strive to allocate capital to maximize value to shareholders, said Reddy. From this perspective, future profits must eventually cover research costs. The associated calculations incorporate inflation, so a dollar spent today is worth less in the future, and accordingly future values and anticipated cash inflows are discounted to quantify the value of a drug program today. For 10 to 15 years, cash flows out; then, assuming the product succeeds, cash starts flowing in, but those dollars are worth less. With such strategic thinking, large organizations try to calculate the relative present value of different projects to figure out which ones to pursue.

The basic logic in these calculations incorporates at least 10 factors, said Reddy (see Box 2-1). This list underscores the idea that companies must balance many issues, including technical risk, development time, time to resolve uncertainty about whether a particular drug will work, expense, and possible payout. Furthermore, such assessments are not performed in a vacuum. Multiple possible projects vie for resources, and decision makers must consider the opportunity costs of investing in a

particular type of compound for a particular disorder rather than a different type of compound for a different disorder.

To produce valuation calculations, analysts must make assumptions about these and other items, and such assumptions are debatable, said Reddy. The challenge for workshop participants is how new policy measures might influence decision-making factors to promote neuroscience innovation.

BOX 2-1

Key Factors That Drive Biopharmaceutical Research and Development (R&D) Project Prioritization

- R&D costs: In neuroscience, these costs are especially high because clinical trials are large and lengthy.

- Duration of R&D: This translates into time to product launch.

- Market size

- Price: The amount of money that is reimbursed by third-party payers.

- Market penetration and time to peak sales: Net present value calculations give more weight to cash that comes in sooner than to cash that comes in later. Extending the duration of patent life and/or exclusive marketing rights contributes to the estimates, but the speed with which a drug can get to market has the largest impact on current value.

- Costs of goods, sales, and marketing

- Tax rates: Tax breaks can have a big impact on decisions; they might occur when a product is launched rather than in early development stages.

- Duration of exclusivity: This has a particularly large impact on biologic drugs. Many R&D organizations have focused on biologics not only because of scientific tractability, but also because it is difficult to develop a biosimilar agent, so these types of agents are better protected from competition than are small-molecule synthetic agents.

- Time line to generic erosion: How long is a product protected from competition by generic versions? Such time lines differ between small (synthetic) and large (biological) molecules. Reddy said that policy changes could bear on this item, particularly by adjusting the so-called risk-stacking effect (further discussed in this chapter).

- Overall risk adjustment: People’s assessment of the relative probability of success for a drug to be approved and to achieve a certain level of peak sales.

SOURCE: Kiran Reddy presentation, January 20, 2015.

David Meeker, president and chief executive officer of Genzyme, said he places unmet medical needs at the beginning of the decision-making paradigm. Company scientists and analysts assess how severe the disease is and what treatment options exist. They take stock of knowledge about the underlying biology, and in particular, whether a reasonable target has been identified and what is known about the natural history, heterogeneity, and other aspects of the disease. Absence of scientific understanding will trump even the most powerful incentives, said Meeker. If a path forward does not present itself, a company cannot proceed, regardless of how rich a possible solution would be if it existed. In addition, effectiveness of the drug needs to be testable, which means, among other things, that patients must be available. Finally, the return on investment is important and relates to the number of patients multiplied by the price. Several participants noted that a crucial component of reimbursement is how much health care systems are willing to pay; regulatory approval alone does not guarantee that third-party payers will cover the drug (see Chapter 3 for more details).

Additional variables contribute to the decision-making process, said Meeker, including the size of the company, how any given project fits into its portfolio, how the particular year is going, and the degree of passion among team members working on the project. Many items factor into choices about whether to pursue a particular area, and algorithms are far from rigid. Ideally, decision makers want to know that the rewards are commensurate with the risks. Meeker added that companies with large and diverse portfolios can be more flexible than those without them. Although incentives are important to the decision-making process, said Meeker, it is hard to know in advance which ones will be important and how influential they will be in any particular situation.

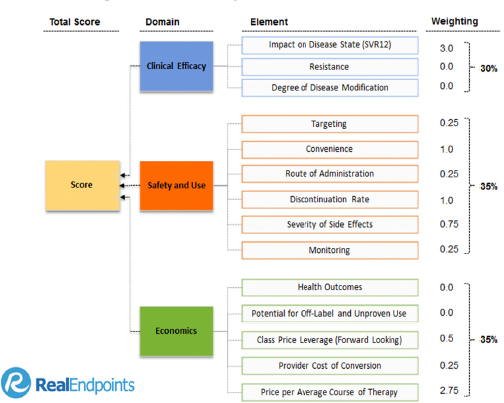

According to Roger Longman, chief executive officer at Real Endpoints, one way to demonstrate and differentiate value is by identifying and measuring all the key elements of medical and economic value. The specific elements will differ among therapeutic areas, but Longman said that they can always be grouped them into three “buckets”: clinical efficacy, safety and use (side effects and practicalities of using the drug), and economics (see Figure 2-1). For each competing drug in a specific indication, one must compare performance on the same set of elements, the scores deprived from normalized data on the endpoint underlying the element (e.g., one element of efficacy from Hepatitis C therapy is the endpoint SVR12, whose measurement must be standardized from drug to drug). Moreover, each element needs to be assigned a certain weight de-

pending on its relative importance. Weights can be changed by different stakeholders depending on how they view the element’s importance. Once values have been quantified in this transparent manner, they can be compared and the degree of breakthrough value assigned.

A system might be set up in which a patient can then make decisions about whether he or she is willing to pay more for a drug that bestows more value, based on what is important to that individual. Longman believes it is important to standardize definitions of value to enable consumers, physicians, and payers to make informed choices.

FIGURE 2-1 Elements driving value in hepatitis C drugs.

SOURCE: RxScorecard™ by Real Endpoints LLC; presented by Roger Longman at the IOM workshop on Financial Incentives to Support Unmet Medical Needs for Nervous System Disorders, January 21, 2015.

BUSINESS IMPLICATIONS OF THE STAGNANT R&D CLIMATE FOR CNS DRUGS

Gail Maderis, president and chief executive officer of BayBio, discussed her experience working with the life-science industry in the San Francisco Bay Area. More than 600 start-up companies and several major CNS research institutes reside there, she said, and they have “a wealth of good CNS ideas.” These groups, however, cannot find investors to move their product candidates forward. The venture capital community says the CNS sector is “a graveyard littered with clinical trial failures,” she said, and when venture capitalists do invest, it’s likely to foster the development of a biosimilar agent rather than a novel target or a brand new approach to treating progressive disease.

Start-up enterprises with breakthrough products are told by venture capitalists and pharmaceutical companies that the products look interesting and that the company should come back when it has established clinical proof of concept, said Maderis. A large challenge exists, then, in obtaining funding to reach that stage. She thus made a strong argument for push incentives, but said that pull incentives could influence where investments go. They might increase pharmaceutical investment, although the trickle-down effects to start-ups and academic labs may be small and delayed.

OVERVIEW OF THE CURRENT INTELLECTUAL PROPERTY (IP) ENVIRONMENT FOR THE PRIVATE SECTOR

Patents run for 20 years from the date initially sought, and typically the most important ones are often sought relatively early in the drug discovery process, said Robert Armitage, IP strategy and policy consultant and former senior vice president and general counsel at Eli Lilly and Company. At that point, the patent clock starts, and it continues through all subsequent drug development stages. As a result, preclinical and clinical studies that are necessary to establish key features of the agent’s physiological impact, safety, and effectiveness consume potential market protection time.

On average, drugs take 11 to 14 years from discovery to market entry (Paul et al., 2010). That time span grows for treatments that require unusually long clinical trials to demonstrate effectiveness and for preventive therapies, especially those for diseases that manifest over decades. If

FDA approval comes early in patent life, many years might be left, said Armitage; however, if approval comes later, few years will remain. The longer the road to market, the less patent life will be left to protect the discovery once the drug is approved. Armitage noted that the reality is that many medicines end up with no development possibilities because the patent term would be insufficient to make the drug financially tenable. According to several workshop participants, the 20-year patent clock therefore provides systemic bias away from innovative therapies whose development and/or testing is protracted—many CNS diseases fall into this category.

Furthermore, abbreviated regulatory pathways (discussed in Chapter 3) have created an expedited path to market for competing drugs that are deemed bioequivalent; such products exploit safety and effectiveness data associated with the original therapy. The weight therefore falls on the drug innovator, not on companies that follow up with similar agents, to gather the information that justifies regulatory approval. With generic drug approval pathways in place, a company can profitably sell generic drugs for little more than manufacturing costs. The company that makes the generic version does not have to find the active agent, develop the drug, or educate physicians on its use, said Armitage. Low-cost production is rewarded rather than innovative product development or tackling a new medical problem. Even the original drug development company has more incentive to develop a minor variation of a current drug—a phenomenon called “evergreening”—than a substantially new agent. The current system therefore has created the perfect way to provide consumers with extremely low-cost medicines, said Armitage, but nothing in patent law ensures that strong protection can be secured for the most promising new or bold ideas.

The patent expiration date typically ends the commercial life of a drug for the company that developed the drug. Unless the patents on a drug are challenged by a generic drug manufacturer, no generic drugs can be approved until the last patent associated with the original one has expired. This is the case even if all safety and effectiveness data have become public.1 When a patent challenge is initiated, the first generic company that challenges patents can bar FDA approval of all competing generic drugs during a 180-day period after marketing commences for the first generic agent. This incentive encourages patent challenges, said Armitage; consequently, an entire legal industry of patent disputes be-

_______________

1See the IOM (2015) report on clinical data sharing and the importance of transparency within companies to avoid data secrecy simply to protect IP protection.

tween innovators and companies that make generic products is thriving. The approximate billion dollars per year that industry funnels into such litigations therefore does not go into R&D, Armitage observed (Guha and Salgado, 2013).

Furthermore, the prospect of patent litigation creates inherent uncertainty about whether any given patent will be upheld, said Armitage. Insecurity about the ability to enforce patents disproportionately affects investments in medicines that take the longest time to develop and that are the biggest gambles in terms of prospective success. Both of these characteristics typify therapies for CNS disorders. This so-called risk-stacking effect makes such programs relatively unattractive to pursue. “The best medicines for patients may not always be the medicines with the best patents,” said Armitage.

LEGISLATION ESTABLISHING MARKET PROTECTION PERIODS

As previously noted, drug originators are focusing their research on drugs for which they can obtain strong patent protection. According to several participants, compelling bias discourages investigation of treatments for chronic diseases, preventive medicines, or agents that operate by an unprecedented mechanism of action; patent law is not designed to provide the best protection for therapies of these types. Congress has enacted several pieces of legislation intended to counteract some of the negative incentives that the standard patent system offers, particularly in medical areas where drug development is challenging and potentially unattractive.

Hatch-Waxman Act

The Hatch-Waxman Act,2 formally called the Drug Price Competition and Patent Term Restoration Act of 1984, created the abbreviated FDA approval pathway that made the generic drug industry possible. It barred use of the abbreviated approval pathway for generic drugs until the patents the originator of the new medicine listed in its New Drug Application (the “Orange Book” patents) expired or were successfully challenged. When no patents existed, the filing for generic drug approval

_______________

2See http://www.gpo.gov/fdsys/pkg/STATUTE-98/pdf/STATUTE-98-Pg1585.pdf (accessed April 21, 2015).

through an abbreviated new drug application route was barred for 5 years. When an originator of a new medicine did secure patent protection, one of the originator’s patents could be extended for up to 5 years—but not for more than a total of 14 years after FDA approval. The extension for up to 14 years from the originator’s new drug application (NDA) approval date was designed—to partially compensate for large amounts of time spent in clinical trials and regulatory review. According to Armitage, approximately 30 percent of patents that have been extended over the past 30 years have been awarded 14 years of extended patent protection after market entry. Furthermore, if a company is granted a new indication for drug use, a 3-year period is added. Not only does this add market protection for the initial developer, but the Hatch-Waxman Act encourages companies to develop generic versions of drugs. It allows generic small-molecule developers to rely on the innovator’s data package after the 5-year data exclusivity period, and when any relevant patents have expired.

Several participants lauded the Hatch-Waxman Act for its positive impact. Nonetheless, they said, it has not fully addressed the problem, as earnings on only 20 percent of marketed drugs exceed development costs (Vernon et al., 2010).

Biologics Price Competition and Innovation Act

As part of the 2010 Patient Protection and Affordable Care Act, Congress created an abbreviated approval pathway for large molecules derived from living cells—biologics—that are “biosimilar” to an FDA-licensed product. This mechanism exists as part of the Biologics Price Competition and Innovation Act (BPCI Act) of 2010,3 and it affords new biological therapeutic agents 12 years of protection from the date of FDA approval. Six months of market exclusivity are added if pediatric studies are performed. Under the BPCI Act, the number of patents on the reference product does not matter, nor do their expiration dates.

In contrast to conventional medications, which are chemically synthesized and thus whose structures are strictly reproducible and defined, biologics come from living things and are consequently more variable, noted several participants. To qualify for biosimilarity, the product must be highly similar to one that has passed FDA review. Biosimilar products have the same safety and effectiveness profile as the reference product;

_______________

3See http://www.fda.gov/downloads/Drugs/GuidanceComplianceRegulatoryInformation/Information/UCM216146.pdf (accessed April 21, 2015).

unlike conventionally produced drugs, they are not structurally identical. During the 12 years (or 12.5 years, with the pediatric provision), a competing biosimilar product cannot rely on the safety and effectiveness data that gained approval for the first one.

Arti Rai, professor of law and co-director at Duke Law Center for Innovation Policy, noted that there is nothing magical about 12 years, and it is very difficult to come up with an optimal term. The 12-year decision relied on political realities as well as scholarly work. It takes approximately 13 to 16 years on average for companies to recuperate the costs associated with developing a therapeutic biological agent (Grabowski et al., 2011). Controversy exists about how heavily this item should be weighed when generating a time period for regulatory exclusivity, in part because the goal is not to incentivize the most marginal next drug; the goal is to incentivize drugs that produce the most improvements in quality of life per dollar, said Rai.

Steve Paul, chief executive officer and board member at Voyager Therapeutics, said that the BPCI Act will not create the same price reductions that can be gained by developing small-molecule generic drugs. Rai pointed out that at this time, scientific knowledge and techniques do not support replication of biosimilar agents as quickly and readily as they support replication of small-molecule chemical generic agents.

Orphan Drug Act

The Orphan Drug Act (ODA) of 19834 provides an example of legislation that has been a “marvelous success for patients,” said Armitage. The act aimed to stimulate corporate interest in rare diseases, which affect fewer than 200,000 Americans. Because of the small patient populations, these illnesses historically had limited market appeal. ODA provides numerous incentives, including tax credits and grants, a fast-track approval pathway, and a 7-year period of market exclusivity for use on the “orphan” condition from the time of FDA approval.

Originally, orphan drugs were for unpatented drugs only, said Armitage. In 1985, orphan drug exclusivity was opened up to patented medicines, and now, the overwhelming majority of orphan drugs have patent protection. When the Hatch-Waxman Act came into being in 1984, it provided more protection for most orphan drugs (particularly new chemical entities) than the 7-year exclusivity period that was pro-

_______________

4See http://history.nih.gov/research/downloads/PL97-414.pdf (accessed April 21, 2015).

vided by ODA. In the 20-year period that followed the adoption of ODA, more than 400 medications for 447 indications were approved, compared with 10 during the prior decade (PhRMA, 2013).

Best Pharmaceuticals for Children Act

A second example of legislation that has drawn corporate interest toward a particular medical challenge is the Best Pharmaceuticals for Children Act (BPCA) of 20025, which was intended to incentivize companies to test drugs that had been approved for adult use in children. BPCA provides 6 months of extra market exclusivity, and it applies to all uses of the medicine, even if its use for children was never approved, said Armitage.

Generating Antibiotic Incentives Now Act

In 2012, Congress passed legislation that might serve as a framework for a type of pull incentive that workshop participants discussed for CNS disorders because it aims to stimulate industry attention on a specific medical field—in this case, drugs that will combat antibiotic-resistant bacteria, said Choi. The Generating Antibiotic Incentives Now Act (GAIN) of 20126 attempts to stimulate development in this area, given weak projected market returns. Although the rise of antibiotic-resistant bacteria poses a serious public health threat, the number of individuals who succumb to the illnesses they cause is small, treatment durations are short, and modest pricing and reimbursement is the historic norm, said Choi. Consequently, financial lures tend to be uncompelling (Choi et al., 2014).

GAIN grants an additional 5 years of market exclusivity to new antibiotic agents that qualify (5.5 years if accompanied by a diagnostic test); this period augments the 5-year data protection package provided by the Hatch-Waxman Act or ODA’s 7-year registration exclusivity. The act also provides a special regulatory approval pathway. The GAIN Act “is the best example we have yet of a truly therapeutically area-targeted incentive,” said Armitage, but it is “too little ventured, too little gained.”

_______________

5See http://www.fda.gov/RegulatoryInformation/Legislation/FederalFoodDrugandCosmeticActFDCAct/SignificantAmendmentstotheFDCAct/ucm148011.htm (accessed April 21, 2015).

6See https://www.congress.gov/bill/112th-congress/house-bill/2182 (accessed April 21, 2015).

POTENTIAL NEW APPROACHES TO EXTENDING MARKET PROTECTION

Focusing on drugs to address unmet medical needs for nervous system disorders, workshop participants explored the idea that increased market protections with data exclusivity might increase R&D innovation by incentivizing industry to advance therapies that require particularly arduous regulatory processes and whose development faces other significant hindrances, such as those previously described.

Europe is ahead of the United States in this area, said Choi. A few years ago, it developed “the so-called 8 plus 2 (plus 1) system of market protection,” which provides, to all new drugs after approval, a fixed period (8 years) of data exclusivity plus 2 years of market exclusivity; in addition, it grants an extra year of protection for innovative drugs that provide significant clinical benefits over existing therapies for unmet medical needs (Frias, 2013). “While this is perhaps not exactly what is needed here in the United States,” Choi said, “it provides an important conceptual framework.”

Increased market protection results in monopolies on particular medicines and associated high costs for patients, according to several participants. It is possible, however, that an individual’s need for other types of treatments and care would diminish if the drug worked well. Although patients carry the economic burden of paying for expensive drugs, a few participants stated that society might pay less overall. Effective medicines made available to patients might translate into lower health care costs associated with the disease or even lower justice system expenses. As much as 80 percent of the chronically homeless population have a mental illness, said Andrew Sperling, director of federal legislative advocacy at the National Alliance on Mental Illness. “They are in jails. They are costing this society an enormous amount of money,” he added.

21st Century Cures Act

The 21st Century Cures Act, recently drafted by the U.S. House Energy and Commerce Committee, may be a major opportunity to develop incentives for therapeutic development for unmet needs, several participants asserted. The first draft of the bill was released in January 2015,7

_______________

7See http://energycommerce.house.gov/sites/republicans.energycommerce.house.gov/files/114/Analysis/Cures/201-50127-Cures-Discussion-Document.pdf (accessed April 27, 2015).

around the time of this workshop, and it included a section on extended market exclusivity. A second draft of the bill was released in April 20158 that has significant changes from the first. While the market exclusivity section has been omitted in the second draft of the bill, the workshop presentations and discussions on this topic may help inform future efforts.

The 21st Century Cures Act aims to “accelerate the discovery, development, and delivery of promising new treatments and cures for patients,” and includes several provisions that might help address the challenges that motivated this workshop9:

- Encourages repurposing of previously approved drugs, in which patent and market exclusivity have expired, for new indications

- Incorporates patient perspectives into the regulatory process (further discussed in Chapters 3 and 4)

- Streamlines clinical trials

- Modernizes medical product regulation

The market protection section in the original draft of the bill drew upon the Modernizing Our Drugs & Diagnostics Evaluation and Regulatory Network (MODDERN) Cures10 and Dormant Therapies11 Acts to allow added marketing exclusivity for a product that is intended to treat an unmet medical need. The bill proposed to guarantee 15 years of market exclusivity for any drug that is approved by FDA for treating an unmet medical need in exchange for relinquishment of the patent rights that companies might have used to extend that term past 15 years, said Benjamin Roin, assistant professor at the Massachusetts Institute of Technology Sloan School of Management. If a drug addressed an unmet need, as indicated by clinical trial results, it would get protection, regardless of whether it is new. Furthermore, the protection would have started not from the patent filing date, but from the date of market entry, he added.

Data and market exclusivity rules are less vulnerable to challenge than are patents, said William Fisher, Wilmer Hale professor of intellec-

_______________

8See http://energycommerce.house.gov/sites/republicans.energycommerce.house.gov/files/files/114/20150429Discussion-Draft.pdf (accessed April 22, 2015).

9See http://energycommerce.house.gov/sites/republicans.energycommerce.house.gov/files/files/f114/FINAL%20Cures-%20Discussion%20Document%20White%20Paper.pdf (accessed April 22, 2015).

10See https://www.congress.gov/bill/113th-congress/house-bill/3116 (accessed April 22, 2015).

11See https://www.congress.gov/bill/113th-congress/senate-bill/3004 (accessed April 22, 2015).

tual property law and faculty director of the Berkman Center for Internet and Society at Harvard Law School. As a result, the incentive they provide for innovating is less likely to be diluted by the need to pay off generic challengers. For these and other reasons, Fisher said that adjustments in data exclusivity are preferable to adjustments in patent terms.

Defining Unmet Medical Needs

Workshop participants held several discussions on how best to define unmet medical needs. Alfred B. Engelberg, trustee at the Engelberg Foundation, expressed concern that an unmet medical need would be determined and designated not when the drug is approved, but when a company files a clinical plan (discussed further in the Chapter 3). A few participants stated that today’s unmet medical need might be resolved 15 years down the road, so companies in the early stage of product development may face this challenge. Marc Boutin, executive vice president and chief operating officer at the National Health Council, said the challenge of circumscribing this benefit has always been an issue. Unmet medical need is defined in the statute, he said, and is based on the definition FDA uses for accelerated approval. Not every product—only about 30 percent of them—qualifies as fulfilling an unmet medical need. A therapy for a condition that is currently untreatable would qualify, as would a product that shows measurable health outcomes and benefits relative to existing products.

Determining Market Exclusivity

According to Armitage, the biggest challenge about the portion of 21st Century Cures that drew from the MODDERN Cures/Dormant Therapies Acts is its fixed market protection—designed to afford parity in market protection for medicines being investigated to address unmet medical needs in life-threatening or other serious diseases, or conditions with medicines that have strong patent protection—of up to 15 years (i.e., the 15-year protection periods serves as both a floor and a ceiling on protection from competition from generic drugs and biosimilar medicine. This section has since been removed in the second draft of the bill. As was mentioned during the discussion about the BPCI Act, data suggest that a typical medicine requires 13 to 16 years to break even, so 15 years is within that window (Grabowski et al., 2011). Numerous participants

shared their thoughts about what an appropriate number (or number range) might be, but no one outlined a clear rationale for any particular length of time. Suggestions ranged between 7 and 20. Multiple speakers indicated that it is difficult to come up with a “good” number. “We know the 7 years is not long enough,” said Boutin. “We in the patient community have never taken a position on what is the right period of time. . . . We know that there is a point where it becomes diminishing returns and it prevents innovation. We also know that 7 years is too short. It is clearly somewhere in the middle.” George Vradenburg suggested that it might be possible to tier the amount of market protection, based in part on the degree of effectiveness, novelty, ability to treat a previously untreatable condition, or some other performance characteristics. The baseline could be 12 years, and a drug could score additional time if its performance hit specified markers.

A “GAIN PLUS” Proposal for CNS

Choi presented a “GAIN PLUS” proposal for the CNS sector.12 Based on the GAIN Act of 2010, it would boost market protection for CNS drugs with high medical impact. FDA and its advisers would ensure that this pathway maintains a high bar so that only innovative drugs that address unmet medical needs would qualify, said Choi. Building on the preexisting GAIN legislation would set a precedent for developing a flexible market protection system that can adapt to society’s changing needs. In the future, an area other than antibiotics or CNS drugs might become more pressing, and similar legislation could be adopted to encourage activity in that realm, said Choi.

According to Choi, the impact of the GAIN Act is likely to be limited because it does not add to existing market protections. Therefore, it might fall short of the protections that exist under the Hatch-Waxman Act. However, “we think it is the right idea and it is a critical precedent.” Choi would like to see the neuroscience version address this key flaw. “We call it GAIN PLUS,” he said, “because the extra protections accorded to breakthrough CNS drugs for unmet medical needs are added on top of existing protections, not subsumed within.”

Although workshop participants discussed at length whether such a proposal would be feasible, Bonnie Weiss McLeod, partner at Cooley LLP, stated that patent law carries a huge amount of risk. “The law is

_______________

12For more details on this proposal, see Choi et al., 2014.

changing so fast just with what we have seen with subject matter patentability over the last few years,” she said. “Thousands of patents may now be invalid.” For example, patent protection for small molecules that were isolated from nature and are used to treat serious diseases is now questionable in light of the U.S. Patent and Trademark Office’s implementation of the Myriad Genetics13 Supreme Court ruling. The current success rate for patent protection (likelihood the patent would be found valid if challenged) is likely around 50 percent, she said. Because the system is struggling to balance rewards for inventors with encouragement of technology development, “I think we are going to see a lot more uncertainty in the patent law before we reach more solid ground,” she said.

OPPORTUNITIES TO INCENTIVIZE R&D THROUGH IMPROVED MARKET PROTECTION

- Establish reforms across the biomedical board that ensure a period of market protection, independent of patentability. Toward this end, some participants encouraged the adoption of the MODDERN Cures/Dormant Therapies Acts provisions noted in the first draft of the 21st Century Cures Act, which has since been removed. This provision aimed to encourage companies to pursue drugs that are not under patent protection, but that might prove beneficial in areas of unmet medical needs, regardless of medical area. While several participants were uncertain whether the 15 years is the optimal length of market protection (as noted in the previously mentioned acts), many participants supported the basic idea of having a lengthy automatic term of protection for newly approved drugs that runs from the date of FDA approval and does not hinge on the drug’s patentability (Boutin, Fisher, Paul, Roin, Zorn,14 and others).

- Establish additional market protection for particularly high-impact “breakthrough” drugs in all medical realms—treatments that demonstrate unusually strong clinical and societal benefits in areas of unmet medical needs. Such a system would reward development of drugs that deliver greater impact and might incen-

__________________

13See http://www.supremecourt.gov/opinions/12pdf/12-398_1b7d.pdf (accessed June 9, 2015).

14Stevin Zorn, executive vice president at Lundbeck Research USA, Inc.

-

tivize truly meaningful innovation (Choi, Fisher, Vradenburg, and others).

- Develop a flexible framework for market protections that can respond dynamically to changing opportunities and society’s needs. At the moment, antibiotics and neuroscience drugs rank high by this metric; in the future, other fields might rise in urgency. The infectious disease community has driven passage of the GAIN Act, which provides extra market protection for antibiotics that address unmet medical needs. Conceptually similar legislation could foster growth of the CNS drug development sector. Adding market protections to existing ones (rather than subsuming GAIN-like protections within existing ones) would strengthen such a measure (Choi, Zorn, and others).

This page intentionally left blank.