Incorporating Technologies into Airport In-Terminal Concessions Programs: A Primer (2025)

Chapter: The Primer

1. Introduction to the Primer

The Primer will provide airports with an overview of incorporating technology into airport in-terminal concessions programs. Alongside ACRP Research Report 279: Framework and Tools for Incorporating Technologies into Airport In-Terminal Concessions Programs (the Framework) and the Self-Assessment Tool, the Primer will assist airports in identifying, evaluating, selecting, and incorporating technologies into their in-terminal concessions programs. The Primer has been developed with due consideration for airport and customer needs and requirements. Both the Framework and the Self-Assessment Tool can be found on the National Academies Press website (nap.nationalacademies.org) by searching for ACRP Research Report 279.

1.1 The Goal of Research

- This research-based Primer presents background and contextual information so that the reader better understands the basics, as well as the issues related to incorporating technology into airport in-terminal concessions programs. As such, the Primer summarizes the results of the research into the approaches used by leading U.S. airports with reputations for innovation, integration of emerging technologies, and excellent customer experiences. It also provides a guide to the passenger airport journey, airport customer needs, and an understanding of the rapidly expanding airport technology environment, which challenges airports’ procurement and implementation processes.

- To further assist the reader, the Primer also defines and describes relevant current and emerging technologies and trends, as well as documenting the role of technology in the evolving landscape of airport in-terminal concessions programs, with an emphasis on developments since 2019. The Primer documents the results of an Airport Survey and an Airport Passenger Survey conducted to support this research and validate the findings and recommendations in the Framework. In addition to consumer insights, stakeholder perspectives were also probed and evaluated. As a result of this research, the importance of early collaboration with all stakeholders, the workforce implications of technological advancements, and the impact of various business models on technology adoption were identified, are documented in this Primer, and culminate in best practices for the reader to consider implementing at their airport.

- The Primer is complemented by a companion Framework and Self-Assessment Tool that is practical, scalable, and adaptable to specific airport characteristics and needs. The Framework and Self-Assessment Tool are provided to help the reader design and implement existing and emerging technology into their in-terminal concessions programs. Readers can access.

1.2 Navigating the Primer

The Primer is organized as follows:

Table 1. Primer Overview

| Chapter | Short Summary |

|---|---|

| Chapter 1: Introduction to the Primer | Chapter 1 gives the reader an overview of the research goal and support in navigating the Primer. An understanding of the research approach and the methodology used to investigate the impact and integration of technology in airport concessions is also provided. |

| Chapter | Short Summary |

|---|---|

| Chapter 2: Guide to the Traveler’s Airport Journey | The second chapter considers every step of a passenger’s journey—from planning and ticket purchase to arriving at the destination airport and heading for their destination. At each step of the way, the passenger may make use, passively or actively, of a wide variety of technology that can assist them in their journey. This chapter discusses these human/technology intersections, what choices or actions lead up to the intersections, and what may result, depending on whether the traveler engages with technology in some way or does not use it. Both the inbound and outbound trips are covered together because the departure and arrival activities, as well as the technology possibly in use, are similar. |

| Chapter 3: The Evolving Landscape of Airport Concessions | Chapter 3 discusses four important foundational concepts that underpin successful approaches to incorporating technologies into airport in-terminal concessions: (1) It provides an understanding of the overall trends in the airport concessions landscape and consumer behavior, (2) the pandemic-driven technological shifts in airport concessions and consumer behavior, (3) the role of e-commerce and omnichannel platforms in modern airport retail, and, (4) the resulting need for a comprehensive understanding of technology in airport concessions. |

| Chapter 4: Setting the Scene: Technologies in Airport Concessions | Chapter 4 gives the reader detailed lists identifying the current and emerging technologies (since 2019) being used within airport in-terminal concessions programs. It also describes how each technology is being used to enhance the experience for airport customers. Chapter 4 also documents technology’s three major roles in enhancing the concessions experience and the key areas of the experience that technology addresses within each of these roles. |

| Chapter 5: Visualizing the Passenger Journey in Airport Concessions | Chapter 5 allows the reader a more focused appreciation of the enabling technology utilized at various journey points during arrivals and departures. Complementing this perspective, the results of an Airport Passenger Survey conducted by the research team provide key insights into customer views and preferences related to technology in airport concessions. Four passenger personas were also identified and detailed using the survey responses. Additionally, the significant benefits that technology brings to the passenger experience for both the airport and the passenger are enumerated. |

| Chapter 6: Consumer Insights and Technological Trends | Recognizing that consumer purchasing habits have significantly changed, this chapter provides a breakdown of key consumer trends uncovered as a result of the research. The impact of these trends on airport concessions is also itemized. |

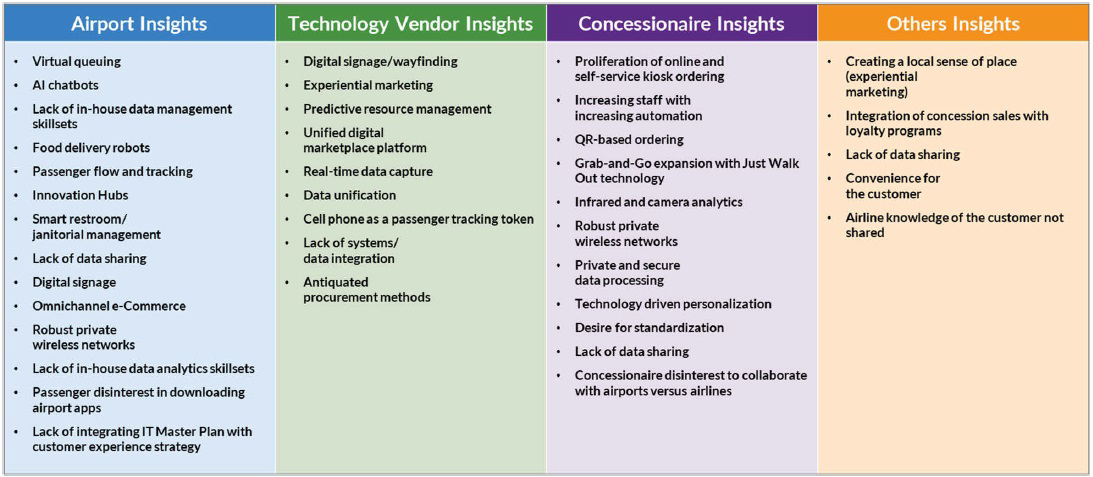

| Chapter 7: Stakeholder Perspectives and Interviews | Chapter 7 provides an overview of the study’s interview process and how relevant stakeholders were selected. It also offers a summary of the insights of the airports, concessionaires, technology vendors, and industry thought leaders. Common themes and notable innovations are identified from across all of the insights garnered from each of these stakeholders. |

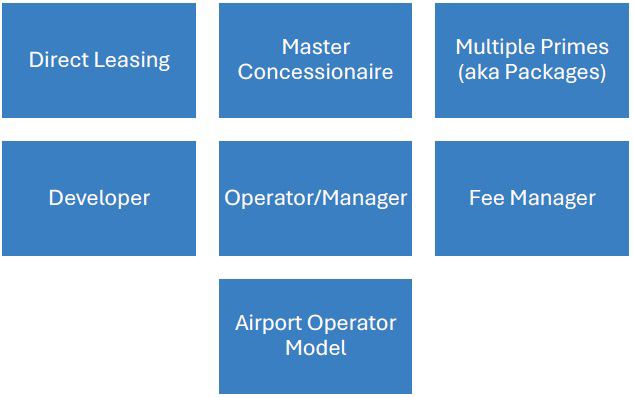

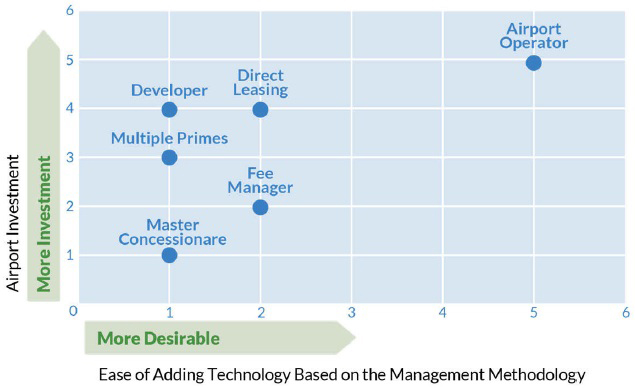

| Chapter 8: Business Models, Local Concessions, and Stakeholder Engagement | Chapter 8 provides a summary of the different business models (concessions agreements) for running concessions programs at U.S. airports, many of which influence a concessionaire’s willingness to invest in technology. This chapter also highlights the challenges and opportunities that are unique to local and small business concessions and the critical importance of collaborating with and engaging key external stakeholders. |

| Chapter | Short Summary |

|---|---|

| Chapter 9: Workforce Implications of Technological Advancements | Chapter 9 reviews the dramatic changes experienced by implementing technology within the airport ecosystem. These changes have had a concomitant impact on the skillsets required by airport employees. Employers are also experiencing challenges regarding recruiting and managing Generation Z and beyond. Recommendations are offered regarding steps to be taken to mitigate these impacts and challenges for the good of the employee, the airport, and ultimately the customers they serve. |

| Chapter 10: Case Studies and Best Practices | Chapter 10 provides examples of a variety of successful uses of technology in airport in-terminal concessions. Case studies highlighting the technology used and lessons learned from discussions with Dallas Fort Worth International Airport, Miami International Airport, Cincinnati/Northern Kentucky International Airport, Concessions Management LLC, Rezcomm, and Veovo are included in the report. A comparative analysis of in-terminal and non-airport concessions is also provided, which shows variation due to several factors inherent in their operational environment. |

1.3 Research Approach and Methodology

A multifaceted methodology to thoroughly investigate the impact and integration of technology in airport concessions was employed to produce this report. Each component of the methodology significantly contributed to forming a solid foundation for detailed analysis and informed conclusions. The approach utilized provided a comprehensive perspective on the interplay between technology and airport concessions, fostering a nuanced understanding of their relationship. The research methodology included the following:

- A Literature Review. Before embarking on primary data collection, a comprehensive literature review of more than 75 resources was conducted to establish a solid theoretical foundation. This review encompassed a wide range of academic and industry publications, focusing on the evolution of airport technology, the dynamics of airport concessions, and the changing patterns of passenger behavior. It provided critical insight into existing studies that helped identify gaps in knowledge to shape the direction of subsequent data collection efforts.

- Airport Passenger Survey. The Airport Passenger Survey was a key component of primary data collection. Data were gathered in Fall 2023 from a nonprobability panel of 1,200 individuals who flew at least twice during the past year. This approach ensured a diverse representation of air travelers. The survey captured both quantitative and qualitative data, offering insight into passenger habits, preferences, and experiences. The collected data was weighted to Census demographics to enhance its representativeness. To analyze the data, advanced statistical techniques in Stata (www.stata.com), including K-means cluster analysis, were utilized. This method segmented

- travelers into distinct groups based on shared characteristics and survey responses, aiding in the creation of four high-level traveler personas. These personas provide a nuanced understanding of different traveler types, their behaviors, and preferences, especially in relation to airport technology and concessions.

- Interviews With Airport and Non-Airport Executives. Complementing the Airport Passenger Survey, the research team conducted interviews with executives and managers from airports, concessionaires, and technology sectors globally. These interviews delved into the operational, strategic, and technological aspects of airport concessions. The insights from these interviews were invaluable, offering real-world perspectives on the integration and impact of emerging technologies in airport environments.

- Airport Survey. Airport staff from various airports worldwide, differing in size, passenger volume, and management structure, were invited to participate in the Airport Survey. This survey aimed to gather firsthand information on the adoption, use, and economic impact of innovative technologies within airport in-terminal concessions. The responses provided a wide view of current industry trends, preferences, and perceptions.

1.4 Limitations of the Research

Due to the smaller sample size used in this research, caution should be exercised when generalizing the results and care should be taken not to draw conclusions beyond the research sample. This Primer’s commentary on the research is intended to assist the airport industry in understanding how technology can be incorporated into airport concessions. While the commentary cannot be generalized to the entire population of airports, the findings do highlight potential opportunities for airports and are broadly illustrative of the different factors that airports can consider when utilizing technology in their concessions operations.

In addition, the research aims to provide an understanding of not only the available technologies but also how passengers, airport employees, and concession operators may use these technologies to gain an understanding of relationships among airports, their stakeholders, and technology. Each airport needs to assess its own organization’s ability to enhance its technology program in relation to its concessions program and its passengers. Finally, the examples cited in the Primer are presented for illustrative purposes only and do not constitute an endorsement for use.

2. Guide to the Traveler’s Airport Journey

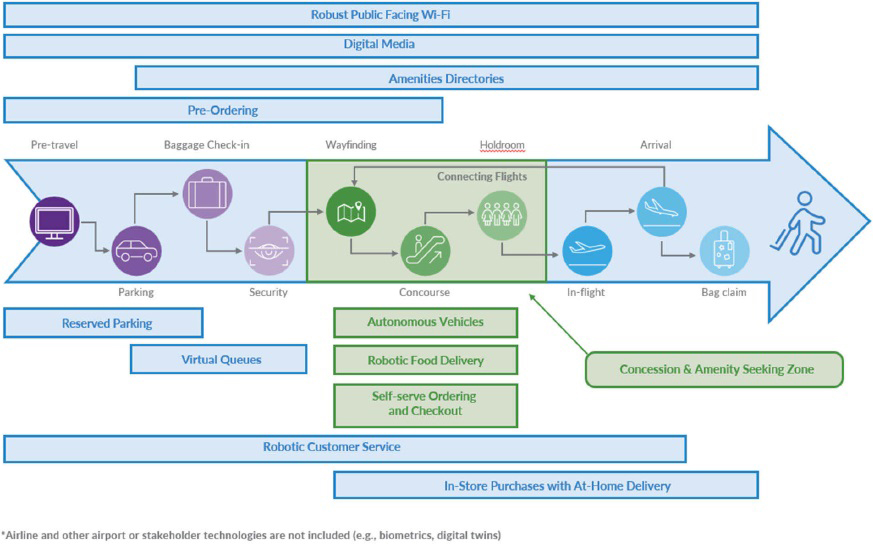

The travel ribbon—or passenger journey, as it is otherwise known—has adapted and expanded due to the significant influx of technology every step of the way. The passenger journey represented in this report is specific to the possible touchpoints where passengers may have the opportunity to interact with

airport in-terminal concessions. Because there are now opportunities for travelers to place orders for food and beverage (F&B) options or make retail purchases for pick-up at the airport, the passenger’s journey starts well before the traveler arrives at the airport. Furthermore, the journey can continue until after the passenger departs the airport because some airport retailers provide options for ordering or purchasing goods in the airport for delivery at home.

2.1 Pre-Travel

Technology has also found ways to help travelers prepare for their trips. Travelers can now check-in from anywhere for their flights on virtually all major airlines 24 hours before departure. This has significantly affected how passengers plan their trip to the airport. Because of information that is available to them, passengers may check either the airport’s or the airline’s website.

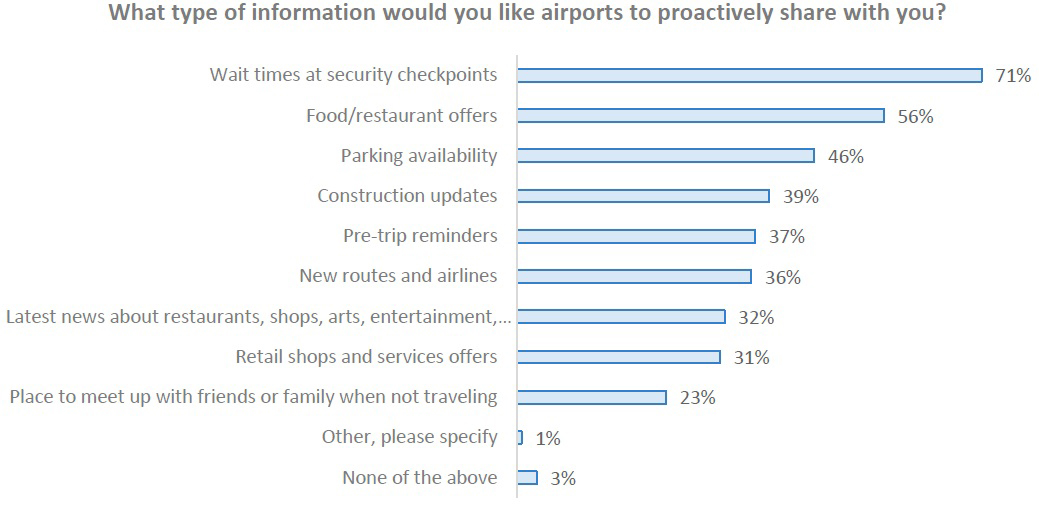

The airport’s webpage is often the best place to start considering the diverse ways of getting to the airport. John F. Kennedy International Airport (JFK) in New York offers information on numerous travel options to help passengers arrive on time for their flights, as well as opportunities for passengers to reserve parking or pre-order food once they arrive at the airport (Rhodes 2024). Parking data is provided, including how full the lots are and the parking rates in each. Some airport websites also provide information on the real-time or predicted queue at passenger screening checkpoints. Technology allows travelers to compare the services provided, the cost, and other factors to help them make better decisions with reduced stress. From this project’s Airport Passenger Survey, it is clear that passengers prefer that airports provide more information about their journey rather than less information, such as wait times at security checkpoints, food/restaurant offers, and parking availability (see Section 6.1 for more details).

2.2 Parking

While airport parking is not within the terminal, this is an important step in the passenger journey. Besides providing airports with a significant portion of their non-aeronautical revenues, passengers’ experiences with parking can influence their concession purchases and their overall airport experience. A more reliable and faster parking experience gives passengers more time in the terminal to shop and eat.

Additionally, airports that offer reserved parking or other parking services, such as valet parking, have an opportunity to cross-promote in-terminal concession offerings, as well as collect important data on these passengers.

2.3 Passenger Check-in/Bag Check

Having arrived at the airport, the technologically savvy traveler has likely already checked-in with their airline; received their boarding pass virtually; paid for checked baggage, if necessary; and been permitted to bypass check-in counters if the traveler has no checked baggage or their airline has adopted self-bag tagging. These various applications of technology have significantly reduced crowding in airport ticket halls, providing a significant time savings and an enhanced customer experience for travelers. Getting travelers to the gate as expeditiously as possible also provides the opportunity for increased non-aeronautical revenue for the airport operator and concessionaires.

Source: ICF

2.4 Passenger Security Checkpoint

The next step in the travel ribbon, usually the one that causes the most stress, is joining the queue to pass through the Transportation Security Administration’s (TSA) security checkpoints. While it is unlikely that going through security will ever become stress-free, technology has entered this aspect of the travel journey to help diminish the stress on technology users (while potentially increasing the stress of nonusers).

De-peaking wait times at passenger security screening checkpoints through virtual queues is one aspect of security technology that offers a means to more efficient use of checkpoint equipment and thus diminishes lines. Using a virtual queue, passengers are able reserve a time to enter the screening checkpoint at a less busy time than they might otherwise enter the screening queue. This has the effort of minimizing their wait time for themselves as well as for others.

Source: ICF

While not a new concept (most people have put their names on a waiting list at a restaurant and waited for a text or phone call), it has only recently been used in airports. In 2021, Seattle-Tacoma International Airport introduced “Spot Saver.” While it had been under development before the pandemic, its importance and priority were elevated as airports attempted to find a way to diminish lines and person-to-person exposure. This was seen as a way to improve customer service and to free passengers to do other activities in the airport while waiting (Youd 2021). Other airports also deployed virtual queuing in 2021-2022, including Denver International Airport (DEN) and Boston Logan International Airport. DEN’s solution was biometric-based, allowing people with health risks to use a dedicated lane. Five additional airports also ran pilot programs during this period.

The significance of virtual queuing with regard to concessions is that it allows passengers to pass through security more quickly and therefore spend more time in the holdrooms, with opportunities to shop at the concessions (Airport Cooperative Research Program 2022).

2.5 Wayfinding

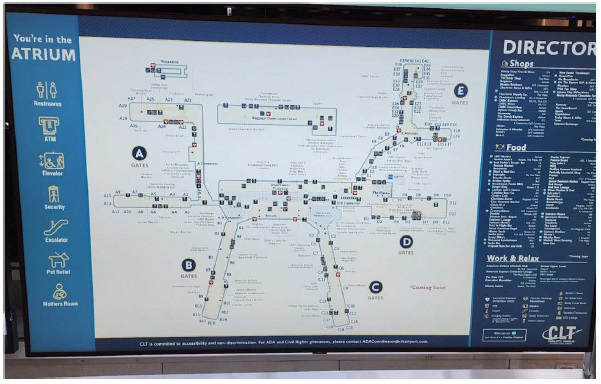

After clearing the passenger screening process, travelers continue their journey. Most travelers will now look for the location of their departure gate, restrooms, and amenities, such as F&B outlets. They may also want to confirm the departure time and gate information for their upcoming flight. The airline’s app is one way of doing this. Many travelers also use an airport’s Flight Information Display System (FIDS). To assist passengers with finding amenities more quickly, many airports are deploying interactive location directories.

Source: ICF

Besides being more appealing than the older static displays, the content can be easily updated by the airport to reflect the current amenity offerings. Passengers can often interact with these displays to show only the types of service that may be of interest to them or that may be open.

2.6 Concourse

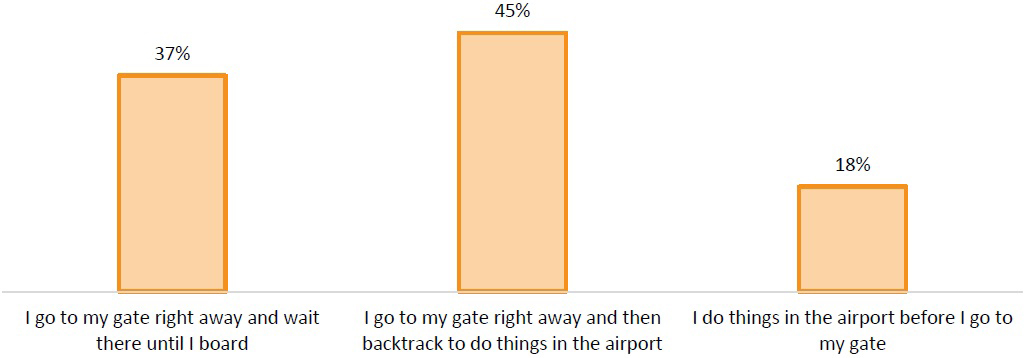

As passengers make their way to the departure gates, they typically do one of three things: (1) they go directly to the gate and wait until they board their flight, (2) they go directly to the gate and then backtrack to do other things until their flight boards, or (3) they will do other things on their way to their gate. The behaviors are listed in order of airport revenue opportunities, where the “gate huggers” are least likely to make concession purchases and the last group is most likely to make purchases. By providing passengers with clear wayfinding information with updated flight departure information, they are most likely to fall into the desirable last group.

Which of the following best describes what you do after security?

- Airport Advertising. Airport advertising has advanced significantly. Gone are the days of paper dioramas that required physical updating. Airport advertising is also no longer a one-way source of information. Many airport advertising firms use technology to collect information on who and how many people view their airport ads. Some digital billboards and screens are equipped with cameras that use facial recognition technology to estimate the number of distinct views of the ads and to gather information on the demographics of these viewers, including age and gender. They can also monitor the emotional response to the ads. This technology, by TruMedia, was first launched at Copenhagen Airport, Kastrup (CPH), the international airport serving Denmark’s capital region and southern Sweden. They installed 550 screens for advertising, with sensors connected to the screens, gathering information on the number of passersby, the number of people who stop, their age group, and their gender. Initially, the information was gathered to provide advertisers with information on who their messages were reaching. No images were recorded, and no uniquely identifiable data can be extracted. Furthermore, it allowed the airport and its advertising provider to narrowly target advertising campaigns for specific travelers.

Source: ICF

- Self-Serve Kiosks. The use of technology in airport concessions is also increasing. As with virtual queuing, much of the growth of concession technology was spurred by the COVID-19 pandemic; however, it has since found its place in increasing sales and reducing costs for concession operators. One of the earlier technologies utilized in airports was ordering kiosks. Primarily, the kiosks utilized in airports are for individual brands and are installed in or near the concession unit to allow customers to place their orders without having to queue. Kiosks offer the additional advantage of being more accurate as the customer can select toppings and extras with full knowledge of any additional cost for add-ons, which prevents customers from coming back and saying that they were not aware of what they were purchasing or that they would pay more for upgrades to their food. Multiunit kiosks were sometimes placed in food courts, operating similarly to the common use self-serve kiosks used for airline passenger check-in.

Source: ICF

- Artificial Intelligence (AI). It is expected that AI-powered equipment will find its place in the airport quick-serve industry during the study period (2023–2031) (Patel 2022). Primary growth is seen in restaurant management software and smart gadgets. For example, customer wait times can be extrapolated based on past data. Automated ordering can minimize spoiled food waste and lost sales due to products being out of stock. These tools can also save money for the restaurant by not ordering products before they are needed, thus reducing the investment in inventory. These

- ordering tools can also be used to calculate the true value to the individual unit of sales or specials, eliminating the human nature to buy because an item is on sale, even if the product is not needed.

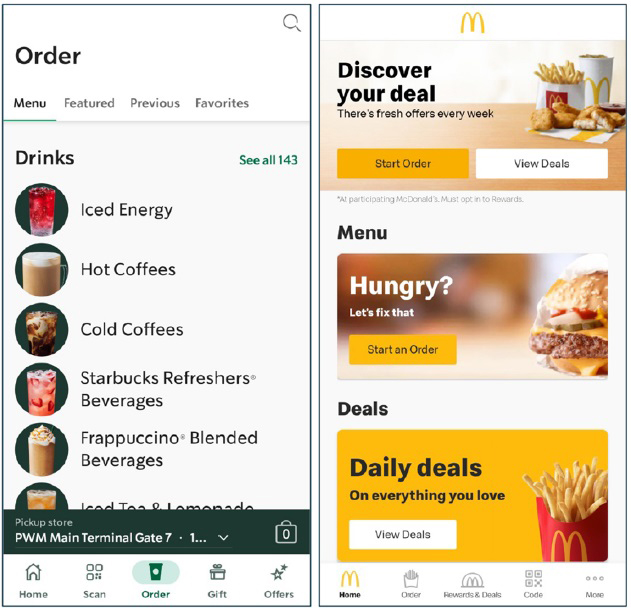

- Mobile Apps. The use of apps in airports has only seen moderate uptake. While companies with their own apps have seen frequent use (e.g., Starbucks and McDonald’s), there has been little success in developing and using an app that allows for ordering from multiple store locations unique to each airport. Before the pandemic, a handful of apps had trials in various airports in the United States. Of those, only Grab (later Servy), which was acquired by Collinson, a company that does work in omnichannel airport e-commerce, has survived. Though it is unknown if the services provide customers with a true level of convenience because while they can order remotely, they are still expected to go to the operation to pick up their orders.

Sources: Starbucks mobile application (LH); McDonald’s mobile application (RH). Accessed September 5, 2024.

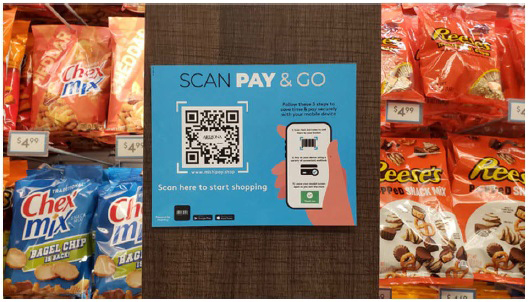

- Personal Delivery. Los Angeles World Airports, the Los Angeles International Airport (LAX) operator, has launched an ordering and delivery app in partnership with concession developer URW, enterprise self-service platform Servy, and delivery service AtYourGate. The app builds on the success of the airport’s LAXOrderNow.com mobile ordering platform. While ordering from concessions was available airport-wide, delivery was initially rolled out only in the Tom Bradley International Terminal and West Gates. Travelers could scan Quick Response (QR) codes throughout the terminal or visit the website to place orders, and if the delivery service is available, they could choose it during checkout (for an additional fee).

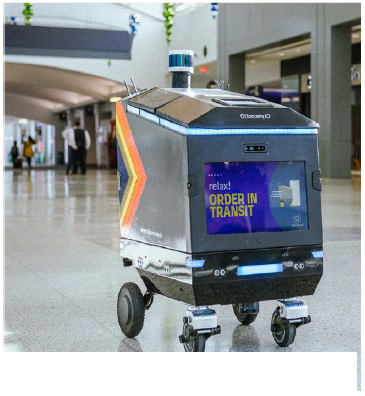

- Robotic Delivery. Cincinnati/Northern Kentucky International Airport (CVG) and Ottonomy launched a test fleet of food and retail delivery Ottobots. Customers could order from select food and retail stores operated by a single operator (Paradies Lagardère). When the customer placed their order, all they needed to do was enter their gate number, and when the order was prepared, the store would place it in an Ottobot. When it reached the gate, the customer would use a QR code to

Source: Ottonomy

- open the robot’s secure carry-chamber to remove their order.

2.7 Airport Technology Environment

Airports, airlines, and concessionaires are encountering unique challenges in their operations and within the airport industry. Shifting customer purchasing behaviors, the evolving e-commerce landscape, and digitalization are disrupting their traditional revenue streams and business models.

“Digitalization is the use of digital technologies to change a business model and provide new revenue and value-producing opportunities; it is the process of moving to a digital business.” (Gartner n.d.)

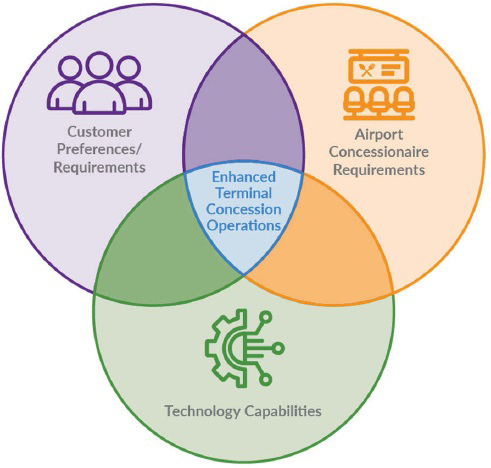

Passenger buying behavior has fundamentally changed with the advent of digitalization, transforming how concessionaires, airports, and customers conduct business. The positive aspect is that, if properly embraced, digitalization offers airports significant opportunities to discover new methods for achieving this requires airports to collaborate with key ce environment (e-commerce). Figure 13 illustrates the generating core non-aviation revenues. However, stakeholders to establish a digital airport commer relationships among these key stakeholders.

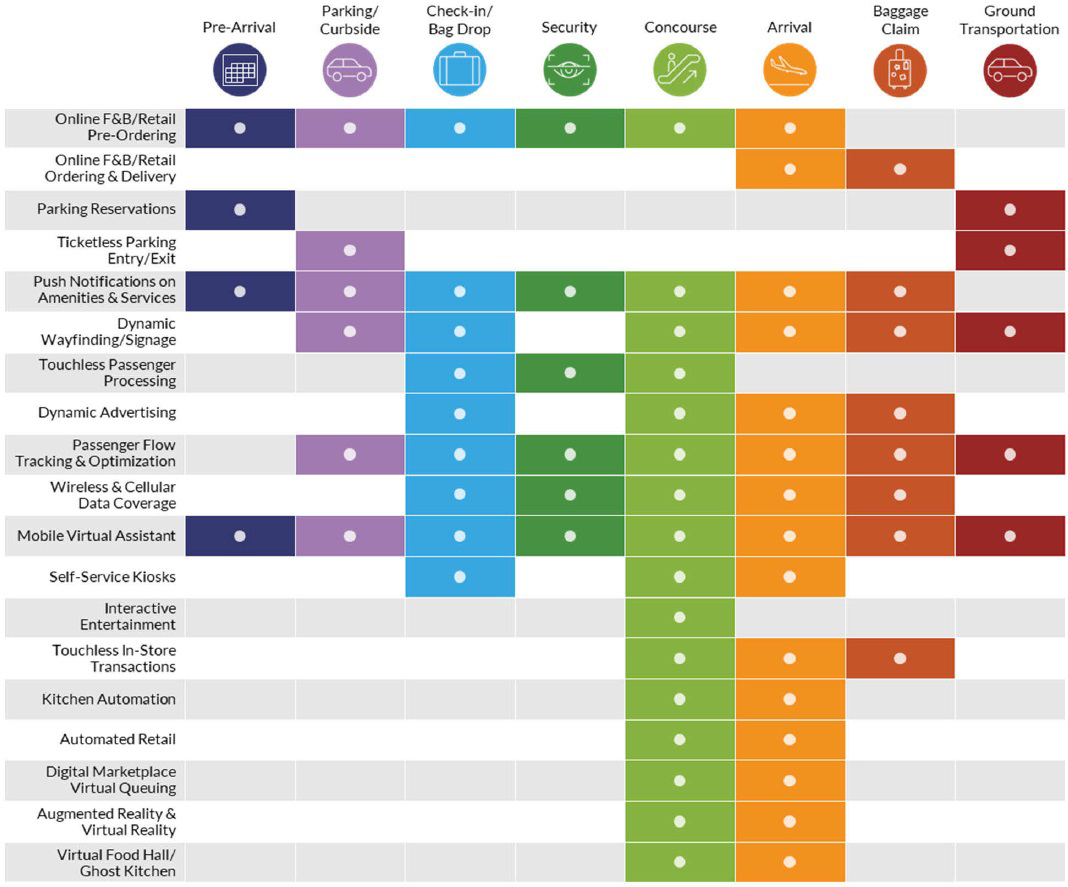

As part of the suite of customer-facing technologies, e-commerce has caused airports, concessionaires, and airlines to revisit the sale of goods and services from a passenger journey perspective, as shown in Figure 14. This perspective introduces new roles in which technology can be deployed at the airport as part of an integrated concessions program.

3. The Evolving Landscape of Airport Concessions

3.1 Overall Trends in the Airport Concessions Landscape and Consumer Behavior

The U.S. airport industry is evolving, and project leadership should determine how concessions design and its business will be affected so it can be addressed pragmatically yet ambitiously. To consider airport concessions trends, we should look at what remains the same in the aviation industry and what is changing or is likely to change.

Much Remains the Same:

- Air travel demand will experience continued growth but will have occasional downturns.

- Airline economics will remain largely intact.

- The air travel journey and airport experience will remain stressful for many passengers.

- Customer centricity needs to be at the heart of everything airports do.

However, Much Is Changing or Is Likely to Change:

- Business and international travel are recovering slowly.

- Airports need to redefine relationships with customers, concessions, and their host communities.

- Sustainability is foremost on consumers’ minds, especially younger travelers.

- Curating delightful airport guest experiences is evolving as an airport strategic objective as airports adopt a hospitality model in the delivery of airport experiences and services.

- As Americans age, older travelers will join people with disabilities (visible and invisible) and other special needs, thereby comprising an even larger portion of the market. This will require a significant investment in equipment and other services to ease travel for passengers with mobility, visual, and/or hearing impairments.

- Digitalization, AI, and experiential technology (i.e., the use of technology to create immersive experiences for guests/customers that engage all of the senses and often have an aspect of personalization) will transform significant aspects of the airport experience, including airport commercial business.

- Airports will need to be more innovative with regard to revenue generation and service delivery.

Before exploring airport concessions trends, a look at megatrends is important. Megatrends outside of airports are often the precursors of what the airport industry might adopt. Relevant megatrends, as of 2024, include the following:

- Sustainability

- Experiential Offerings

- Incorporating and Leveraging Technology

- Food Trends

- The Evolution of the Customer

- Omnichannel Shopping

The restaurant and retail industries assess trends annually in order to maximize revenue; some megatrends resonate with airport operators, concessionaires, and customers, but not all.

3.1.1 Sustainability

Sustainable practices at airports are essential for long-term economic resilience. Airports and their partners are seeking financially and environmentally sustainable practices. As such, sustainability remains a primary focus for airport vendors, airports, and customers in 2024, and likely will continue to be an important aspect of all types of businesses. Sustainability is a long-term trend and remains at the top of many organizations’ priorities. F&B operators consume substantial amounts of electricity, fuel, and water, and quick-service restaurants generate substantial amounts of trash from unconsumed products, single-use wrappers, and plastic waste (Electricity Plans 2022).

Retail operators’ sustainability efforts focus on reducing packaging waste, reusing displays and signage, and consuming more environmentally sustainable power. Their methods of pursuing sustainability are substantially similar to those of food service operations.

Sustainability is believed to be a megatrend and a driving force behind many of the choices that airports and airport concession operators will make in the near future. While airport concessions are not the largest contributors to airport-generated pollution, they are front and center and highly visible, and their actions allow the airport to show its efforts in areas that are most visible to the public. However, sustainability efforts should be measured to be recognized. This requires key performance indicators (KPIs) or quantifiable metrics and a means to collect and report these KPIs.

3.1.2 Experiential Offerings

Experiential dining is more popular than ever, especially among millennials, Generation X, and Generation Z customers. Restaurant guests are looking for unique experiences that can be achieved at various times throughout a meal and can come in many different forms, including thematic products and décor, views, sustainability-focused meals featuring locally sourced food, and surprising menu items. As an example of why experiential dining is a trend, according to Yelp, searches for “underwater restaurants” were up 263% in 2023, while searches for dinner theaters were up 109% (Yelp 2022).

While a wide variety of experiences are possible, the rules surrounding airports and the limitations regarding the time available to potential diners somewhat limit the opportunities. For example, facility availability limits the possibilities for rooftop and outdoor dining in airports. However, many airline and credit card clubs see the benefits of creating outdoor terraces for their members. Most of these terraces either feature food or allow members to carry food from other areas onto the terrace.

To measure passenger demand and the level of success of new concepts, airports need to track the performance of each concept using transaction sales data collected from the concessionaires.

Experiential Dining.

Experiential dining in airports can be found in many of the same forms found streetside. Experiential dining at airports has been a well-established concept for quite some time. At London’s Heathrow Airport (LHR), The Perfectionist’s Café delights travelers with a rich but casual design. The design also incorporates open kitchen elements, such as a wood-fired pizza oven and a curing chamber.

Aburi-EN, inside of the Singapore Changi International Airport (SIN), serves fine Australian and Japanese wagyu beef. Kansai International Airport (KIX) in Osaka, Japan, has a conveyor belt sushi concept that also has interactive displays.

Wine bars, such as Vino Volo, offer guests the opportunity to enjoy wine flights tailored to their individual preferences. The knowledgeable Vino Volo staff introduces the wines and provides valuable information, guiding the guest to explore the diverse and fascinating world of wines.

Throughout the country, musical performances have entertained diners in airport restaurants. Notably, Austin-Bergstrom International Airport (AUS) has one of the most robust music programs. Other noteworthy airport music programs include those in Nashville, New Orleans, and Denver. In New Orleans, several locations have open kitchens that allow diners to watch the kitchen staff work through service, be mesmerized by the flames in the pizza ovens, or listen to the manager work through the orders.

Outdoor Dining.

Outdoor dining is a growing trend in airports, too. Diners at the Mumbai Chhatrapati Shivaji Maharaj International Airport’s (BOM) All Day Diner have access to outside seating. This location is also landside, providing a different airport user segment with the benefits of outdoor seating.

Source: Changi Airport

The cactus garden on the rooftop of SIN’s Terminal 1 has dining service available for those who want to bask in the sun and enjoy the views. Palm Springs, Long Beach, and Tampa are just a few airports where outdoor dining has been implemented. Inspired by the positive effects of outdoor dining, some airports have designed concepts to bring the outdoors into the terminal. In some airport concepts, to evoke the feeling of outdoor seating, the indoor restaurant spaces utilize skylights and windows to let natural light in. Simple structures, such as

pergolas, are used to keep an open, airy atmosphere. The choice of materials often includes naturally occurring elements, such as wood and stone, or iconic exterior elements, such as bricks and marble. To enhance the outdoor ambiance, designers also incorporate plants.

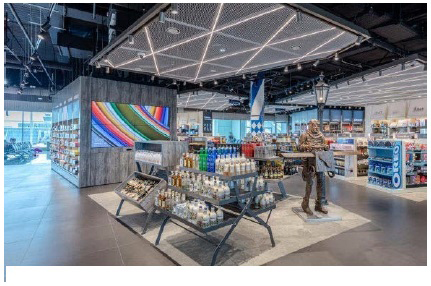

Large and Open Retail Designs.

International airports have long recognized the advantages of large and open designs at convenience and duty-free concepts. Large and open designs increase access and visibility to the products inside, draw passengers in, and stimulate impulse shopping. Spacious layouts allow passengers to move around comfortably, increasing the time spent shopping. This design also supports a store-in-a-store concept. Similar designs are implemented in Munich, Dubai, and Cancun.

Source: Umdasch Group

In recent years, in such airports as Nashville, Detroit, and San Francisco, concessionaires have been incorporating concepts within concepts to optimize their revenue potential. This approach can ensure that the concept is relevant during all times of the day and can provide capital investment and operational efficiencies. The practice also provides concessionaires with the flexibility to change concepts more frequently. The Bower Bay Shops in LaGuardia Airport(LGA) are 15,000 square feet of shopping in a “store within a store” format. Concessionaires are also incorporating large and open news convenience locations.

Digital Media.

In terms of digital media, large-scale dynamic digital installations have been incorporated into several international airports, immersing passengers and giving the potential to generate revenue. At SIN, digital technologies augment the interior environment, enhancing the passenger experience at multiple touchpoints. Large-format digital panels have been immersing passengers into company brands at U.S. airports for some time. In 2023, Orlando International Airport’s (MCO) Concourse C opened with massive light-emitting diode walls that utilize cameras and AI to integrate passengers’ silhouettes into content to provide passengers with a sense of place. At LAX, large-format displays were installed to capture revenue for interactive retail partnerships, create a unique shopping experience, and boost revenue.

Sources: JCDecaux (ULH); The Moodie Davitt Report (LLH); Moment Factory (RH)

Source: Moment Factory

Immersive experiences play a role in getting passengers to arrive early. Shanghai’s Hongqiao International Airport hosted the Louis Vuitton “Time Capsule” video display exhibition, where passengers explore different models of a custom-made Louis Vuitton trunk made of liquid crystal display screens in a room surrounded by projections of stunning visuals. These sorts of unexpected touches excite passengers and reinforce their decision to come early to the airport and are additional ways for the airport to generate revenue and for the brands to convert customers or build loyalty.

3.1.3 Food Trends

In some cases, the food itself can be considered a technological innovation. Current trends in the food industry are emerging due to technological advancements and shifting consumer awareness toward the environment. Consumers are becoming activists to protect the planet through their shopping and dining choices. While these are current trends, they also remain future food trends that will continue to evolve to reflect the expected growing emphasis on sustainability and innovative food production methods.

- Cell-Based and Cultivated Meat: Cell-based meat production could become more widespread, offering a sustainable and ethical alternative to conventional meat. The annual compound growth rate for the cultured meat market is expected to be 51% from 2023 to 2030 (Grand View Research 2023). Insect-based protein and algae could gain popularity as consumers seek diverse and sustainable protein options.

- Innovative Snacking: The snacking industry might witness a surge in creative and nutritious snack options, such as plant-based snacks, protein-rich bars, and functional snacks that target specific health needs.

3.1.4 Evolution of the Customer

There is an increase in value-seeking consumers who prioritize a well-balanced combination of quality, affordability, and functionality in their buying choices. This shift in consumer behavior is driving companies to innovate and offer products that not only meet but exceed these expectations. Brands that can effectively balance these three elements are likely to see increased customer loyalty and market share. Additionally, businesses are focusing on transparent communication and sustainable practices because these factors are becoming increasingly important to value-seeking consumers. By understanding and adapting to these evolving preferences using data and business intelligence tools, companies can better position themselves for long-term success in a competitive market.

As value-seeking consumers’ preferences evolve at an unprecedented pace, companies should rely on data and feedback to quickly adapt and meet their changing needs; however, it is essential to recognize that these sources might not always provide the complete picture.

3.1.5 Other Technologies

As a result of the COVID-19 pandemic, one of the largest sustained changes has been the conversion to and growth of e-commerce. The change in how people shop continues to evolve; however, the change to e-commerce has been rapid, revolutionary, and irreversible. Consumers spend a growing share of their money online, primarily because of the convenience of shopping from wherever they are. According to CommerceIQ, 64% of global consumers are excited to be able to purchase multiple brands through one retailer (CommerceIQ 2022). Retailers such as Amazon, Walmart, and Target have invested heavily in omnichannel and logistic solutions to deliver orders in as few as 2 hours. According to the U.S. Department of Commerce, Food and Beverage Program, e-commerce sales grew 8.6% during the first quarter (Q1) 2024 compared with Q1 2023 versus a total retail sales increase of 1.5% (U.S. Department of Commerce 2024).

E-commerce has also significantly affected the at-home food service market. Food delivery services, such as DoorDash and Uber Eats, became ubiquitous during the pandemic and have continued to be major factors in the market. E-commerce food sales grew 7.5% in Q1 2024 over Q1 2023 (U.S. Department of Commerce 2024).

The growth and expansion of AI will have a massive effect on the retail and F&B markets through 2024 and beyond. From science fiction to a factor in everyday life, AI has the potential to revolutionize virtually everything human beings do, making tasks easier, less repetitive, and more thorough. Some of the ways in which AI is transforming these markets, and will continue to do so, include the following:

- Demand Forecasting/Inventory Optimization. Improve inventory management by utilizing demand forecasting to minimize stockouts and overstocking based on predicted customer demand. These will reduce waste spoilage and inventory carry costs, while helping to ensure that products are always available for the consumer.

- Supply Chain Efficiency. Enhance supply chain processes, from logistics to warehousing, enabling faster deliveries and smoother operations.

- Personalized Marketing. AI enables personalized marketing based on customer preferences, which increases consumer engagement and loyalty by offering tailored promotions.

- Customer Support. AI-powered chatbots provide 24/7 assistance with faster response times, ensuring positive customer satisfaction.

- Quality Control. AI has an additional role in the food service industry of the future. The responsibility of handling, inspecting, and maintaining food quality currently resides primarily with humans, who are prone to human error, need breaks, get tired, and so forth. A lapse in such

- monitoring can have drastic consequences. AI can continuously monitor food conditions based on pre-established parameters. Using AI, chatbots can then interact with human participants in the quality chains, facilitating communications to address the problems that the chatbots uncovered (Matthewson 2024).

- Menu Optimization. AI tools can analyze customer preferences and sales data to optimize menu offering by daypart. This data is then tied into the ordering system, ensuring that the operator can provide the items in greatest demand at the appropriate times.

- AI and Machine Learning. AI and machine learning are now being used in self-checkout kiosks to gather information about the customer and make menu recommendations on screen.

- Robotics. From 2018 to 2021, Montreal International Airport (YUL) and HMS Host, now known as Avolta, deployed a humanoid robot. The robot was provided with directions to gates, restrooms, and Avolta’s F&B locations in the terminal. The robot could also give menu and wine/food pairing suggestions, as is the case today at Oakland International Airport (OAK). Another use of robotics is seen at Narita International Airport in Japan (NRT), where AI-powered robots patrol the airport. When the robot identifies irregularities, it notifies an operator who then dispatches security guards.

- Delivery Services. Some services deliver food and retail items directly to passengers at the airport. One such service is AtYourGate, which currently provides its delivery services, sometimes working with Servy and at other times with the airport using its app, at approximately 17–19 airports. The service originated at San Diego International Airport through their Airport Innovation Lab (Carr 2019). AtYourGate provides a digital marketplace (or operates through the airport’s app) and the convenience of delivery to passengers wherever a passenger might be in the airport. Passengers can order what they want from participating airport retailers and food vendors and have it brought to them.

- Online Marketplace. London’s Heathrow Airport (LHR) offers a robust electronic marketplace for passengers, both current and future. Through a system called Reserve and Collect, passengers departing on future flights can shop at all stores in all terminals at LHR, select the merchandise they wish to purchase, and reserve it. To pick up their order, passengers either go to the store location in the terminal from which they are traveling or, if the store is not located in the terminal from which they are departing, the merchandise is brought to a pick-up point in another terminal. At the intersection of technology and the human touch, Heathrow also offers a complimentary personal shopper service, where the traveler can book a personal shopper who is knowledgeable about the offer and the shopper’s interests (and language) based on the shopper’s response to a few questions when they request the service (Heathrow Airport Limited 2024). These services are designed to expand available food and retail options and provide greater convenience for passengers and employees as well.

- Virtual Queuing Apps. American Express uses a virtual queuing app at their Centurion Lounges, using their app when overcrowded conditions require that customers wait their turn to enter the lounge.

These strategies aim to cater to the evolving needs of passengers, particularly younger and digital-savvy consumers. However, it is important to note that most travel retailers are still in the early stages of developing digital and omnichannel strategies (Anastasi, et al. 2022).

3.2 Pandemic-Driven Technological Shifts in Airport Concessions and Consumer Behavior

The COVID-19 pandemic of 2020–2021 (and beyond, to a greater or lesser extent) has led to permanent changes in consumer behavior. Katherine Cullen, the National Retail Federation’s senior director of industry and consumer insights, said “We’re seeing consumers of all age groups saying that the shopping behaviors that changed during the pandemic are now habits they’re going to continue.” (Medina 2021). Even while a 2023 study completed for the Transportation Research Board found that the changes were not completely sticking, it also found that post-pandemic, many people tended to use in-person and online shopping as complementary, increasing their shopping behavior overall (Diaz-Gutierrez 2023). This finding was indicated long before the pandemic, however. A 2012 article found that the Internet as a shopping channel tended to have a complementary effect on in-store shopping, not a replacement effect (Cao 2012). However, no studies specifically referenced airport shopping behavior and pandemic-induced changes. This leaves primarily observational information as the only data available on the topic of pandemic-driven technology shifts.

Once air traffic began to return, one of the major impacts of the pandemic was the extreme reluctance of airport concession employees to return to work. It is unknown whether this was due to fear of contagion, unemployment payments by state or federal governments being equal to or greater than the wages they had previously received, the quality of the jobs in airports, or a desire to move on to different employment that was now easier to access. It is believed that all four of these factors, and possibly others, affected the choices made by workers. A lack of workers often led to problems with keeping concessions open during all contractually agreed-upon hours. While airports understood the issues, nonetheless, they put significant pressure on the concessionaires to keep the concession locations open due to the airports’ need for the revenues generated.

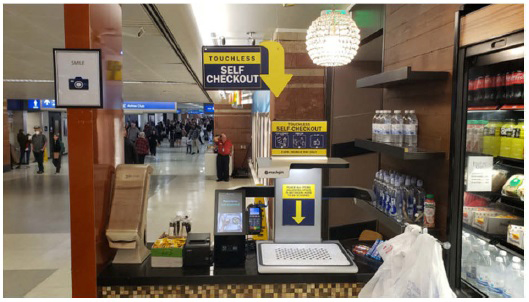

As a result, concessionaires sought solutions, and one of the most popular choices was to automate the payment system so that it required fewer employees. While self-checkout has been a popular option in supermarkets since the 1980s, its use accelerated in the early 2000s on the street and had been piloted, primarily by the firm OTG in airports, through the use of iPads placed at every seat within a restaurant and often in adjacent seating areas that would have previously been part of an airline’s holdroom. However, one drawback of the iPad system was that it required human contact for payments (in certain cases, or if the customer wanted to use cash). There were also limitations to ordering for a group: If each person input their own order on the iPad in front of them, each person was required to pay separately, which could result in food being delivered to the group in a somewhat random order (e.g., desserts arrive before meals; one person’s meal comes early, the next person’s meal arrives 15 minutes later; drinks are delivered at random times while waiting for food, or after the food was delivered).

A variation on this—self-ordering and payment kiosks—also became more popular. These kiosks were placed near counter service (also known as quick service or fast food) concessions or, in some cases, on the front counter where a person had previously taken orders. More often than not, a kiosk was brand-specific. Still, in cases where a single operator was responsible for multiple brands within a food court or area, the kiosk might allow the customer to order from multiple brands (although usually, they were not able to order from two brands on the same order, so a customer could not order a Carl’s Chicken Sandwich and a McDonald’s Chocolate Shake, for example). These kiosks could allow more orders to be processed faster and allow the units’ operators to concentrate their labor force on food production, not customer service. They remain popular in both airports and streetside locations.

Like Grubhub and Uber Eats, attempts were made to establish similar airport ordering and delivery apps. If customers could order without getting into queues, it would have helped improve customer social distancing without ordering queues stretching out farther than a food court was designed to handle. While the technology for ordering was relatively simple and already developed and tested, the challenge would

be to manage the delivery function. Some apps, such as Grab (later Servy), offered pre-ordering but could only offer delivery when paired with another company. Initially, Airport Sherpa was its chosen partner, which attempted a pilot program at Dallas Fort Worth International Airport (DFW). Sales through the Grab app were approximately $2.00 higher per order than orders placed at the counter during the test period (Petrie 2019). Following that, Servy and another app—AtYourGate—partnered in multiple airports to offer similar services (Aviation Pros 2021). While these programs are still operating, they have not had the impact on the industry that was originally envisioned.

Self-checkout in airports started when OTG convenience stores introduced such technology in New York area airports in 1995. With the pandemic, however, self-checkout mushroomed in retail convenience stores by larger operators, often removing the entire former cash register areas and replacing them with banks of self-checkout machines. Concessionaires needed less staff to keep their retail facilities operating. However, there were numerous unforeseen negative consequences in several areas, including the following:

- Lack of accessibility for disabled travelers.

- A hesitancy to utilize self-checkout by those less comfortable with technology.

- Perceived lower levels of customer service, including significant stock shortages and outages, particularly in lower volume stores (assuming that vendors concentrated limited restocking staff in higher volume stores and restocked lower volume stores less frequently) and customer difficulty with finding someone to ask questions of or to assist them in the case of a machine malfunction.

- Reduced customer interaction, which, while seen as an advantage by certain groups of consumers (younger, more tech-savvy travelers), was not considered a positive factor by most travelers. Also, without customer interaction, opportunities to plus-sell to consumers and increase the value of the purchase were lost, as was the impact a positive customer interaction can have on a consumer’s travel experience.

- Significantly greater opportunities for theft—not ringing up all items; using a lesser priced item’s tag and scanning it in lieu of the tag from a higher priced item; product theft by potential criminals who believe that they are not being watched; or potential customers who need help or have a question, react poorly after waiting for what they perceive to be an excessive amount of time, and who just take the item (and anything else they had been planning to purchase).

In the early 2020s, AI-driven stores were also considered an alternative to traditional staffed locations. In such stores, a person would pre-enroll with Amazon, Google, or the store operator, logging a valid credit card. The person was then allowed entry into the store by swiping/tapping the credit card or potentially via biometric identification, which might include face matching, fingerprints, or palm matching. In December 2021, a new, frictionless version of Camden Food Express, using Zippin technology, was introduced at JFK in Terminal 4. Customers entered via their registered credit card and then could select from a number of pre-packaged snacks or meal substitutes.

A collaboration between Pernod Ricard Global Travel Retail and Lotte Duty Free has created a unique, AI-powered experience that completely transformed retail in an airport setting. This groundbreaking idea in an airport setting pushes the boundaries of retail through a combination of technology, customization, and imagination. Reflecting the world-class Singapore Changi International Airport’s (SIN) passenger-focused and technology-driven vision, the newly opened boutique offers a range of immersive experiences and services, ranging from an AI virtual ambassador to digitalized merchandising units, to robotic bartenders, and VIP tastings. Teo Chew Hoon, Changi Airport Group’s Managing Director, Airside Concessions, said:

“We are proud to launch the Martell AI-powered boutique, which harnesses the power of data and technology to deliver personalized customer-centric experiences; a key tenet of the Changi Airport retail experience.” (Brownlow 2023)

Situated in Changi’s Terminal 1 Lotte Duty Free store, the interactive exhibit features the “Martell Untouchable Taste” tool, which will guide shoppers through the different Martell range, and provides personalized tasting recommendations based on their inputs. This analyzed result is then sent to the Martell robot bartender, who will then serve the desired beverage to the customer. The integration of this innovative experience demonstrates Changi’s desire to continue improving passenger experience through the use of new technologies (Brownlow 2023).

Besides retail, self-serving kiosks are also introduced in currency exchange, like the ones installed at LHR by Travelex in 2023. The automation of currency exchange is significant for airports that may find it challenging to support staffed currency exchange locations.

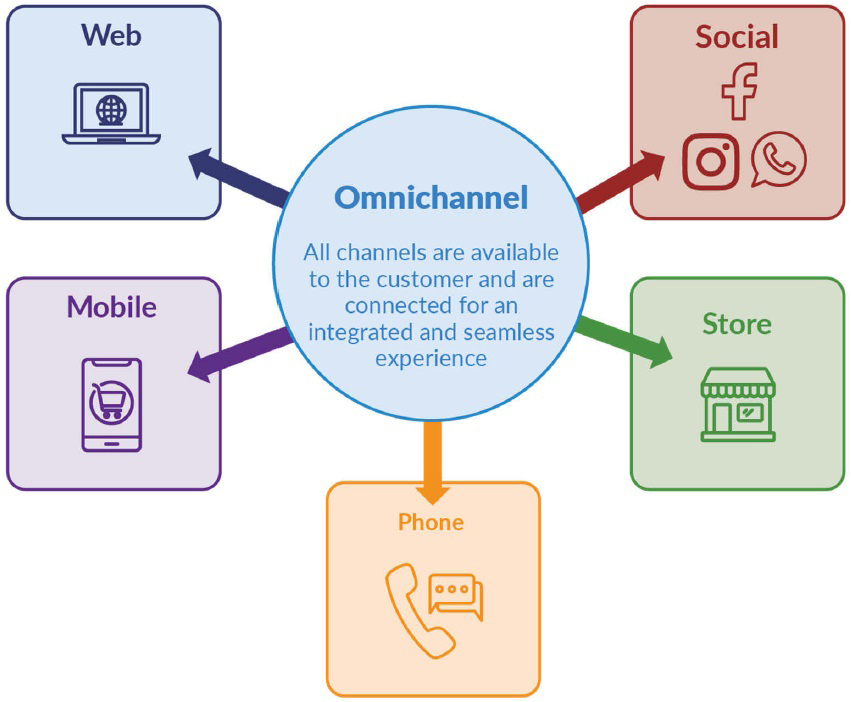

3.3 The Role of E-Commerce and Omnichannel Platforms in Modern Airport Retail

Omnichannel shopping is revolutionizing retail with integrated social and mobile commerce for seamless customer experiences. An omnichannel platform connects the online and physical worlds. Omnichannel retail, or e-commerce omnichannel, refers to the sales approach of using multiple channels that focus on delivering a unified purchasing experience to customers regardless of whether the shopping occurs across all channels or whether it is from in-store kiosks or other digital channels. Omnichannel e-commerce may include online storefronts, brick-and-mortar stores, e-commerce marketplaces, and social media-supported stores. Passengers can browse online, reserve items, and pick them up at the store or have them delivered to their gate. Omnichannel platforms can gather data and offer targeted promotions or recommendations based on travel details and past purchases and distribute that information to passengers through a variety of communication channels. Data from the e-commerce platform (e.g., past purchases, travel information) could be used to suggest relevant products or promotions across other channels, such as airport kiosks or loyalty program emails. Additionally, the omnichannel platform reduces congestion at physical stores and optimizes inventory management for concessionaires.

Examples of omnichannel offerings include Nike’s social media presence on platforms such as Instagram and Facebook, which complements its mobile app, allowing customers to browse and purchase products on social media and the app interchangeably. Lyft has seamlessly integrated its ride-ordering service into Google Maps, making it effortless for users to book a Lyft ride while looking for directions. DoorDash collaborated with Instagram to enable users to order food delivery from restaurants directly within the Instagram app. Wayfair, Bonobos, and Made In, originally e-commerce ventures, have all expanded to include brick-and-mortar stores in response to their growing popularity. This move allows customers to try on clothing or see cookware before purchasing, offering greater flexibility and enhancing the overall customer experience.

Technology and omnichannel shopping go hand in hand and need to be addressed as one. The newest means of an alternative approach to shopping includes technological solutions. Internationally, airports are capitalizing on omnichannel shopping by not only having brick-and-mortar stores but also having an e-commerce presence. Airports employ a variety of omnichannel marketing strategies to enhance the passenger experience and boost retail sales. Some key strategies are found below.

3.3.1 Digital Platforms and In-Store Shopping

International airports are supported by a variety of self-checkout solutions. At Munich International Airport (MUC), passengers can scan or tap a bar code on the shelf, which opens a website where the passenger can complete the transaction. At airports with significant international traffic, the value

proposition of high-end products in duty-free stores continues to stimulate sales. To further stimulate retail sales, international airport operators such as LHR and SIN provide additional savings if passengers order online.

Traditional airport retail has limitations. Travelers are pressed for time, and physical stores only offer a fraction of what could be available. This is where e-commerce and omnichannel platforms come in, transforming the airport concession experience from a rushed, limited affair to a convenient and potentially personalized one.

3.3.2 E-Commerce Platform

Supporting an omnichannel approach is the underlying e-commerce platform. An e-commerce platform for airport concessions is essentially an online marketplace specifically designed for airports. It allows passengers to browse, pre-order, and purchase items offered by airport concessionaires—think duty-free shops, restaurants, and cafes—all from their mobile devices. The following are key features of an e-commerce platform:

- Pre-Order and Collect. Passengers can browse menus for F&Bs; shop from a variety of retail stores, including duty-free items; and pay for them online before reaching the airport. This saves them time upon arrival by skipping queues and avoiding waiting in line.

- Wider Selection. Unlike physical stores limited by space, an e-commerce platform can showcase a much larger variety of products, giving passengers more options.

- Convenience. The platform is accessible from anywhere, anytime, allowing passengers to shop on their phones or tablets at their own pace.

An airport e-commerce platform would allow you to browse the airport shops, find the specific brand you need, pay for it online, and then simply pick it up at a designated location within the airport before your flight.

Unlike an e-Commerce platform, an omnichannel platform is not a single platform itself but rather a concept that integrates various channels (e.g., physical store front, web app, social media) to create a seamless shopping experience for passengers. An omnichannel platform addresses these issues by connecting various channels into a unified system:

- E-Commerce Platform. Passengers can browse and pre-order duty-free items, restaurant meals, or other concessionaire offerings through their phones or tablets before arriving at the airport.

- Physical Stores. These stores remain, however the omnichannel approach enhances their functionality. Passengers can use the e-commerce platform to reserve items for faster pick-up or browse menus digitally.

- Airport Apps. These apps can integrate with the omnichannel platform, allowing passengers to access the same features (e.g., browsing, pre-ordering) directly within the airport app.

- Loyalty Programs. Data from the omnichannel platform (e.g., purchase history, travel preferences) can be used to offer personalized promotions or recommendations through loyalty programs.

3.3.3 Omnichannel Considerations

The landscape of e-commerce platforms for airports with omnichannel capabilities is evolving, and some vendors are moving toward offering more comprehensive solutions. This is what needs to be considered:

- Maturity of the Market. Omnichannel solutions for airports are a relatively new concept. While some vendors are expanding their offerings, established e-commerce platforms might not have fully integrated omnichannel features yet.

- Vendor Capabilities. It is important to research different vendors to see their specific offerings. Some may provide a core e-commerce platform with the ability to integrate with third-party omnichannel solutions (e.g., delivery services, loyalty programs). Others might be developing their own omnichannel functionalities.

-

Customization Needs. Consider the level of customization required. If a highly tailored omnichannel experience is required, different solutions from various vendors may need to be integrated. Below are some approaches to consider:

- Single Vendor With Integrated Features. Some vendors might offer an e-commerce platform with built-in omnichannel capabilities, such as order fulfillment options (e.g., pick-up at store, delivery) and basic data integration for personalization.

- Platform and Integration. An e-commerce platform with strong application programming interface (API) capabilities can be chosen and integrated with separate solutions for omnichannel functionalities, such as delivery or loyalty programs.

- Best-in-Class Approach. For specific needs, combining a best-in-class e-commerce platform with separate best-in-class solutions for omnichannel features can be selected. This requires more technical expertise for integration but offers maximum flexibility.

3.3.4 Airport and Passenger Benefits

Airports can benefit significantly from implementing both an e-commerce platform and an omnichannel strategy. Here is a breakdown of the advantages:

For Passengers:

- Convenience and Time Savings. Passengers can pre-order or browse menus, saving them from waiting in lines and rushing through the airport.

- Wider Selection. Passengers have access to a much larger variety of products compared with physical stores.

- Personalized Experience. Omnichannel platforms can offer targeted recommendations and promotions based on preferences and travel details.

For Airports:

- Increased Revenue. E-commerce opens new revenue streams through pre-orders and greater product selection. Omnichannel strategies can further boost sales through targeted promotions.

- Enhanced Passenger Satisfaction. Convenience, time-saving options, and a wider variety of products lead to happier travelers, potentially improving overall airport ratings, and increased non-aeronautical revenue.

- Data-Driven Insights. Platforms provide valuable data on passenger behavior and preferences. This allows airports to optimize their offerings and marketing strategies, and potentially improve terminal layouts based on passenger flow.

- Operational Efficiency and Enhanced Airport Ambiance. E-commerce can reduce congestion and thereby enhance the ambiance at physical stores, while omnichannel delivery options can minimize foot traffic altogether. This frees up staff and allows for better resource allocation.

In conclusion, e-commerce and omnichannel platforms are powerful tools for airports to use to improve passenger experience, generate additional revenue, and gain valuable data-driven insights. By implementing both options, airports can create a future-proof food, beverage, retail, and entertainment strategy that caters to the evolving needs and wants of modern travelers.

3.4 The Need for Comprehensive Understanding of Technology in Airport Concessions

Airport management needs to have a deep understanding of technology in airport concessions for several reasons:

- Infrastructure for Concessionaires. For a smooth and seamless rollout of new technologies by concessionaires, airports should establish the necessary infrastructure, such as sufficient Wi-Fi bandwidth, to enable the effective use of the technology.

- Technology in Solicitations. Airports should prepare their solicitation documents with language that specifies their expectations for the use of certain technologies by concessionaires. Specific or general requests can be made. This is in line with the latest trends to enhance the customer experience through technology.

- Improving Sales and the Customer Experience. Airports should not solely rely on their concessionaires to identify technologies that improve sales and the customer experience. They can also introduce their own technological innovations for commercial program improvements. For example, airports can enhance sales and the customer experience by implementing technologies, such as apps, which allow for pre-ordering before arrival or potential in-terminal delivery of products.

- Financial Impact on Concessionaires. The introduction of technology solutions for the concessions program brings additional costs that were not part of the profit and loss forecasts 5 years ago. Rents required by request for proposals (RFPs) need to take these costs into account. The escalating capital and operating costs have put pressure on the existing business model of in-terminal concessions. At the same time, e-commerce may negatively affect sales, especially for specialty retailers.

- Understanding Challenges as a Landlord. Concessionaires might face challenges when implementing technologies. As a good partner, the airport should provide the necessary support to enable the concessionaire to deliver digital solutions. The introduction of new concession technologies does not end there. Airports need to understand the challenges and opportunities that these technologies might present, how they would meet customer needs, and their effect on airport and concession operations. It is important to note that customer complaints about technology are likely to be directed at the airport rather than the concessionaire, so it is crucial to understand the details of these technologies.

4. Setting the Scene: Technologies in Airport Concessions

4.1 Defining Current and Emerging Technologies Since 2019

Airport concession programs encompass a wide range of retail, dining, and service offerings provided to travelers within an airport. These programs are evolving rapidly due to advancements in technology. Here is a detailed look at the current and emerging technologies shaping airport concessions.

Table 2 lists and defines the current technologies in in-terminal concession programs, either directly or indirectly:

Table 2. Current Technologies for In-Terminal Concessions

| Current Technology | Application |

|---|---|

| Mobile Ordering and Payment |

|

| Self-Service Kiosks |

|

| Digital Signage |

|

| Point-of-Sale Systems (POS) |

|

| Advanced Kitchen Technology |

|

| Loyalty Program |

|

| Wi-Fi/Bluetooth Mobile Phone Tracking |

|

| Automated Retail |

|

| Current Technology | Application |

|---|---|

| Wi-Fi and Connectivity Solutions |

|

| Business Analytics and Business Intelligence Tools |

|

Table 3 lists and defines the emerging technologies in in-terminal concession programs, either directly or indirectly:

Table 3. Emerging Technologies for In-Terminal Concessions

| Emerging Technology | Application |

|---|---|

| AI |

|

| Robotics and Automation |

|

| Digital Marketplace/Omnichannel Retail |

|

| Augmented Reality (AR) and Virtual Reality (VR) |

|

| Biometric Solutions |

|

| Emerging Technology | Application |

|---|---|

| Internet of Things (IoT) |

|

| Blockchain Technology |

|

| Light Detection and Ranging (LiDAR) |

|

| Virtual Queuing |

|

| 5G/Citizens Broadband Radio Service/Private Wireless Networks |

|

| Virtual Food Hall/Ghost Kitchen |

|

These are just a few examples, and the landscape is constantly evolving. The key for airport concessions is to leverage technology to improve the passenger experience, increase efficiency, and boost revenue.

4.2 Documenting the Role of Technology in Enhancing the Airport Concessions Experience

The airport concessions experience encompasses the variety of services and amenities available to travelers, including retail stores, dining options, lounges, and other passenger services. In recent years, technology has significantly transformed this experience, enhancing convenience, efficiency, entertainment, and satisfaction for passengers. Once known for long lines, limited choices, and generic offerings, airport concessions are embracing technology to create a smoother, more personalized, and ultimately more enjoyable experience for travelers.

Based on the industry research conducted by the ICF Team, three major roles in terms of technology as business drivers were identified as the focus of airport in-terminal concession programs. See Table 4 for the key areas being addressed by technology in each of these major roles:

Table 4. Business Drivers for Technologies

| Role of Technology – Business Drivers | Key Areas Being Addressed |

|---|---|

| Helping to Understand and Address Customers’ Needs |

|

| Optimizing Concession Operations |

|

| Boosting Revenues |

|

Technology has greatly affected the airport concessions experience, making it more efficient, convenient, and enjoyable for travelers. From digital retail and contactless payments to AR navigation and personalized marketing, these innovations have transformed how passengers interact with airport services. As technology continues to evolve, the future of airport concessions promises even more advanced and integrated solutions, further enhancing the travel experience.

5. Visualizing the Passenger Journey in Airport Concessions

5.1 Visualizing the Passenger Journey

The following graphics depict the enabling technology and applications at the various touchpoints of the passenger journey for both arrivals and departures. Note that Federal Inspection Services was not included because that facility is under the authority of U.S. Customs and Border Protection, and generally concession outlets are not located in these areas.

5.2 Passenger Views and Preferences Regarding Technology in Airport Concessions

Ideally, each airport would have the resources to collect data on their passengers to understand the characteristics of their passengers either by conducting this research on their own or by using services such as J.D. Power & Associates or Airports Council International (ACI) World’s Airport Service Quality (ASQ) programs; however, understandably, most have neither the resources nor have they prioritized this relative to other initiatives.

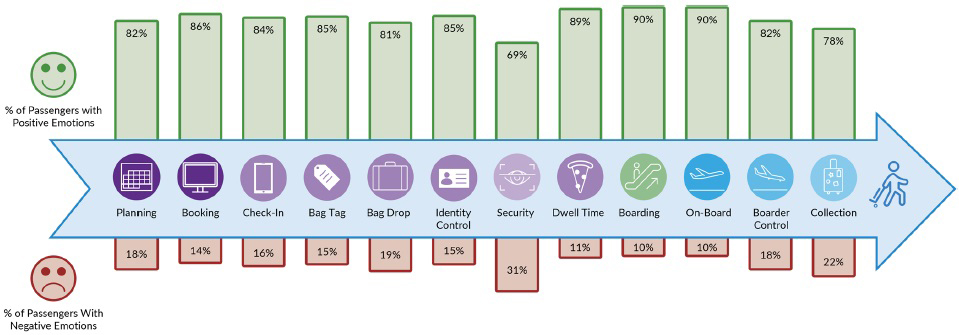

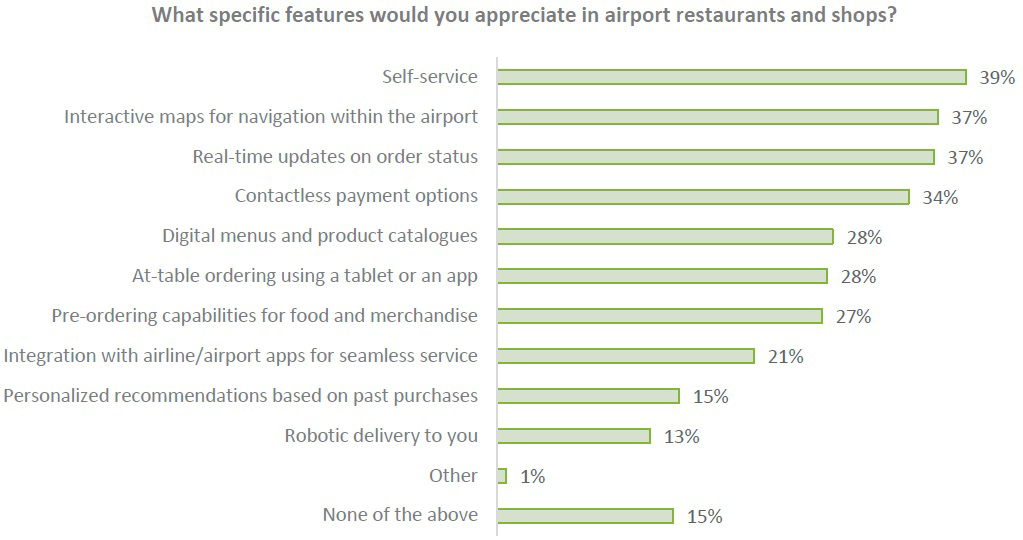

Along these lines, the ICF Team conducted an Airport Passenger Survey, which offers key insights into air travel experiences, drawing from a representative sample of 1,200 individuals who had flown at least twice during the past year. The survey’s findings encompass various aspects of travel habits, preferences, technology use, and spending behaviors.

Using the survey results, the research team then identified four passenger personas that airports can use when considering technology initiatives. These general personas can assist airports regarding the relationship that different passenger groups may have with technology.

5.3 Summary of the Findings from the Airport Passenger Survey

Travel Habits and Preferences.

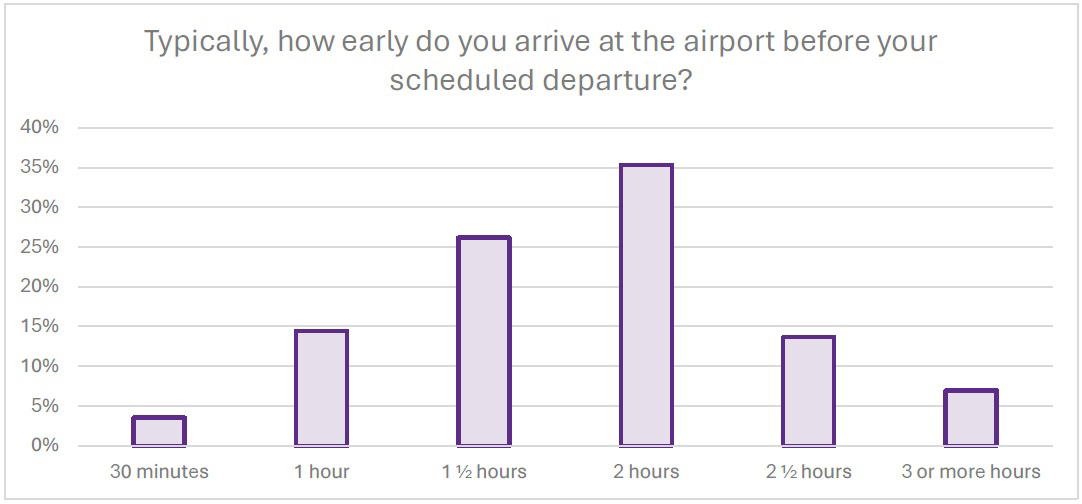

Approximately 72% of the respondents flew twice during the past year. The survey indicated that leisure travel is the primary reason for flying, with 40% citing rest and relaxation, followed by 38% visiting friends or family, and 35% who are on family vacations. More than one-third of the participants (35%) typically arrived at the airport 2 hours before their flight, which is a behavior that is more common among older travelers.

Technology and Communication.

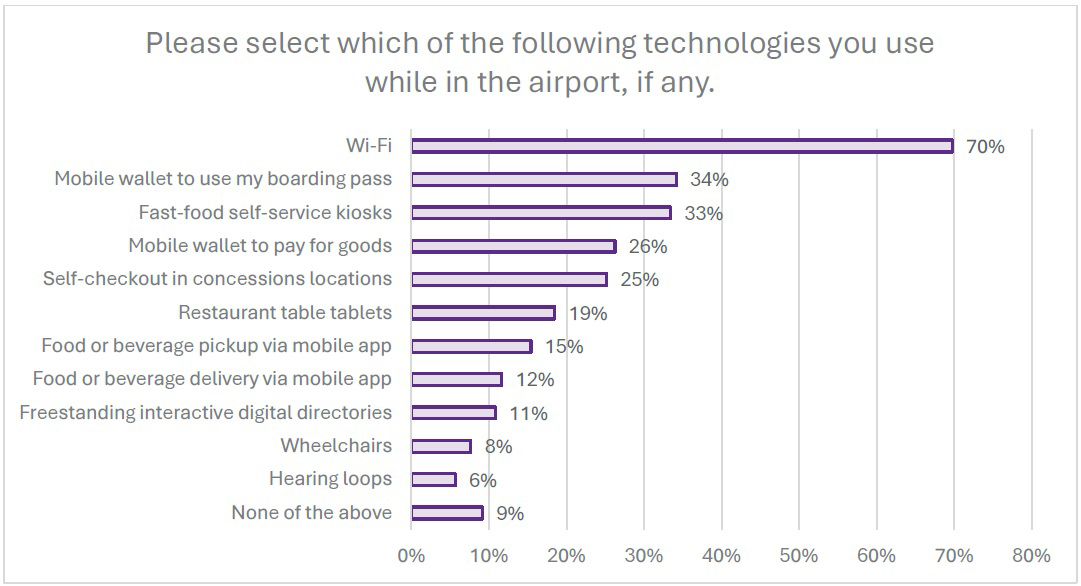

The reliance on technology was significant, with 88% of the respondents carrying smartphones during their travels. Airport Wi-Fi usage was high, with 70% of the participants using this service, thus emphasizing the need for strong digital infrastructure in airports. Mobile wallets and self-service kiosks are also used by a sizeable portion of the respondents.

Spending at the Airport.

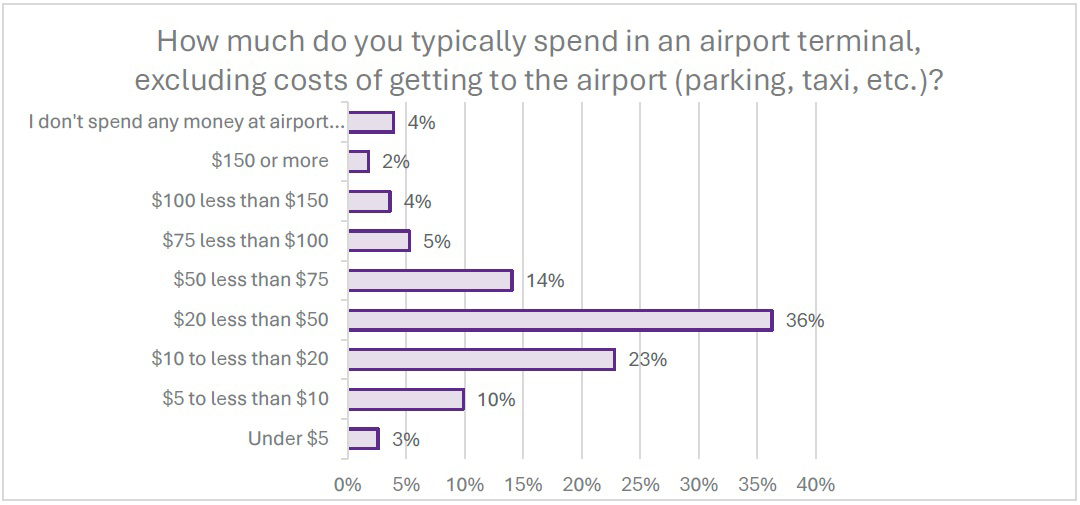

The survey revealed spending trends within airport terminals, with more than a third of the respondents (36%) spending between $20 and $50. Younger travelers, particularly those ages 23 to 38, showed a higher propensity to spend, with 41% typically spending more than $50. Conversely, older travelers, specifically those age 65 and above, were more conservative in their spending habits, with 18% typically spending $10 or less in an airport terminal.

Summary:

The survey’s findings underscore the pivotal role of technology in modern air travel. The high comfort level with smartphones, digital booking platforms, and Wi-Fi usage among passengers signifies a paradigm shift in the travel experience. This trend reflects a growing expectation for seamless, technology-driven interactions throughout the journey—from planning and booking flights to navigating airports. As this digital integration becomes increasingly ingrained in the traveler’s journey, it highlights an opportunity for the travel industry to further innovate and enhance the overall efficiency and enjoyment of air travel.

5.4 Passenger Personas

The results of the Airport Passenger Survey served as the basis for identifying a range of travelers frequenting airports. The four high-level personas were created by analyzing this dataset by studying trends, patterns, and correlations among the data that was collected. These personas are not just fictional representations but are grounded in real data and survey research. They encompass various traits, such as demographic attributes, psychographic attributes, core motivations, pain points, and technographics, providing a comprehensive view of different traveler types.

The Role and Impact of Personas in the Airport Ecosystem.

Personas serve a critical role in contextualizing passenger journeys within the airport ecosystem. They allow for the mapping of unique passenger experiences, catering to the distinct ways in which different customers interact with brands, services, and technology. This leads to more relevant and personalized experiences for travelers at scale. Personas simplify design tasks and focus on the varied needs among different customer groups. They unify teams around a common language and understanding of stakeholder groups, humanize market segment data, and build a deeper connection to stakeholders. This approach is pivotal in creating customer-centric experiences, guiding future research efforts, and aiding in decision-making.

Utilizing Personas for Enhanced Airport Experiences.

While there is no limit to how many personas can be created, it is best to remain focused and targeted. Identifying the most important stakeholders (e.g., primary customers, employee groups, purchase influencers) will help do this. At their core, personas are about painting a fuller picture of stakeholders to build a brand (or, in the case of airports, an ecosystem) and better design options and experiences. Knowing which characteristics influence customer perceptions and behaviors will help airports and concessionaires connect better with them. A primary objective of incorporating technology into an airport’s concessions program is to enhance the customer experience. To accomplish this goal, airports should first understand who their customers are and how they relate to technology.

Defining Key Traveler Personas for Technology and Concessions in Airports.

In analyzing the responses from the Airport Passenger Survey, four distinct airport passenger personas were identified, each representing unique interactions with and attitudes toward technology. These personas include (1) the Tech-Savvy Young Explorer, a younger, technology-enthusiastic traveler; (2) the Digitally Engaged Family Navigator, who leverages digital tools for efficient family travel; (3) the Connected Business Professional, who relies heavily on technology for business travel efficiency; and (4) the Golden Age Leisure Enthusiast, an older traveler who prefers a more traditional approach to travel and technology. These personas, derived from comprehensive data analysis, offer valuable insights for airports and concessionaires to understand and cater to the diverse technological needs and preferences of different traveler segments, enabling the creation of tailored and satisfying airport experiences.

The following four passenger personas in Figure 24 were categorized as part of the Airport Passenger Survey with their weighted response allocation.