Examination of Transit Agency Coordination with Electric Utilities (2024)

Chapter: 2 Literature Review

CHAPTER 2

Literature Review

This chapter summarizes the results of a scan of resources regarding the battery electric bus market in the United States; the U.S. electric utility industry; electric utility interest in, and support for, transit bus electrification; specific policies and programs that are available to transit agencies adopting battery electric buses; and guidance for transit agencies on how to effectively engage with their utility and navigate the world of electricity policy and pricing.

State of Battery Electric Bus Deployment

This section is intended to place the synthesis research into context by describing the current state of transit agency adoption of battery electric buses in the United States. The deployment of BEBs in the United States has been steadily increasing in recent years as transit agencies have embraced zero-emission technology; federal-level funding has increased; and states, localities, or transit agency boards have implemented zero-emission transit fleet mandates.

No resource was identified that rigorously tracks the total number of battery electric buses in the United States. The primary sources that are used for this section are the APTA’s 2023 Public Transportation Vehicle Database, the FTA National Transit Database, and a report published by the non-profit consortium CALSTART, titled Zeroing in on ZEBs in February 2023 (CALSTART 2023).

Total U.S. Battery Electric Transit Bus Fleet: Current and Expected Growth

APTA maintains a transit vehicle database where transit agencies self-report vehicles in service in their fleets. As of January 2023, APTA estimated that the transit bus fleet in the United States totaled around 54,000. Of this figure, APTA’s database recorded approximately 1,000 zero-emission buses (ZEBs) in use in U.S. transit agencies, or around 1.8% of all active transit buses in the United States. Since this database is self-reporting, it likely does not capture all ZEBs in use across the United States but can be used as a reasonable estimate.

Data from CALSTART indicates that the BEB fleet is growing rapidly. The CALSTART report (2023) strives to track the number of both battery electric and fuel cell electric buses (FCEBs) that have been funded, ordered, and/or delivered in the United States and Canada. The report found that the United States had a total of 5,480 full-size, zero-emission transit buses “on the road, awarded, or on order” as of September 2022. (Full size is defined as 30 ft. or larger.) Of these, 5,269 (or 96%) are battery electric buses, while fuel cell electric buses total 211. This report does not break out that number between buses in service versus on order or funded, so it is not clear exactly how many ZEBs are actually operating on U.S. and Canadian roadways.

The 2023 report also indicated how those ZEBs are distributed: 230 agencies have ZEB fleets of 10 or fewer buses, 114 have 11–50, and 24 have more than 50. The data indicated that most agencies are still in an early pilot or exploratory phase of ZEB deployment.

While BEBs still comprise a small percentage of the total U.S. transit bus fleet, the BEB fleet market is growing rapidly. In its 2020 edition of its Zeroing in on ZEBs report, CALSTART reported a total of 2,160 ZEBs in use or on order in the United States as of December 2020. Thus, from December 2020 to September 2022, the report found that the number of ZEBs in use, on order, or funded more than doubled, growing from 2,160 to 5,480.

Drivers for BEB Adoption

BEB purchases are gaining momentum in part because of advances in battery technology, which have improved the range and performance of these buses, and because of the wider availability of full-size transit BEB models. However, there are also important policy and regulatory mechanisms driving the adoption of BEBs in the United States.

Note: The policies described in this section are intended to drive deployment of zero-emission buses overall, which can be either BEBs or FCEBs; however, this report is focused only on the BEB market. A brief review of the state of FCEB adoption is in Box 1: Status of Fuel Cell Bus Adoption in the United States.

State, county, or city mandates for the adoption of ZEBs play a key role. In California, transit agencies are under a state-level mandate to transition to a fully zero-emission bus fleet by 2040. Numerous other mandates at the state, county, or city level are driving the transition to zero-emission transit buses; examples include Maryland and King County, Washington.

Government funding programs are also playing a critical role in incentivizing transit agencies to purchase ZEBs. At the federal level, government funding comes primarily through the FTA Low or No Emission Grant Program

Box 1. Status of Fuel Cell Bus Adoption in the United States

While BEBs continue to be the large majority of ZEBs in use and in purchase orders in the United States, a scan of news articles and announcements from transit agencies shows that many agencies are looking at hydrogen fuel cell electric buses as a zero-emission option. Agencies have indicated interest in FCEBs due to concerns over BEB range—especially reduced range in cold weather—and the length of time needed to recharge the buses. Agencies have reported a desire for a one-to-one replacement of existing buses with a zero-emission option as a driver for adopting fuel cell buses. A one-to-one replacement ratio can be hard to achieve for battery buses in certain operating environments.

Agencies have also indicated a concern over the complexity of utility engagement, electricity costs, and charge management strategies. Agencies cite an interest in hydrogen fueling infrastructure as one that more closely resembles the fueling model for compressed natural gas buses in making a decision about a technology pathway.

Fuel cell buses may require some level of coordination with electric utilities—for example, to provide power for on-site hydrogen generation via electrolysis. However, the electricity use case for this vehicle is different from that of battery electric bus fleets since it’s more likely to be a steady demand that can be arranged to occur during non-peak hours if energy storage is used.

Nevertheless, the literature review suggests that electric utilities have some interest in engaging with agencies if they are planning on a hydrogen fuel cell bus fleet that will require significant electrical loads for the fueling. This issue, however, is not the primary subject of this synthesis report.

(Low-No Program), which supports the purchase or lease of zero-emission or low-emission buses by transit agencies. These competitive grant funds have facilitated the purchases of both BEBs and FCEBs and incentivize agencies to explore zero-emission technology by overcoming the higher up-front costs associated with ZEBs.

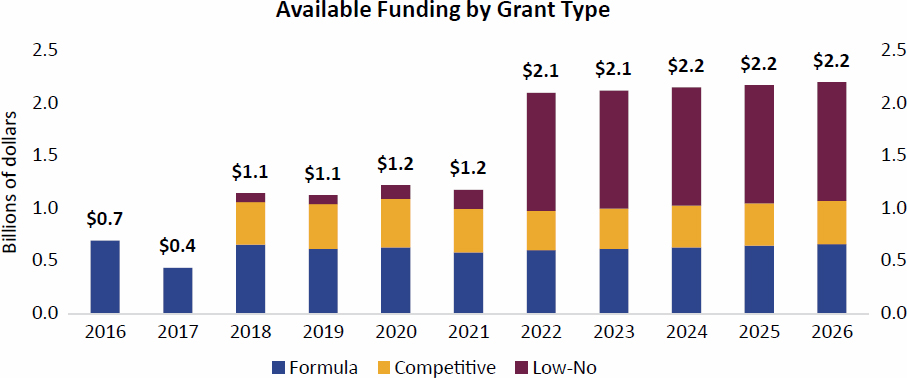

Because of the Infrastructure Investment and Jobs Act (IIJA), which was signed into law in November 2021, federal support for ZEB purchases is even higher from 2022 to 2026 and may drive even greater adoption of both BEB and FCEBs. Figure 1 shows the available funding from 2016 to 2026 for three categories of grants under the Buses and Bus Facilities Program: formula grants, where funding is allocated to recipients based on predetermined formulas set by Congress to be distributed to states, tribal recipients, and agencies; competitive grants, in which funding is allocated to recipients based on applications received through a Notice of Funding Opportunity, and winning project applications are selected based on a variety of factors including eligibility, evaluation criteria, and U.S. Department of Transportation/FTA priorities; and Low-No Program grants, the competitive program providing funding to state and local governmental authorities for the purchase or lease of zero- and low-emission transit buses as well as the acquisition, construction, and leasing of required supporting facilities.

As shown in Figure 1, there is a dramatic uptick in Low-No Grant Program funding from 2022 to 2026 under the IIJA, with annual funding amounts at almost twice the annual levels available in the previous five years. This increased funding is driving greater adoption of both battery electric and fuel cell electric buses as the grants help offset the higher capital costs and the cost of new facility investments needed for the charging infrastructure. The most recent FTA Buses and Bus Facilities and Low-No grants for fiscal year (FY)2022 will fund the purchase of 1,100 zero-emission buses—as many as are reported in service by APTA as of January 2023.

Further fueling the growth of the BEB market is a requirement in the IIJA that “any application for projects related to zero-emission vehicles include a Zero-Emission Transition Plan” with their application (FTA November 2022). This requirement is spurring transit agencies not only to purchase a small number of ZEBs but also to think about how to scale up their ZEB fleets significantly and make a full transition. The program also typically has spread its awards across a large number of agencies. This practice is helping to “seed” greater uptake of BEBs (as well as FCEBs) across the United States. It should also be noted that Low-No program funding levels beyond 2026 are unknown, thus creating a degree of uncertainty around the longer-term incentivizing of zero-emission buses through this FTA program.

Utility Impacts

Overall, the literature review suggests that, as battery bus technology continues to mature and costs decrease, and combined with federal funding support and state or local mandates, BEB deployments will likely accelerate further. In this scenario, agencies will be seeking to understand how to scale from the pilot stage to large BEB fleets, requiring more coordination with their electric utility to build out infrastructure and manage capital and operation costs.

Applicants to the Low-No grant program are required to “describe the partnership of the applicant with the utility or alternative fuel provider” in the transition plan submitted with their Low-No grant application (FTA November 2022). This requirement will help drive initial engagement with an electric utility.

Finally, since the Low-No grant program provides only capital funding for the purchase and lease of buses and the construction and leasing of facilities, agencies may look to other stakeholders—including utilities—to support their operating costs for these vehicles.

The U.S. Electric Utility Industry

The electric utility sector in the United States is complex, with multiple governance models that have a significant impact on how the utility is allowed to operate, the rates it can charge, and the types of services it can provide. This complexity is part of the challenge that transit agencies face when deploying a battery electric bus fleet. A critical factor in understanding how electric utilities operate is their regulatory framework.

This section provides a high-level overview of the electric utility regulatory structure in the United States and of the service that utilities typically provide to their customers in the current regulatory and business model paradigm. It outlines the practical implications of the different governance models for transit agencies seeking to “fuel” their fleets with electricity.

Regulatory Framework of U.S. Electric Utility Sector

An electric utility is a power company involved in the generation, transmission, and/or distribution of electricity. In the United States, this sector has evolved to be highly regulated; since electricity is considered a “public good” that requires significant capital investment, much of the U.S. electric utility industry operates as a “regulated monopoly” with strict oversight either from a government agency or a utility board to ensure that service is provided to all customers and to manage the price at which the service is offered to the customer—while also ensuring that the utility is able to secure a return on investment.

In the United States, there are three primary types of utilities: investor-owned utilities, public power utilities, and cooperatives. The following definitions are based in part on definitions from the U.S. DOE and U.S. Energy Information Administration in the U.S. DOE publication United States Electricity Industry Primer (July 2015).

Investor-owned utilities (IOUs) are for-profit companies owned by their shareholders. As described in the U.S. DOE publication United States Electricity Industry Primer (U.S. DOE 2015), these tend to be large electric distributors that may have service territories in one or more states. They are governed by a state commission, known as a Public Utility Commission (PUC), that grants IOUs the license to operate in specific areas of the state under certain terms and conditions. Their interstate generation, transmission, and power sales are regulated at the federal level by the Federal Energy Regulatory Commission (FERC), and their distribution system and retail sales are regulated by their state PUC.

The industry association for the IOUs is the Edison Electric Institute (EEI). EEI reports that there are over 40 investor-owned electric companies, many of which are parent-holding companies with multiple subsidiaries. According to EEI, IOUs provide service to around 250 million people in the United States (EEI 2024).

IOUs typify the model of a regulated monopoly described. The state PUC provides an IOU with monopoly power to provide electricity to a certain region and in turn oversees and regulates the companies’ activities, ensuring that it provides service to all customers. The state PUC also ensures that the rates enable the utility shareholders to receive a return on their investment. Importantly, for the case of BEB deployments, the PUC has oversight over the rates that an IOU can charge its customers.

Because of this structure, the IOUs operate within a tight set of regulatory boundaries. IOUs are required to serve all ratepayers in their service territory equally. If an IOU wants to increase its rates or provide a different type of rate like a time-of-use rate, the utility must go through a lengthy process with the state PUC. It is challenging for an IOU to receive approval to provide special rates for particular customer segments like transit, or even more broadly, transportation fuel customers (i.e., fleet managers) who typically have different needs from those of more traditional power customers.

Similarly, an IOU must go through a lengthy application process if it proposes to offer new services or solutions outside the usual “swim lane” within which IOUs operate. This includes any services to pay for “customer-side” infrastructure and owning or operating charging equipment (see the “Utility Infrastructure” section for more on what is covered by “utility-side” and “customer-side” infrastructure). This regulatory structure means that IOUs are not easily able to change policies governing rates or services to meet the needs of transit agencies in their service territory that are transitioning to BEBs.

Public power utilities are community-owned, not-for-profit utilities. They are typically governed by a local city council or an elected or appointed board. (City-owned utilities are commonly referred to as municipal utilities or munis.) The American Public Power Association (APPA), the association representing public power utilities, estimates there are around 2,000 public power utilities operating in the United States. APPA estimates that public power utilities provide service to around 49 million people in the United States (APPA n.d.-b).

Most public power utilities are small—both in terms of their service territory and the size of the utility itself. APPA notes that many of them have fewer than a dozen employees.

Since public power utilities are not-for-profits and are not responsible to shareholders but rather to a community government or council, they operate with the primary goal of optimizing service to customers without the need to secure a profit. While a public power utility must still justify any proposal to offer different rate structures or new solutions and services, it is typically a simpler process for a public power utility to implement new policies that can support transit bus electrification. The community government or council may also determine that the public utility’s priorities include benefits such as sustainability or decarbonization and therefore the utility may adopt policies supporting those goals, including ones that help agencies deploy BEBs.

Cooperatives (co-ops) are not-for-profit entities owned by their members and, as noted in the U.S. DOE publication United States Electricity Industry Primer (U.S. DOE 2015), tend to operate in rural areas, where they provide electricity over a large geographic service area but to a relatively small number of customers. Co-op members vote for a board of directors that oversees operations.

The National Rural Electric Cooperative Association (NRECA) estimates that rural co-ops provide service to around 42 million people in the United States (NRECA 2023). Similar to public

power utilities, co-ops are not permitted to earn a profit from electricity sales. Co-ops operate with the primary goal of optimizing benefits to co-op members. These utilities may define community benefits more broadly beyond safe, affordable, and reliable electrical service. For example, members may define benefits as including sustainability or decarbonization. Thus, similar to public power utilities, rural co-ops have an easier pathway to implementing new rates or solutions that can benefit transit agencies as they electrify their fleets.

Utility Infrastructure: Utility Side Versus Customer Side

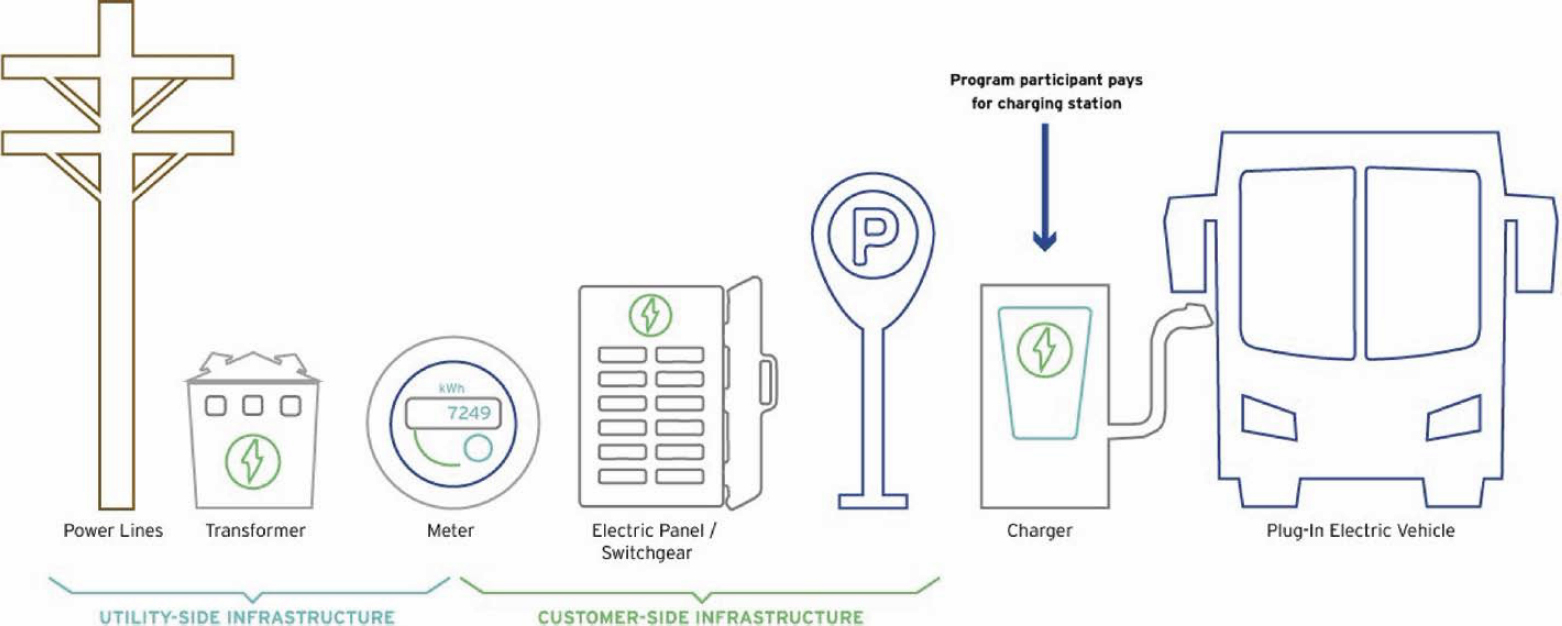

In addition to the governance structure, it’s important to have a basic understanding of what utilities typically do for their customers—and, by implication, what they typically do not do—in order to understand the types of collaborations they may undertake. The illustration in Figure 2 from San Diego Gas & Electric (SDG&E) shows the typical flow of the electricity grid. Utilities typically are responsible for building out and financing the infrastructure that allows electricity to flow through power lines, to the transformer, and up to the meter at the customer site. In utility language, this is referred to as “front-of-the-meter” service or, as shown in the SDG&E figure, “utility-side” infrastructure.

From the utility perspective, anything that occurs after the electricity has hit the customer meter is considered “behind-the-meter” or “customer-side infrastructure.” As shown in Figure 2, for a BEB project, this means that once the electricity flows through the electrical panel or switchgear to the charging station and then to the bus, it is considered to be customer-side infrastructure. Utilities will typically operate “in front of the meter” only; “behind the meter” is the responsibility of the customer.

This distinction is important for transit agencies as they build out charging infrastructure at their facilities because the upgrades required on the customer side can be costly. An electric utility may find that there are benefits to both the utility and customer if the utility can cover more of the customer-side infrastructure buildout costs, but the utilities may need to secure approval to offer this service—either through a state PUC, a governing city or county council, or the utility board of directors:

- An IOU must go through a regulated PUC filing process, which can be time-consuming and involve substantial input from other utility stakeholders; this process is the most challenging that any of the three utility types need to undertake to gain approval for “behind the meter” investment.

- A public power utility and co-op will need approval from their governing bodies, but the governing structure of these utilities means they are able to be guided by sustainability or decarbonization goals set by the governing bodies, which then are able to approve new rates or investments.

For some work that happens “in front of the meter,” the utility may pass along costs to the customer. For example, the utility may pass along the costs of upgrades to customers who are planning new facilities that will add a significant load that requires a new transformer. This is more likely to occur with public power utilities or co-ops; investor-owned utilities are more likely to incorporate these costs into their overall rate calculation.

Utility Electricity Rates

Electricity rates are one of the most important inputs to a transit agency’s anticipated costs for transitioning to a BEB fleet and are one of the most challenging for agencies to understand. Rates are designed to allow the utility to cover the cost of providing service to its customers (i.e., the costs to build, operate, and maintain the energy grid and deliver the electricity). Importantly, utility charges to the customer should allow it to recover not only the cost of the total amount of

electricity a customer uses but also the costs associated with that customer’s peak power demand. Rates are also designed to encourage efficient use of the grid. These so-called time-of-use rates offer varying rates at different times of the day to provide a financial incentive for customers to shift their electricity use to off-peak hours of demand.

The EEI report entitled Preparing to Plug In Your Bus Fleet (EEI 2019) defines the three elements that a typical commercial customer will find on their electric bill as:

- Fixed charge: recovers costs that do not change over time and is a flat monthly charge

- Energy charge: recovers costs that vary with a customer’s energy usage (i.e., kilowatt-hours, or kWh)

- Demand charge: recovers costs that vary with the capacity needed to serve the highest or peak power demand (i.e., kilowatts, or kW)

Demand charges tend to be the electricity cost that is of greatest concern to transit agencies planning to electrify their bus fleets, as they can add significant cost to BEB fleet “fueling” and can be difficult to predict. A demand charge is based on the highest rate of electricity usage that occurs during a billing period. Specifically, demand charges as defined by the APTA report, Checklist for Engaging on Fleet Electrification (APTA March 2023, p. 5), “are [charges] determined by multiplying a set dollar per kilowatt figure by the maximum amount of kilowatts being used ($/kW × peak kW demand).”

The rationale behind this charge from the utility perspective is that the utility must build capacity to meet the highest level of demand that occurs during any given period, even if this maximum demand only occurs during a short period of time.

A review of early transit agency experiences with BEBs finds that some agencies were caught off guard by hefty demand charges on their electricity bills for charging the battery buses. A 2019 report from Denver Regional Transportation District (RTD) found that demand charges made up around 80% of the agency’s monthly electricity bills (APTA 2020).

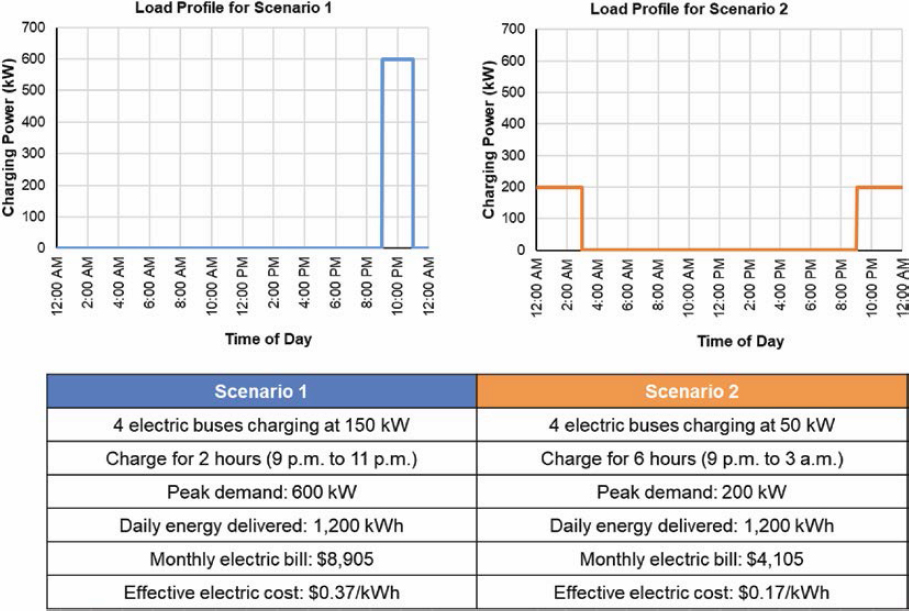

Much of the guidance provided by the utility industry to transit agencies (and other fleet customers) that are electrifying their fleets is to prepare an operating plan that spreads out the electricity demand from recharging the fleet over a longer period of time, to avoid high peak demand. The example in Figure 3, provided by EEI (2019), shows how the same total electricity usage of 1,200 kWh can result in two different billing levels depending on the fleet’s operating profile.

However, TCRP Research Report 219: Guidebook to Deploying Zero-Emission Transit Buses (Linscott and Posner 2021) notes that even with charge management strategies, the agency may experience unexpected needs to charge more buses than are planned for, incurring costly demand charges. Overall, this unpredictability of demand charges seems to be an ongoing issue and concern for transit agencies, driving them to look for relief with special rates. The following section discusses briefly how utilities approach rate design and special rates.

Rate Design and Special Rates

Transit agencies are frequently interested in securing lower rates to reduce these electricity costs. The ability to secure a special rate is largely determined by whether the utility is an IOU, a public power, or a co-op utility. It will also depend on the overall political environment in which the utility operates.

IOUs, public power utilities, and co-ops approach rate design somewhat differently. Co-ops and public power utilities are able to create rates that reflect goals such as equity or adoption of new technologies. IOUs are more strictly regulated to ensure that costs are distributed fairly across their customer base.

An IOU must receive approval for any special rates from its governing PUC. The filing process with the PUC is typically lengthy and requires public hearings where all affected stakeholders are invited to provide input and comments. Efforts to secure a special rate for one category of customer face significant challenges in this environment.

A public power utility or a co-operative utility can implement a special rate more readily if their governing body—city or county council, or board—is aligned with the goals of the special rate. If the governing body, for example, has set decarbonization of the transportation sector as a goal, they may see a lower rate for battery electric buses as helping to achieve this goal.

U.S. Electricity Sector Trends Driving Engagement with Transit

Finally, the literature review highlighted some macro-level trends driving utility engagement with fleet electrification. One trend is the flattening of electricity demand in the United States. Because of government regulation affecting overall efficiency improvements, electricity demand in the United States has essentially been flat for the past two decades. This has led some utilities to explore and embrace new electricity markets such as transportation generally and transit specifically—and in turn has driven some utilities to consider providing services that fall outside the traditional “front-of-the meter” structures previously noted.

The other is the utility sector’s commitment to reducing electricity’s carbon emissions and the sector’s contribution to climate change. This is partly driven by federal and state policies on electricity sector carbon emissions, but the industry is also publicly positioning itself as a leader in clean energy and decarbonization. For those utilities setting aggressive decarbonization goals, supporting greater transportation electrification is one way to help reach these goals. This commitment is driving some of the regulated utilities to adopt programs that support fleet

electrification by offsetting customer-side infrastructure costs, providing services to help agencies plan for their infrastructure rollout, and providing rates that offer temporary relief from demand charges.

Guidance on Working with Utilities

There is a wealth of resources on transportation electrification published by government entities, non-profits, and advocacy groups, but most of these focus on light-duty vehicle electrification. However, several guides targeting transit agencies or commercial fleets overall were identified. This section utilized resources produced by three utility associations—EEI, APPA, and NRECA—as well as reports from Atlas Public Policy (2022), Union of Concerned Scientists (2019), Rocky Mountain Institute (2021), Ceres/Navigant (2020), and TCRP (Hanlin et al. 2018; Linscott and Posner 2021).

In some cases, these reports provide much more information for transit agencies beyond utility coordination, such as how to think about infrastructure planning and deployment, overviews of charger technology options, and facilities considerations. This section will focus only on the information related to utility-agency coordination, but these resources may prove valuable to agencies for overall planning and deployment guidance, and to utilities looking to better understand fleet electrification and how to support it. The References section contains details on accessing these resources.

Engage Early

All these resources stress the importance of engaging the utility early in the process of preparing a BEB fleet. The recommendation from the literature review is for agencies to reach out to the utility as one of the first steps, prior to procuring vehicles, developing a BEB program, or drafting a transition plan. As will be described in some of the case examples, the most productive and effective relationships between an agency and a utility will be where the utility is an active participant in the agency’s planning process for its BEB deployment and transition.

A key reason to start early is that electrical upgrades can take 18 months or longer for the utility to carry out. From the utility side, to accommodate a new, significant amount of power—as will be needed for BEB fleets—the utility will need to draw up engineering plans, procure equipment, and carry out construction. It is important to be aware that available electrical capacity is site-specific; it may be that the grid overall can handle the new load, but it may be insufficient to handle it at the specific bus depot location. In addition, if an agency is considering solar or energy storage installations at their charging facilities, that will involve some unique interconnection processes that require additional time.

The utility will also be managing the new transit agency load request alongside requests from other customers like new hospitals, shopping centers, and housing complexes. Because of the long timeline from an initial request by the customer to the availability of power, early consultation with the utility is essential to avoid long delays between the delivery of the buses and putting them into service. The report Steep Climb Ahead (Rocky Mountain Institute 2021, p. 52) recommends that “a fleet customer should begin discussions with the utility at least three years before they expect to actually need the power.”

Another potential benefit of establishing a relationship with the utility is for agencies to better understand the utilities’ rate schedule and work together to determine a plan to optimize charging and minimize costs. The agency ideally will view the utility as a partner in helping the agency estimate potential power and energy demand from its BEB fleet and thinking about how to keep

electricity costs down. The relationship can also allow the agency to be brought into any discussions that the utility is having about potential rate changes or the creation of new rates.

Share Long-Term Plans

Another key piece of guidance is that utilities are accustomed to having long lead times for any major new load—for example, building a shopping center or apartment building. By contrast, transit agencies building out their BEB fleets offer a less predictable potential new load. Agencies are more reliant on securing federal or other funding for their BEBs, which may mean making a series of relatively small purchases over time. In addition, agencies are pursuing a strategy of incrementally expanding their fleet to allow them to better understand a new technology and how it operates in their service environment, as well as to incrementally build out the needed facilities. These disparate needs can create a disconnect between the utility and agency needs.

An Atlas Public Policy report, Deploying Charging Infrastructure for Electric Transit Buses (2022), specifically focuses on this topic, providing guidance on “future proofing” infrastructure investments; in other words, thinking about how the ZEB program will likely evolve and what infrastructure will be needed so that early investments can lay the groundwork for future needs. The report advises sharing a long-term ZEB plan with the utility, with timelines for expected ZEB fleet additions. The report notes that it’s not always possible for agencies to have a firm long-term ZEB procurement plan in place but recommends that agencies provide the utility with as much of a road map as possible, and supply utilities with updates to the road map as changes occur or on a predetermined schedule. This helps the utility with its long-term planning.

Work to Understand and Manage Electric Rates and Usage

A number of the literature review reports provide information to help agencies better understand and manage electricity rates (Box 2). Preparing to Plug in Your Bus Fleet (EEI 2019), a report released jointly by EEI, APPA, and NRECA, provides insights from the utility perspective into electric rates, how they are set, and why. For example, the report describes how electric rates are designed to encourage efficient use of the energy grid such as encouraging off-peak charging. The report recommends that transit agencies should consider the rightsizing of electrical service, site design, and charging layout when evaluating charging infrastructure options to try to keep costs down.

TCRP Research Report 219: Guidebook to Deploying Zero-Emission Transit Buses (Linscott and Posner 2021) provides a primer for transit agencies to understand electricity rates and their electric bill and how to manage costs. This includes a discussion of tiered rates—where the cost per kWh changes at different levels of consumption—versus time-of-use rates—which strive to encourage usage at non-peak times and critical peak rates. The report provides guidance on how to model potential electricity consumption and develop a charging strategy. The guidebook (p. 81) also recommends transit agencies coordinate with their utility early in the deployment process but also throughout the life of the BEB to ensure the agency has “a seat at the table for any discussions about proposed changes to rate schedules.”

Guidance on Information to Share with the Utility

For most commercial customers with new electricity needs, the initial point of engagement with the utility may be when they fill out an initial intake form for a new facility. The recommendations from the literature review are clear that transit agencies should engage with their utility much earlier in the process—as much as three years before the fleet will be deployed. The types of

Box 2. What Is the Utility Responsibility?

Most resources from the literature not only offered guidance to transit agencies, but also recommended that utilities be proactive in developing programs to help fleets that may be considering electrification. The report Steep Climb Ahead (Rocky Mountain Institute 2021, p. 52) urged utilities to embark on outreach programs to help fleet customers and noted that they heard from fleet managers who said they “encountered a distinct unwillingness among the utility staff to wade into a complex new business area.”

The Union of Concerned Scientists’ report Electric Utility Investment in Truck and Bus Charging (2019) offers a set of recommendations for utilities on how to support fleet electrification. These include

- Establish financing options to help public sector customers address the up-front costs of electrification.

- Set commercial rates to address demand charges.

- Consult with fleet managers when developing utility programs.

The report by CERES, the California Trucking Association, and Navigant Research, titled The Road to Fleet Electrification (2020), provided several recommendations to utilities to support fleet electrification, including

- Provide alternative rate structures.

- Provide easier access to information on available grid capacity and interconnection costs.

- Consolidate electric vehicle programs and create a team of fleet electrification experts.

This TCRP synthesis report is intended to provide guidance to transit agencies. However, it can also be used by utilities to learn from successful utility engagement strategies, which are based on the literature review and case examples.

information that should be provided for a bus fleet are also going to be quite different than for a commercial building.

Checklist for Engaging on Fleet Electrification (APTA March 2023), a report developed by APTA with input from agencies and from electric utilities and EEI, provides a detailed list of information and data that transit agencies should explore when they begin having conversations with the electric utility about their BEB plans. The checklist breaks the information into three categories: Planning Data, Fleet Data, and Facility Data. It also includes questions that the agency should ask the utility, reflecting the importance of establishing a two-way relationship. This checklist is found in Box 3.

The most progressive utilities . . . are now developing outreach programs to engage with their large fleet customers to help them plan their electrification strategy. The utilities can then use that information for their own resource planning purposes, so that they will be able to meet the new demand when those customers undertake electrification of their fleets.

– Rocky Mountain Institute report “Steep Climb Ahead” (2021, p. 38)

Resiliency and Alternatives to the Utility

Several literature review sources mentioned the need to consider backup power options to ensure resiliency of the BEB fleet; the Checklist for Engaging on Fleet Electrification (APTA March 2023) specifically recommends that the agency have discussions with its utility about resiliency and backup power.

Box 3. Checklist for Beginning Fleet Electrification Discussions With Your Electric Company

Planning Data

- Agency fleet electrification, zero emission transition, or sustainability plans

- Short and long-term goals for your bus fleet electrification (i.e., number of buses or percentage of the fleet you plan to electrify and expected timeline)

- Funding sources for your project, when funding will be received, and any conditions on that funding

- Primary barriers and concerns for electrification of your fleet

- Internal staffing plan for fleet electrification project along with primary points of contact and descriptions of their roles in your organization. This list will vary by agency, but will likely include representatives from IT [information technology], facilities, finance, operations, planning, maintenance, purchasing/procurement, legal, and union representatives

- A contact list for relevant individuals outside of your organization including any grant writers you may have used, representatives from your bus OEMs (original equipment manufacturers), representatives from your charging equipment OEMs, your leasing agent if you lease your land or facilities, and any third-party consultants or engineers you have hired for this process

Fleet Data

- The number of buses in your fleet by size

- The number of auxiliary vehicles owned by your agency such as work trucks or sedans

- How those fleets are managed and points of contact for each fleet if there are multiple

- Replacement schedules for current buses

- Any route analyses you have completed; if you are working with a consultant or other third party on the planning, please have them forward their analyses

- A schedule of when buses are parked/serviced

- Any information on battery buses currently in your fleet including size, manufacturer, battery size (in kWh), and how they are charged

- If you have any battery buses on order: the number of buses, the manufacturer, the size of the buses, the battery size (in kWh), what types of charging they are equipped for (e.g., plug in, overhead, etc.), the expected delivery date, and the planned service date

- Any other procurement plans for battery buses over the next 36 months or the details of any battery bus RFPs (request for proposal) you are developing

Facility Data

- Location of all fleet depots along with facility diagrams if available

- Account numbers for existing electrical service

- Current electrical load at those facilities

- Ownership structure of your facilities—do you own or lease?

- If vehicles are parked inside or outside

- Plans to update or expand your facilities and in what time frame

- Current charging infrastructure installed and total kW rating

- Types of charging planned for future electric bus deployments: number of chargers by type (AC, DC, overhead, or on-route), total kW for all chargers at the facility, and kW rating for each charger

- Charging strategy for your buses (overnight, staggered, on-route, etc.)

Questions for Your Electric Company

- Do they have any available programs or EV [electric vehicle-]specific rate offerings?

- Can they provide estimated timelines for major site or grid upgrades including lead times for equipment like transformers and switchgear?

- What is the availability of the correct phase/voltage of electric service needed for DC fast charging at your facilities?

- Can they provide existing power capacity estimates at facility sites?

- What are the space requirements for electric company equipment?

- Can they provide approximate cost estimates for equipment and construction?

- Can they provide a breakdown of who is responsible for what equipment and potential ownership and maintenance models for that equipment?

- Can they provide reliability reports for your facilities?

- Do they have eligible equipment lists or equipment recommendations?

- What are typical response and repair times for maintenance of grid infrastructure?

- Is redundant service available for resiliency planning?

- Where are our transformers located and where would additional ones need to be placed?

- Do they have an outline of steps that are needed before an electric company can start construction and timelines for each?

Source: APTA March 2023.

However, the literature review did not turn up an in-depth examination of resiliency options for transit agencies’ BEB fleets.

TCRP Research Report 219 (Linscott and Posner 2021) features a short section on “Resilience and Emergency Response Planning” that provides a high-level overview of backup power options. The report recommends that agencies consider on-site energy generation and storage, power purchase agreements, and community microgrids. Agencies may also want to consider if there are alternatives to the electric utility that serve the agency territory. This recommendation may be especially relevant to an agency that is struggling to find an advocate within the utility or finds that the utility is unable or unwilling to consider creative ways to help manage costs. There is limited additional information from the literature review that dives deeply into these subjects, and such options may be worth additional research as the BEB transition progresses.

Examples of Utility Programs

This section provides a sample of utility programs available to help transit agencies in their BEB infrastructure planning, deployment, and management, as shown in Table 2. This information was compiled through a review of the Edison Electric Institute’s EEI Member Company Electric Vehicle Program Database and a scan of available programs offered through public power utilities or co-ops.

The most commonly offered programs that benefit transit fleets are make-ready programs and time-of-use rates.

The first programs viewed were those that are specifically offered for the benefit of transit agencies. There were relatively few of these out of the dozens of programs. IOUs must receive permission from the governing PUC for any programs that specifically benefit one customer group, and it has proved to be

Table 2. Sample of electric utility programs for transit agencies.

| Electric Utility | Program Name | Description |

|---|---|---|

| Capital Funding or Financing | ||

| Austin Energy (TX) | Plug-In Commercial Charging Station Rebate | Rebates for installation of DC Fast Charging |

| DTE Energy (MI) | Charging Forward Expansion | Funding for an existing DTE Energy Program. Pilots funded under this effort include eFleet Battery Support, a program where DTE will cover the cost of electric bus batteries for transit agencies buying an electric bus, and DTE will recover the cost of that battery purchase on the transit agency’s monthly bill. |

| Duke Energy (multiple states) | EV [Electric Vehicle] Commercial Charger Rebate | Program that provides rebates for EV chargers |

| El Paso Electric Company (TX) | Public Transit and Customer Fleet Smart Charging Program | A rebate for public transit operators and large customer fleets of up to $26,000 to offset 50% of the installation cost of a qualifying DC fast charging station with up to $37,000 in utility service upgrades per site or a rebate of up to $3,500 to offset 50% of the installation of qualifying L2 stations with up to $13,000 in utility service upgrades. |

| Hawaiian Electric | Charge Up eBus | Make-Ready pilot for two charging ports at up to 10 electric bus charging sites. Hawaiian Electric to own, install, and operate infrastructure up to the first point of connection with the customer’s charging equipment for 10 years. Participant must install qualified charge stations and provide data for 10 years. |

| Pacific Gas & Electric Company (CA) | EV Fleet | The EV Fleet program deploys make-ready infrastructure, supporting the electrification of medium- and heavy-duty fleet vehicles. A minimum of 15% of the budget must serve transit agencies. Fleet electrification sites located in disadvantaged communities or those that support public transit/school buses are eligible to have up to 50% of charging station costs covered. |

| Indiana Michigan Power | Electric Transit Authority and School Buses | U.S. EPA settlement funds for customers to offset the incremental cost of electric transit or school bus above cost of a new diesel bus |

| PECO (aka Exelon) (PA) | Transit Charging Pilot | Incentives ($1million total) for transit charging infrastructure development costs including purchase and installation of equipment (with min. capacity of 250 kW) and make-ready costs. Transit agency to provide PECO with charging transactional data to PECO for three years. |

| Rochester Gas and Electric Corporation (NY) | Transit Bus Make-Ready Program | Incentives covering up to 100% of customer side and utility side make-ready costs |

| Public Service Company of New Mexico | 2022–2023 Transportation Electrification Program: Mass Transit Charging Installation Incentive | A total budget of $1.5 million reserved for charging infrastructure for mass transit that serves low-to-moderate income communities |

| San Diego Gas & Electric (CA) | Power Your Drive for Fleets | Provides financial and programmatic support for facility infrastructure buildout |

| Southern California Edison (CA) | Charge Ready Transport | Provides $356.4 million through 2024 to support installation of EV charging equipment for medium- and heavy-duty EVs or non-road EVs for fleet applications at low or no cost to eligible program participants. Provides make-ready infrastructure to qualifying commercial customers procuring or converting at least two medium- or heavy-duty EVs. Also provides equipment rebates for transit/school buses for eligible participants installing charging stations in disadvantaged communities. |

| Xcel Energy (MN) | Fleet EV Pilot | Provides support “beyond the meter” for public fleets |

| Electric Utility | Program Name | Description |

|---|---|---|

| Operational Financial Support | ||

| Baltimore Gas & Electric (MD) | EV Fleet Program | Provides technical fleet assessment, fleet advisory services, and make-ready incentives for fleet electrification |

| Evergy (MO) | Transit EV Charging TOU Rates | Time-of-use (TOU) rate with two peak periods designed to align with actual costs and time periods for transit agencies. The rate does not include a demand charge but does include a facility demand charge in order to incentivize managed charging. Customers must separately meter their electric vehicle supply equipment (EVSE) to participate in the tariff. |

| Hawaiian Electric | E-Bus Pilot Rates | Hawaiian Electric’s E-Bus pilot TOU rates encourage charging during the midday period (9 AM–5 PM) when there is abundant solar energy on the grid, and overnight during the off-peak period (10 PM–9 AM) when electricity demand is low. Enrollment through December 2023. |

| Holy Cross Energy (CO) | EV Charging Time-of-Use Rate | Charges 6 cents per kWh for off-peak charging |

| Sacramento Municipal Utility District (CA) | Pilot Commercial EV Rate | Commercial EV rates that offer relief from demand charges |

| San Diego Gas & Electric (CA) | EV High Power Rate | Special EV charging rate |

| Seattle City Light (WA) | Commercial EV Charging Rate Pilot | In effect beginning in 2024, this provides lower rates for off-peak charging. |

challenging to receive this approval. Public power utilities and co-ops have much greater latitude in developing programs to target specific customer groups.

However, it is also more likely that a utility will create a program broadly benefiting “fleets” without specifically designating them for transit. The review searched for programs or policies that are not specifically created to help transit bus electrification but that are being utilized by transit. Most of these are “make-ready” or time-of-use rate programs that are available to all commercial and industrial customers. This table does not include the many utilities that offer planning support or overall collaborative support for fleets, including transit agencies. These types of collaborations are covered in the case examples.

An important consideration for transit agencies seeking to use any of these programs: It is often the nature of these types of programs that they are time- and funding-level limited. In other words, the utility allocates a finite amount of funding for the program, and once it is drawn down, the program sunsets, the program sunsets at a specific date, or both limits are in effect.

Note that this is a snapshot of types of utility programs, but it is not comprehensive. In addition, utilities are regularly adding or updating programs, so agencies are advised to explore what their specific utility has to offer.