Electric Vehicle Charging Stations at Airport Passenger Parking Facilities (2025)

Chapter: Appendix B: Documentation of Survey Results and Analysis

APPENDIX B

Documentation of Survey Results and Analysis

This appendix presents the analysis of survey responses and highlights the status of EV charging at airport parking facilities. The survey was distributed via an online platform to 123 hub airports. The survey was initially distributed on December 05, 2023, and was open until January 31, 2024. A total of 37 responses were received from the representatives of 36 airports (2 responses were received from 1 airport). In terms of hub size, 21 small-, 8 medium-, and 7 large-hub airports responded to the survey. Figure B-1 shows the map of airport locations that responded to the survey. A total of 35 responses were received through an online platform, and 2 responses were received by email. The 37 respondents were not required to respond to all questions in the survey. The online survey allowed respondents to skip questions if those questions were not pertinent to them based on their responses to the previous questions. Also, respondents were allowed to select multiple choices for a few questions. Therefore, the sample size of each question varies, and the summary of all responses is not equal to 100%.

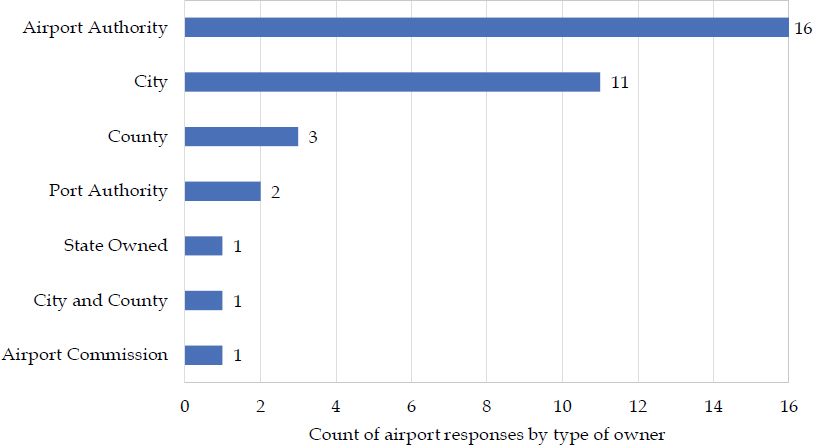

Figure B-2 shows the distribution of airport owners who responded to this survey. Sixteen airports are owned by an airport authority, followed by eleven airports owned by a city. A county owns three airports, and a port authority owns two airports. One airport is state-owned, a city and county own one, and one is owned by an airport commission. Two airports that responded to the survey via email did not respond to the survey questionnaire.

The airports that responded to the survey stated that most airport parking facilities are privately managed. Figure B-3 shows the distribution of airport parking facility managers. Nineteen airports mentioned that private entities manage their parking facilities. Twelve airports mentioned that they manage the parking facilities, and three have a contractual service to manage them. One airport said that the airport and private entity manage their parking facility jointly.

EV Charging Stations at Airport Parking Facility

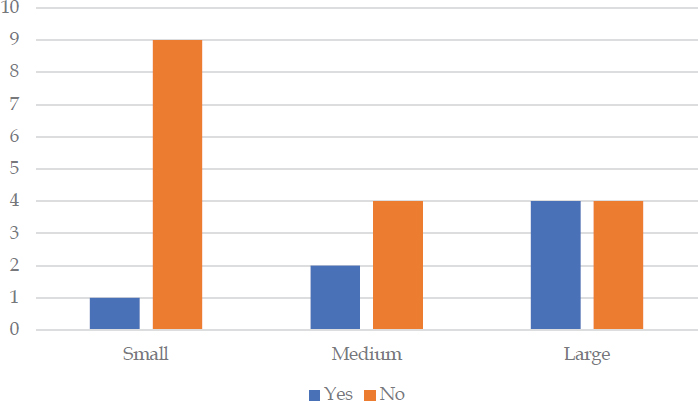

Out of 36 responding airports (one airport had multiple responses), 14 do not have an EV charging station in their parking facilities as of February 2024. Out of 36 responding airports (one airport had multiple responses), 22 have installed EV charging stations in their parking facilities. Out of the 14 airports that do not have EV charging stations, 8 airports responded that they have plans to install EV charging stations in the future, 4 said they do not have any plans to install charging stations, and the remaining 2 did not respond. Small-hub airports represent 13 out of the 14 without EV charging and 1 medium-hub airport does not currently have charging infrastructure. Some of the 14 are considering options outside a parking garage, while others plan to make their parking facilities EV-ready during expansion.

The airports that do not have EV charging stations noted cost and infrastructure as the most common barriers to installing EV charging stations. Other barriers include a clear picture of

demand, management issues, maintenance contracts, on-site utility capabilities, and space. Some respondents also mentioned the challenge of vehicles being left in the charging positions for extended periods. However, a few respondents reported no barriers.

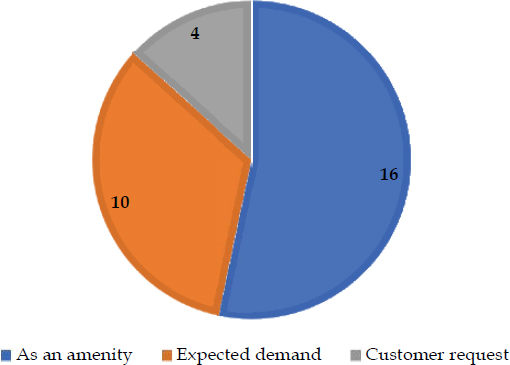

Airports installed EV charging stations in their parking facilities for various reasons. As shown in Figure B-4, out of the 30 airports responding to the question, 16 airports said it was an amenity, 10 airports said the reason was expected demand and 4 airports said customer request as the reason to install EV charging stations in their parking facilities.

In addition to the responses shown in Figure B-4, one airport responded that they added EV charging stations as an amenity and request from the rental car agencies. Another airport mentioned the reasons as expected demand and compliance with local ordinances.

EV Charging Station Quantity and Levels

The airports have installed EV charging stations in various on-site parking facilities, including central garages, covered parking near the terminal, passenger parking decks, daily parking areas, short-term and long-term public parking lots, maintenance garages, and solar-covered valet parking areas. Some airports have EV charging stations in all their garages, while others

only have specific garages or lots. A few airports are still in the planning stages and do not have EV charging stations yet.

The reasons for choosing specific facilities for installing EV charging stations vary among the airports. Some common reasons include proximity to terminals, power availability, premium location, future demand for EV charging, and high use of customer parking. Some airports also mentioned that they chose to install EV charging stations in new garages or during the construction or expansion of existing facilities.

Some airports offer free use of EV charging stations but charge for parking, while others include the use of EV charging stations as an additional amenity with covered parking. Standard parking fees apply in some cases.

The survey results show that 13 airports have only Level 2 (240V outlet) chargers, and 4 airports have only Level 1 (Standard 120V outlet) chargers (see Figure B-5). Seven airports reported that they have Level 1 and Level 2 chargers, one reported that they have Level 2 and Level 3 chargers, and one reported that they have Level 1, Level 2, and Level 3 (480V DCFC) chargers. Figure B-6 shows the availability of different charging stations based on hub size. Only large-hub

airports reported having Level 3 charging stations and Level 2 charging stations were the most common. Figure B-7 shows the distribution of Level 1, Level 2, and Level 3 chargers at airports.

Figure B-8 shows the distribution of connectors available at airport EV charging stations. Thirteen airports have Type 1 connectors, seven have Type 2 connectors, and three have CCS connectors. CHAdeMO connectors are not supported by the airports that responded to this survey as of February 2024. One of the airports mentioned plans to ensure that any vehicle can charge at any charging station, regardless of connector type. The airport is still working on the solution.

The airports indicated that the number of charging stations installed was determined according to various factors and methods, such as the following:

- Consideration of the rate of EV adoption in the region and the likely subset of that parking at the airport;

- Assessment of the availability of electrical power and the capacity of the current electrical panels;

- Consideration of the existing infrastructure when determining the number of charging stations to install;

- Use of grants to install charging stations;

- Consideration of available funding and consumer demand;

- Existence of constraints due to a limited budget;

- Starting with a few chargers that had monitoring capabilities to determine the number of users that used the chargers before adding additional chargers;

- Consultant recommendations;

- Installation of charging stations on a trial basis to see how much use they would receive;

- Conduct of a parking study to determine the number of charging stations; and

- Determination of the number of charging stations during a construction project.

Locations of EV Charging Stations

The EV charging stations have been installed at various locations in the airport parking facilities, as shown in Figure B-9. Eighteen airports have designated parking areas with EV charging stations. Twelve airports have installed EV charging stations close to the terminal and seven airports have installed charging stations close to elevators or other access points. One airport has installed EV charging stations in a long-term parking facility.

The survey responses reveal that several factors determined the location of charging equipment within parking facilities. Visibility and convenience were important, with some airports believing that more visible and accessible stations would encourage greater use. The proximity to electrical panels or service, as was the existing infrastructure, was a key factor for some. Some airports installed chargers at a medium-desirability location, not too close or too far from the entrance and near the power source. Access to utility infrastructure and safety considerations (e.g., accessibility to fire trucks) also influenced the location choice.

Consultant recommendations played a role for some, while others determined locations based on feasibility and a preference toward new construction. Some advised against placing chargers close to doors or elevators to avoid tempting non-EV vehicles to park there. Minimizing installation costs was a consideration for some, as was the location of solar carport structures. Other considerations included proximity to entry doors, existing electrical service, and the access/egress location to the terminal. Some airports aimed to make it convenient for EV drivers and located the chargers in noticeable locations, frequently near the front of the garages.

EV Charging Data Monitoring and Usage

As shown in Table B-1, 12 airports with EV charging stations monitor the usage, and the remaining 14 do not monitor the usage. Out of 13 airports, 10 airports have networked charging stations. Seven airports out of 13 responded that they use the usage data to determine the additional EV charging station needs.

Figure B-10 shows the responses to questions in Table B-1 by hub size. Five large-hub airports out of seven surveyed were monitoring data usage while three out of twenty-one small-hub airports were doing the same. Networked chargers were more common in medium- and large-hub airports; however, a similar number of airports reported using the data to determine when to add charging stations. Overall, large-hub airports are monitoring usage to a greater extent based on the responses to the survey.

In response to the survey question about creating benchmarks, measures, or metrics for assessing demand and assisting with charging station planning, airports provided varied feedback. Some are actively working on it, while others have not yet started. A few airports track usage data and some expressed interest in future metric development. One of the airports noted that they analyze the data but have not created defined metrics for looking at demand or station planning. Another airport said that ongoing energy master plans aim to address these studies.

Airports provided diverse responses regarding using data and information beyond their original purpose. Some airports are looking into data usage and determining alternate use cases. One airport employs the data for tax reporting to the Department of Revenue. Another emphasizes environmental benefits, including gas savings and reduced carbon footprint. Additionally, data is

Table B-1. EV charging station monitoring and usage response.

| Question | Yes | No |

|---|---|---|

| Do you monitor the usage of your charging stations? | 12 | 14 |

| Are your charging stations networked? | 10 | 3 |

| Do you use the data to determine when to add additional charging stations? | 7 | 6 |

used to track power consumption and average dwell time on chargers, assess uptime and maintenance needs, and report Low Carbon Fuel Standard credits.

Funding of EV Charging Infrastructure

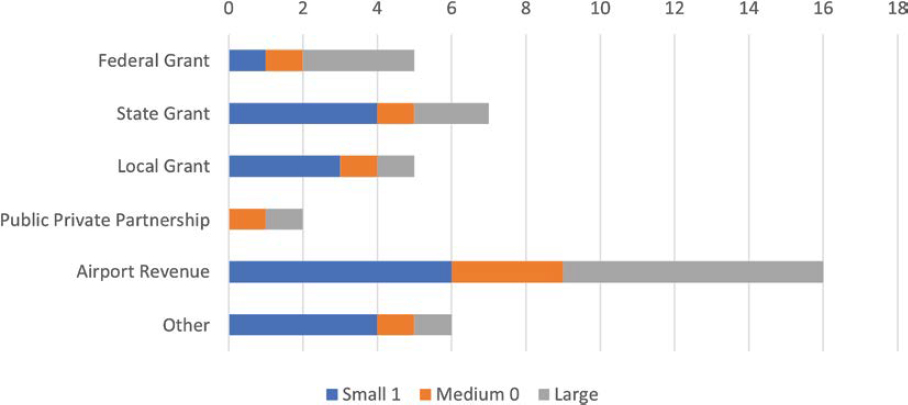

Figure B-11 shows the funding options used by airports for the purchase and installation of EV charging stations at passenger parking facilities. Sixteen airports responded that they had used airport revenue as the funding source, followed by seven airports that used state grants for purchasing and installing EV charging stations. One airport used a capital improvement project budget to purchase and install EV charging stations in addition to the local or regional grant. Along with the grant funding, three airports used airport revenue, two airports mentioned airport funds, and two airports mentioned the use of capital improvement budget for matching funds. Small- and medium-hub airports were more likely to use grant funds, but airports of all sizes reported using airport revenue to support EV charging stations. One large-hub airport that used public-private partnership and federal, state, and local funding said that the public-private partnership is structured as a long-term lease. One airport mentioned that they maintain the EV charging station, and another mentioned that a third party handles the operation and maintenance of the EV charging station.

Out of 25 responses, 20 airports reported that they do not charge a fee to use the EV charging station, and 5 airports charge a fee to use the EV charging station (see Figure B-12).

Out of the five airports assessing a fee to use the EV charging station, the breakdown by hub size was one small-, one medium-, and three large-hub airports. Two airports reported that they assess the EV charging fee, and two airports reported that private partners assess the fee. One airport reported that a city-owned utility company set the EV charging fee. One of the airports where the airport assesses fees said that the fee structure is designed to recoup the operating costs and associated taxes with EV charging stations. They also mentioned that the fee covers the operation and maintenance costs of the EV charging stations. One airport reported that they do not have a submeter for the EV charging stations. However, the EV charging fee is included in the parking fee if the user parks in an EV charging station. One airport mentioned charging a flat $5 fee for the EV charging station parking spot. Out of 17 responses for this question, 8 airports reported that they intend to charge a fee to help with cost recovery in the future, and 9 airports reported they do not intend to charge a fee.

Airports depend on various funding sources for the operations and maintenance of the EV charging stations. These include revenue generated from parking facilities, general airport funds, and overall parking fees. Some airports also allocate specific budgets each year for operations and maintenance. Two airports mentioned that there have been discussions and assessments about charging fees for EV chargers, but this has not been implemented yet. Additionally, third-party operators and airport revenue contribute to sustaining these services.

Electrical Capacity Assessment and Coordination with Utility Company

Eighteen airports responded that they conducted an electrical capacity assessment before installing EV charging stations, and six airports reported that they did not conduct the electrical capacity assessment. From airports responding to this question, 70% of small-, 100% of medium-, and 71% of large-hub airports have conducted an electrical capacity assessment. Three airports said they plan to conduct an electrical capacity assessment, and two airports said they do not plan to conduct an electrical capacity assessment. One airport mentioned that they will conduct an electrical capacity assessment if they do a large-scale expansion of the EV charging stations in their parking facilities.

Sixteen airports said that they contacted or coordinated with the local utility company regarding the installation of EV charging stations. Eight airports have not contacted or coordinated with the utility company. The coordination with local utility companies regarding the EV charging stations ranged from a few virtual meetings to conducting studies to assess the need and install the EV charging stations. Airport and utility company coordination regarding the installation of EV charging stations can be summarized as follows:

- Conducted virtual meetings to discuss the airport’s needs.

- The utility company installed the EV chargers free of charge through a grant. The details of the grant were not provided.

- Discussions about future expansions and available utility resources.

- The utility company will visit the airport facility to assess the need.

- The utility company subsidized the installation and network fees; however, they collected all revenue from the EV charging station usage.

- The airport designed a new garage facility for future EV charging stations and informed the utility company.

- Conducted electrical study to assess the installation of new charging stations.

- Coordinated with the utility company to expand capacity at selected locations.

- Coordinated with the utility company for solar and net metering infrastructure to support the EV charging stations. The installation also required a new transformer.

- Purchased Level 2 EV charging stations and will receive a rebate from the utility company.

Twenty-five airports responded to the question. Currently, two airports use load management strategies to mitigate the effect of additional load from the EV charging stations. Seven airports do not use any load management strategies. Sixteen airports mentioned that they plan to use load management strategies to mitigate the effect of additional load. Four airports said they are looking at load management strategies through research, talking to different vendors, or conducting load bank studies as part of a sustainability plan. One airport said that they plan to have a load management system that would allow them to reduce EV charging during peak demand or a load-shedding event. One airport said that they do not have any issues related to load management with the existing Level 2 chargers but will coordinate with the local utility company and load management vendors because the airport wants to install Level 3 DCFCs. One airport mentioned that they had set a hard limit for charging sites with limited capacity and implemented a load management system for individual chargers to avoid exceeding the capacity. They have also conducted an EV charging capacity assessment of the airport facilities to identify areas with the most capacity to install EV charging stations.

Safety Requirements for EVs and EV Charging Stations

Out of 24 responses, 17 airports responded that they do not have specific safety requirements or procedures for EVs and EV charging equipment (see Figure B-13). Two airports mentioned having first responders training for EVs and EV charging equipment. One airport mentioned that they have a safety procedure with their insurance company. One airport mentioned that installing all EV charging stations must follow the current code requirements. One airport mentioned that they have standards for EV charging equipment installation at the airport for power supply and transformer requirements. The same airport also requires all EV charging station installations to go through their building inspection and code enforcement group, to ensure that all applicable code laws and standards are satisfied. One airport provided examples of the safety requirements, such as no chargers can be installed under cover (i.e., the first floor of a parking garage) and EV charging stations cannot be installed within 6 feet of a gas-powered vehicle.

Out of 24 responses, 4 airports have specific safety training related to EVs and EV charging equipment for their staff while 20 airports do have specific safety training for EVs and EV charging equipment. One of the four airports has equipment that can fit in the garage in case of a fire. One airport asks each staff member to go through designated safety and preventive maintenance classes on EV charging stations. One airport provides training through an outside contractor, and another trains its staff through a fire department with EV fire response training.

Out of 25 responses, 9 airports said that they have coordinated with their fire departments to determine the need for additional standards or procedures related to EVs and EV charging equipment. Out of 25 responses to the question, seven airports said they have not contacted the fire department, and nine airports said they plan to contact the fire department.

In terms of airports coordinating with their fire department, or the local fire department, these discussions can happen as early as the planning phases and include recommendations on charging equipment location, access, and proximity to fire suppressants. One airport is evaluating the feasibility of installing DCFCs with existing fuel dispensers in a quick turnaround facility and are evaluating the feasibility of providing space for both. One airport’s on-site fire department has standards of practices for handling EV-related fires.

This page intentionally left blank.