Enhancing Airport Access with Emerging Mobility (2025)

Chapter: 12 Freight Access Considerations

CHAPTER 12

Freight Access Considerations

Use Cases for Airport Freight Access

Emerging ground access technologies transport not only people but also goods moving to and from airports. Airports are already multimodal facilities, and goods usually arrive by either airplane or truck. As vital links within the freight delivery process, airports are also an important piece of logistics operations. Moreover, airports seek the transport of these goods as part of their tenants’ business needs. Goods that end up at the airport can be anything from in-flight catering to aircraft components. Airports can develop dedicated infrastructure to facilitate ground access for freight.

Airport freight access is concerned with different use cases, including

- Trucking in and trucking out freight shipped by plane (air cargo),

- Ground freight brought to the airport to be stored or sorted and then leave the airport by truck, and

- Parts and large payloads delivered at industrial sites located at the airport.

In addition, deliveries of various goods and supplies are needed for the airport to operate, including

- Refrigerated and non-refrigerated food and beverages for airport concessions;

- Other goods for airport retail (e.g., newspapers and souvenirs);

- Materials and special equipment (e.g., for construction projects or maintenance); and

- Fuel deliveries for ground vehicle and aircraft, either by truck (tanker) or pipeline.

Cargo Activities at Airports

Many airports host freight and logistics operations. Goods transported by air include equipment and parts for the aerospace and automotive industries, pharmaceuticals, medical equipment, electronic components and consumer products, luxury goods, perishables (e.g., flowers and seafood), time-sensitive documents, banking materials, and other economically perishable materials (e.g., newspapers). This freight can be transported by dedicated all-cargo carriers, integrated express carriers, and combination aircraft carriers (Maynard et al. 2015).

In addition, e-commerce has had a significant impact on air cargo activities at airports. Aviation is now a critical logistic component for the e-commerce industry. With the rise of online shopping, there has been an increase in the number of small and lightweight packages being shipped globally since air transportation enables companies to move orders reliably and speedily, thus reducing the costs for retail and distribution.

At the dawn of e-commerce, electronic retailers (e-retailers) would rely on freight forwarders to arrange shipments. More recently, Amazon has undertaken a vertical integration. Overall, the increase in air cargo demand due to e-commerce has led to an increase in freight volumes at airports served by flight operators that focus on package delivery. The largest cargo hubs have been established at major airports, such as Memphis International Airport (MEM) with the FedEx SuperHub; Louisville Muhammad Ali International Airport (SDF), which is home to the UPS Worldport; and Cincinnati/Northern Kentucky International Airport (CVG), where both the Amazon Air Hub and DHL Americas Hub are located. However, Amazon Air’s strategy tends to favor smaller airports for its aircraft, bringing new volumes to aviation facilities such as Lehigh Valley International Airport (ABE), Fort Worth Alliance Airport (AFW), Austin-Bergstrom International Airport (AUS), Rickenbacker International Airport (LCK), Ontario International Airport (ONT), and Stockton Metropolitan Airport (SCK) since these airports experience less congestion and offer lower operating costs than others. Figure 84 illustrates one of Amazon’s facilities in Florida.

Amazon is not the only e-retailer generating additional air cargo traffic. For instance, online auction and shopping platform eBay facilitates business-to-consumer and consumer-to-consumer transactions. Unlike Amazon, eBay is not involved with the fulfillment process or any part of the logistics, but the existence of this e-commerce platform does impact parcel shipments from independent retailers that are transported by the U.S. Postal Service or private parcel and delivery services, such as DHL, FedEx, and UPS. If shipped across the country, many of these packages will fly at some point in their journey. Another example is Express Scripts, a pharmacy benefit–management company that processes claims and manages drug plans electronically through in-network pharmacies. Some of these medications are shipped by air, and the company operates, for instance, a warehouse facility at St. Louis Lambert International Airport (STL).

Logistics and Non-aviation Freight Activities

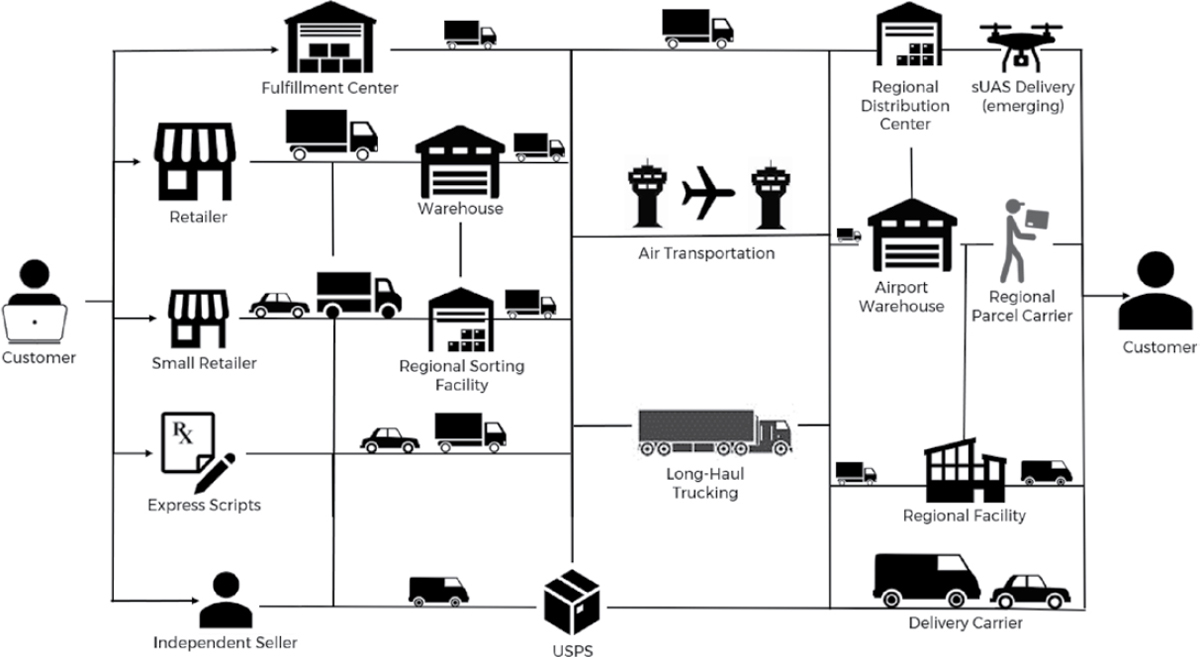

Not all cargo processed on airport land will necessarily fly from the same aviation facility. Airports can be home to a variety of logistics operations that do not involve an air segment, as shown in Figure 85. For instance, a freight forwarder can leverage its warehouse located at or near an airport to truck-in freight, store or sort it at the facility, and truck them out to their final destination. An example of non-aviation freight activity at airports is the Norfolk Southern Charlotte Intermodal Facility located at Charlotte Douglas International Airport (CLT).

Note: sUAS = small uncrewed aerial system.

This large, intermodal terminal facility can transfer containers from trains to trucks and perform 250,000 cargo lifts annually. The facility is located between runway thresholds 36L and 36C. However, there are no air/rail or air/truck intermodal transfers. A similar project is being implemented at Spokane International Airport (GEG), Washington, that could also facilitate deliveries by rail to tenants of the industrial park located on airport lands.

Furthermore, the logistics around air cargo shipments may be handled partially off-airport. For instance, most of the parcels shipped by air from the UPS Airlines’ hub at King County International Airport-Boeing Field (BFI) are sorted in nearby, off-airport sortation facilities. Transportation networks operated by shipment and logistics companies include transloading facilities, fulfillment centers, sortation centers, regional ground hubs, last-mile delivery stations, and other transportation facilities, some or all of which may be located at airports. The local ground transportation context and the type of freight and logistics activities conducted at aviation facilities strongly influence ground access requirements and the decision-making regarding infrastructure investments.

Finally, some airports accommodate industrial activities that have their own unique access requirements and logistics challenges, such as aerospace and car manufacturing and testing. These activities can occur on airport property or in its immediate vicinity. For instance the Boeing Renton Factory, performing the final assembly of the Boeing 737 MAX and P-8 Poseidon, is located along Renton Municipal Airport (RNT), Washington. It is served by the BNSF railway network through a spur line used for delivering Boeing 737 fuselages by train.

To facilitate freight access, airports typically have dedicated cargo facilities that are equipped with the necessary infrastructure, such as cargo terminals and warehouses. These facilities are

designed to handle different types of cargo, including perishable goods, oversized items, and general cargo.

There are several modes of transportation used to carry freight to and from airports, including

- Air transportation, which is used for transporting freight to and from airports. This mode of transportation is particularly useful for perishable goods or time-sensitive shipments that require speedy delivery.

- Road transportation, which is the most common mode for moving freight to and from airports. It is ideal for shorter distances, and it is often used for delivering goods to and from the cargo terminals.

- Rail transportation, an efficient mode of transportation for long distances and for moving large quantities of cargo. Many airports have railway links that connect to cargo facilities, enabling freight to move by rail.

- Water transportation, which is often used for transporting goods that are bulky or heavy or for moving cargo over long distances. Ports located near airports can serve as gateways for the transportation of goods to and from airports.

- Pipeline transportation, in which some hub airports have aviation fuel delivered directly by pipeline. They can have a hydrant system supplying each gate with jet fuel from the fueling station. Also, new supply chains are emerging to deliver new fuels, such as hydrogen.

Efficient freight access to and from airports is critical for the smooth and timely movement of goods. It is essential for airports to have robust transportation networks that connect them to major shipping routes and transportation hubs to ensure that cargo is delivered quickly and efficiently, reduce transit times, and increase productivity.

Reliable and cost-efficient supply chains have a significant role in air passenger and freight operations. Disruptions and delays may interfere with the key advantage of traveling by air: fast and secure transport.

Emerging Trends in Freight Forwarding

As this industry continues to expand, air cargo will continue to play a vital role in the e-commerce supply chain, especially for express long-haul shipments. However, e-retailer strategies carefully balance capacity, operating costs, delivery times, and other factors for each market and all along the value chain. Factors such as the cost of fuel or workforce availability in aviation operations and trucking have a significant influence on these decisions. Moreover, emerging technologies—such as electric powertrains for air and ground mobility, automated trucks, small uncrewed aerial systems (sUASs) teaming with delivery trucks, and automated or remotely piloted feeder aircraft—will have an impact on these decision parameters.

An alternative for traditional trucking to and from airports may be the implementation of automated vehicles (AVs); once these finish the testing phase, they could be utilized as another option for the transport of goods. AV technologies for truck operations are gaining traction. They have the potential of reducing costs and shortening long-haul trip duration, which could change the attractivity of air cargo for some interstate and transcontinental shipments. Automated trucking startups, such as Waymo Via, Aurora, TuSimple, and Kodiak Robotics, intend to operate vehicles developed by original equipment manufacturers (OEMs) such as SoloAVT, Navistar, and Volvo VNL. Waymo announced plans to build a hub for automated semi-trailer trucks in the Dallas–Fort Worth area. In the regional parcel shipment market, ground-based automated delivery systems can be more versatile than aircraft. They can travel to smaller towns and cities, which may not be financially viable with air freight. Finally, on the first and last miles (FLM) segment, automated vans, robots, and sUASs can deliver packages to their destination without the need for human intervention, which is expected to revolutionize the logistics industry.

Source: Hanley (2020)

Uncrewed aerial systems (UASs) are another emerging technology that could serve as an alternative to trucks. For instance, UPS Flight Forward, Inc. has been utilizing sUAS to deliver medical supplies at WakeMed hospital campus in Raleigh, North Carolina (Federal Aviation Administration 2023e). The use of sUAS fleets for FLM transportation of light payloads is emerging. Larger UASs are being developed to carry several hundred pounds on distances of over 20 miles. With the emergence of new operations and UAS traffic management technologies, it will soon be possible to fly UASs safely and efficiently from aviation facilities, including from airport-based or near-airport freight and logistics facilities (Federal Aviation Administration 2022b).

Some freight companies have produced alternatives that take advantage of the natural environment of different locations, such as package delivery using water transportation. DHL has started shipping parcels from Heathrow Airport (LHR) to London onboard a boat that travels on the Thames River, as depicted in Figure 86. While such a solution is more of a niche for handling relatively modest volumes, it could be applied to other locations with extensive navigable waterfronts.

Air-Rail Intermodality

While it is usually more expensive to ship goods by plane, air-freight operators can transport goods to any part of the country—and the world—in a matter of hours, whereas rail-based delivery systems may take days to do the same. This is one of the reasons why air- and rail-freight markets do not overlap and are not a relevant multimodal pair—including at airports hosting inland ports (e.g., CLT).

The development of high-speed rail services in the United States is not expected to change this situation, especially considering the cost of building new railways and operating rolling stock built for high-speed rail on train slots that are not competing with passenger services. For example, Euro Carex—an initiative to ship express parcels by rail between European airports—has struggled to materialize, despite a mature high-speed rail ecosystem with largely preexisting infrastructure. The only successful example of such service was the TGV La Poste night service, operated by the French railway company SNCF for the national postal carrier La Poste from 1984 to 2015.

The use of light rail for middle-mile or last-mile transportation could find some niche applications as an innovative solution for sustainable urban freight transport (Pietrzak et al. 2021)

and potential airport access for specific types of cargo (e.g., transfer of parcels, airport deliveries). However, combining light rail transit (LRT) in this context with the transport of passengers would need adequate planning and logistics in place with local partners to coordinate train schedules, minimize the turnaround time of freight handling operations, and mitigate the impact on passenger trains.

Finally, the hyperloop concept has been promoted as suitable for freight transportation by its developers. HyperloopTT has proposed shipping container–compatible pods, while the Cargo Hyperloop Holland coalition has evaluated the feasibility of a corridor across the Netherlands (Hardt Hyperloop n.d.).