Municipal Solid Waste Recycling in the United States: Analysis of Current and Alternative Approaches (2025)

Chapter: 4 Direct Costs and Financing of Recycling Programs

4

Direct Costs and Financing of Recycling Programs

Summary of Key Messages

- Costs of recycling: Although local governments and private parties pay for most costs of recycling, they experience only a small fraction of its global and regional benefits; thus, incentives are weak for these parties to maintain or increase recycling.

- Volatility and market disruptions: Volatility in end markets for recyclables can undermine the economic sustainability of recycling programs.

- Traditional financing approaches: Financing for residential recycling in the United States relies largely on local governments, with little contribution from state or federal sources. When businesses recycle, they typically pay for recycling services that are provided by private waste management companies.

- Extended producer responsibility (EPR): As an emerging financing model, EPR alleviates financial burden on local governments by shifting residential recycling costs to producers and, indirectly, to households that purchase their products. If properly designed through “eco-modulation,” these systems may provide incentives to producers to reduce packaging volumes and increase recyclability of packaging and products. Existing EPR laws vary greatly by state.

- Deposit-return systems (DRSs): DRSs encourage direct recycling by consumers and can lead to reduced litter and high recycling rates of the products covered by the policy (e.g., beverage containers). However, their effectiveness is limited to covered products. The adoption of new DRS policies may decrease revenues of existing curbside programs and materials recovery facilities (MRFs), which could undermine the economic viability of those programs and therefore the recycling of materials not covered by the DRS. This tradeoff could be managed with alternative financing approaches for existing curbside recycling programs (e.g., via EPR).

- Investments in MRFs: Investing in MRF technology is important for cost-effective recycling, as advanced sorting and processing equipment reduces per-ton processing costs and increases the quality of recyclable materials.

Local governments and private entities bear the primary financial burden of recycling in the United States, yet they receive only a fraction of the broader environmental and economic benefits. Spending on curbside and other recycling systems involves costs of collection, such as trucks, labor, and fuel, and costs of processing, sometimes at capital-intensive materials recovery facilities (MRFs). This spending often exceeds the revenue earned from selling recyclable commodities, straining municipal budgets and discouraging program expansion. Emerging financing approaches, such as extended producer responsibility (EPR), show promise in redistributing costs and stabilizing material quality. This chapter examines the costs and financing sources for recycling programs nationwide, with particular emphasis on curbside recycling as the dominant mode of collection (see Figure 2-1 in Chapter 2).

4.1 CURBSIDE RECYCLING PROGRAMS

Many different waste and recycling systems operate throughout the United States, which entail multiple collection and processing stages. The most common recycling system for households is curbside recycling. An estimated 53 percent of the U.S. population—about 176 million persons living in approximately 69.8 million households—has curbside recycling services provided to their homes automatically as

a part of the residential solid waste management systems in their communities (The Recycling Partnership, 2020a). Furthermore, most of these residents receive single-stream recyclables collection service, meaning that they do not separate recyclable materials from each other but place them in a commingled fashion in a single recycling collection container, which is wheeled or carried to the curb by the resident on the collection day. In contrast, recycling systems for commercial establishments may be single stream or have different collection for specific types of materials. In many rural communities, households do not have curbside collection but may have access to recycling drop-off locations. The discussion of local government costs in this chapter focuses on curbside recycling because it is the dominant collection method and because limited cost data are available for other forms of collection.

Curbside recycling involves the provision of two services: (1) collection by municipal governments or private companies and (2) processing of the collected recyclables by municipal governments, solid waste authorities, and/or private companies. This chapter first distinguishes between these collection and processing costs and then considers the revenues from recycled commodities that may help offset the processing costs. Finally, these categories are combined to compare curbside recycling costs with costs of disposing of these materials in other ways.

4.1.1 Curbside Recycling Collection Costs

Curbside collection costs include expenses for bins provided to households and the costs of owning, operating, and maintaining trucks for collection. These costs (e.g., labor, fuel prices, equipment purchases) vary by state and within states across the country. Rates are calculated based on the number of households served per crew per day and/or tons collected per day by each crew. Communities with high participation rates may achieve lower average costs per ton because of efficient truck and labor use. Labor costs are lower in the South than in many urban areas of the Northeast and the West Coast, which are often unionized. Capital costs associated with trucks and equipment yards make up a significant portion of the cost of collecting waste and recyclables from households and businesses in the United States. While most regions of the country have some cities with extensive recycling programs, recycling services in rural areas may not be integrated into broader solid waste programs.

A full picture of these costs across the country is not available, but a few studies provide details on these costs at specific locations. In North Carolina, a long-term survey provides detailed data on recycling and refuse collection expenditures for a set of municipalities (UNC School of Government, 2024). Most of the communities studied provide single-stream recycling collection services to single-family residents on a biweekly basis. In 2022–2023, the total cost associated with these services—including the capital costs of the collection vehicles and containers—averaged $45 per household per year. The North Carolina data also provide the opportunity to calculate costs per ton of recyclables collected (and not just per household). These data show an average collection cost of $275 per ton in 2022–2023 (UNC School of Government, 2024). Reflecting economies of scale, communities with higher recycling set-out rates had lower average costs per ton. For Florida, Anshassi and Townsend (2024) provide similar figures. Across the six counties they studied in 2021, collection costs for curbside recycled averaged $49 per household, similar to the North Carolina values. The Florida costs ranged from $23 per household to $81 per household (Anshassi and Townsend, 2024).

Additionally, Anshassi and Townsend (2023) used Florida data to estimate the average costs for a typical U.S. residential household cost for separate recyclables collection. They found an average cost of $45 per household per year. Among the factors they considered are the number of households at one stop, participation rate, collection frequency, number of working days per week, and working hours per day per vehicle. The collection costs change as a function of mass and composition (for both garbage and recyclables stream) as well as the frequency of the collection service (which is typically weekly or biweekly). The primary factors that vary by region include the waste compaction density, recycling participation rate, total masses collected and recycled, and number of households participating (Anshassi and Townsend, 2023).

4.1.2 Curbside Recycling Processing Costs

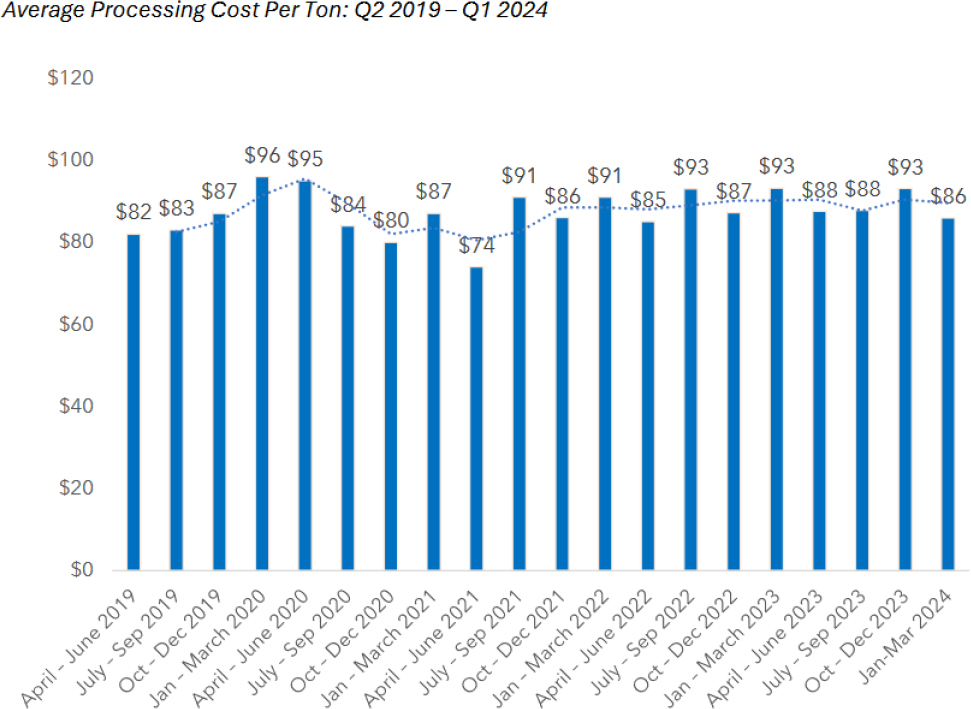

Recyclables collected at the curb from single-family residences are typically processed at MRFs. Figure 4-1 shows recent trends of processing costs per ton on waste from MRFs in the Northeast region (10 states).

NOTE: Data are as reported by facilities and underlying methodologies may vary.

SOURCE: NERC, 2024.

A review of commingled recycling costs completed for the Oregon Department of Environmental Quality audited a small number of MRFs in Oregon using their actual 2022 fixed and operating costs (Crowe LLP, 2024). These MRFs ranged from small, labor-intensive facilities to larger MRFs with investments in some newer technologies, although none are as advanced as the newest MRFs being built in the United States (see Box 2-5 in Chapter 2). The average cost of processing commingled recyclables through the single-stream MRFs in Oregon in 2022 was $129/ton (Crowe LLP, 2024).

Processing prices can also vary in response to international policy changes. China and other countries have increasingly imposed restrictions on the levels of contamination allowable in imported recyclables (Resource Recycling, 2022). The private company WM estimated that these restrictions have increased processing costs by about 15 percent—or about $13 per ton—across its 43 single-stream MRFs. These increased costs cover labor needs and investments in sorting equipment to meet the new contamination standards.

Investments in new technology have large initial costs that enable MRFs to process each additional ton of recycling less expensively and more efficiently (see Chapter 3 for more on economies of scale). Over

time, advancements in recycling technologies may increase sales of materials by raising the quality of the sorted recyclables.

4.1.3 Curbside Recycling Revenues

The net costs of the curbside recycling programs depend not only on the direct costs of collection and processing but also on the revenues received from the recyclable commodities at the end of processing. These values fluctuate with the macroeconomic conditions, product demand, material quality, transportation costs, and price of competing resources. Demand for recycled commodities reflects their value to manufacturers who use them, so prices indicate some of the current value of the recycled material. Other values, such as environmental improvements, are outside of the market and may not be captured by prices. Chapter 5 presents more information on individual recycled commodity prices.

Figure 4-2 shows estimated revenues that MRFs in the Northeast received from selling processed materials.1 Comparing the revenues in Figure 4-2 with the processing costs in Figure 4-1 demonstrates that revenue sometimes covers processing costs (e.g., in 2021 and 2022), but other times it does not. Periods when end-market revenues did not cover costs include 2019, shortly after China’s National Sword Policy was instituted (see Chapter 5), and much of 2023, which did not feature these trade disruptions. MRFs may still make profits in years when the materials revenue is lower than their processing costs. because of the processing fees paid to them by local governments and third-party collectors (Anshassi and Townsend, 2024).

NOTE: Data are as reported by facilities and underlying methodologies may vary.

SOURCE: NERC, 2024.

___________________

1 Although these values are specific to this region and time period, they appear to be representative. Using the average prices of recyclables reported by the U.S. Environmental Protection Agency for 2009–2018 (see Figure 5-6 in Chapter 5) and typical material shares reported by The Recycling Partnership (2004) yields a revenue estimate of $167 per ton (not inflation-adjusted), within the range shown for the Northeast in Figure 4-2.

4.1.4 Overall System Costs for Curbside Recycling

Ignoring external costs for now, the direct costs above include collection plus processing costs minus revenue received from recycling. Putting these direct costs together provides an overall picture of the net financial costs of curbside recycling. A review of rates in several states highlights the variability of these overall costs across the country.

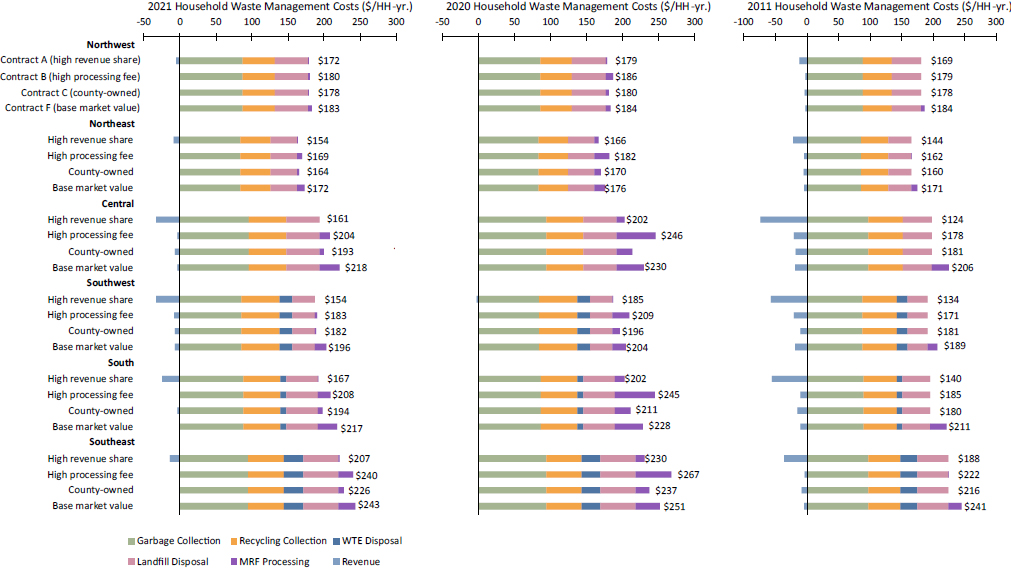

National Estimates

Anshassi and Townsend (2024) estimated government expenditures (net of commodity revenues) on waste and recycling systems in regions across the United States (see Figure 4-3). They found that these expenditures vary based on MRF processing fees, revenue-sharing structures with MRFs (described in the figure by different contract letter types), and market conditions for recyclables. The lowest annual household waste management expenditures were in 2011, during peak recycling markets, while the highest expenditures occurred in 2020, during a market low. Expenditures ranged from $124 to $241 per household per year in 2011, $166 to $267 in 2020, and $154 to $243 in 2021 (Anshassi and Townsend, 2024). Across all years and regions, the lowest expenditures were associated with Contract A, which featured a high revenue share of nearly 97 percent and a processing fee of $85 per ton (see Figure 4-3). The Northwest and Northeast regions had the lowest expenditures, while the Southeast region had the highest. In these estimates, garbage and recyclables collection costs accounted for 53–78 percent of total household waste management costs (excluding recyclables revenue), while landfill and waste-to-energy disposal made up 19–34 percent, and MRF processing (once commodity revenue in subtracted) ranged from less than 1 percent to 23 percent (Anshassi and Townsend, 2024).

NOTES: Costs for each region based on four types of contracts with MRFs: Contract A (referred to as high revenue share), Contract B (high processing fee), Contract C (county-owned), and Contract F (base market value). HH = household; MRF = materials recovery facility; WTE = waste-to-energy.

SOURCE: Anshassi and Townsend, 2024.

California. The state of California recycles 20 percent of the volume of recyclables collected in the entire United States. Regulations require separate diversion of waste, recycling, and organics, which means that multiple trucks service each house each week. Recycling requirements and fees on waste disposal increase the overall cost to the customers. With few exceptions, all costs are bundled into a monthly garbage charge that includes recycling at no additional visible cost to customers.

The cost of waste and recycling in California is higher than in other areas of the country because of this regulatory environment. These costs appear in fees for consumers. For example, in San Jose, households are charged $53 per month, or $641 per year, for residential solid waste management and recycling.2 In San Mateo, this service costs $42 per month.3

Washington. Washington is one of only two states that regulate waste and recycling rates (West Virginia is the other). While incorporated cities can contract with private companies for services or provide municipal services, customer rates in unincorporated areas of the state are set by Washington’s Utilities and Transportation Commission. The annual cost for all waste and recycling services in Washington State ranges from $406 to $500/year across various urban and suburban areas of the state. The recycling portion of these rates is highly scrutinized, and regulated rates range from $103 to $128 per year per household.

Although, existing literature does not provide a systematic comparison of the costs of recycling and disposal. Table 4-1 shows the per ton costs for disposal and for recycling in North Carolina (not per household monthly costs as above). As reported in the table, collection accounted for most of the cost of both recycling (73 percent) and disposal (80 percent) (EREF, 2024; NERC, 2024). In North Carolina in 2023, average costs per ton recycled exceed the cost of disposing of a ton, even when revenues from end markets were high for the year. These cost differences do not indicate the savings from shifting materials from recycling to disposal (or the costs of shifting them from disposal to recycling), because they do not capture possible increasing or decreasing returns to scale for either activity. As with the per-household costs, they only capture average costs of current levels of recycling and disposal.

These cost estimates are context and time dependent and do not apply to all curbside recycling programs. In some areas of the United States, such as the Northeast, where landfill costs are high, curbside recycling may have lower average costs than landfilling. In addition, as Figure 4-2 shows, recycled commodity revenue is sometimes much higher than in 2023, which would make the net per-ton cost of recycling more favorable. However, even when average costs (net of commodity revenues) are lower per ton for recycling than for disposal, curbside recycling may not save towns money because of the duplication involved in sending both a garbage and a recycling truck to households every week or every other week.

TABLE 4-1 Costs of Curbside Recycling and Residential Refuse Collection in North Carolina, 2023

| Curbside Recycling | Average Cost ($/ton) |

|---|---|

| Collection Costs | $270 |

| Processing Costs | $100 |

| Revenue from Sale | –$70 to –$110 |

| Net Recycling Costs | $260–$300 |

| Refuse | |

| Collection Costs | $160 |

| Disposal Costs | $40 |

| All Refuse Costs Total | $200 |

SOURCES: Data from North Carolina Benchmark Project 2.0 for collection and processing costs; NERC (2024) for 2023 revenues; EREF (2024) for disposal costs in North Carolina.

___________________

2 See https://www.sanjoseca.gov/your-government/departments-offices/environmental-services/recycling-garbage/residents/garbage-recycling-rates-billing.

3 See https://www.cityofsanmateo.org/DocumentCenter/View/89316/2022-Solid-Waste-Notice-of-Public-Hearing.

The cost discussion thus far considers only the “on-budget” costs of recycling. Even single-stream recycling requires input of household time and effort not included here, although it is a real resource cost to consider in assessing these programs. Table 6-1 in Chapter 6 presents estimates that suggest household time costs may be either on par with or several times higher than the local government’s collection costs for recycling. Although households may also have time costs for setting out waste, those costs are likely much lower. In addition, none of these costs are full social costs of recycling or waste management because they recognize market costs from energy and materials use and do not account for other external environmental impacts (see Chapter 7). Box 4-1 describes an effort to calculate this broader definition of costs by the State of Oregon.

BOX 4-1

Case Study: Incorporating Social and Environmental Costs in Oregon

As the result of a long stakeholder process, Oregon adopted a 2050 Vision for Materials Management in 2012 (ODEQ, 2012), taking a unique approach to prioritizing material management in the state. As part of the State’s extended producer responsibility program (EPR) implementation, the Oregon Department of Environmental Quality (ODEQ) evaluated a range of materials, considering their commodity value and end markets, as well as the cost of handling each material. Recyclables included on Oregon’s new Uniform Recycling List (required for curbside recycling) were all subject to a review of direct (e.g., infrastructure, labor, fuel) and indirect costs. These indirect costs include impacts from climate change; loss of ecosystem services; and illness, disability, and death (and associated health care costs). Reducing the need for extraction and production, recycling—if done well—creates “savings” of negative indirect costs, in the same way the commodity revenues create savings with negative direct costs (ODEQ, 2023a).

Direct costs of disposal other than recycling ranged from $983 to $1030 per ton as indicated by the modeling, while indirect social and environmental costs were $495–$595 per ton (ODEQ, 2023b). Recycling can perform better than disposal criteria for the material to be added to the Uniform Recycling List and included in Oregon’s new producer-funded recycling programs.

Once implemented, the state’s EPR program will pass along many of the financial costs of recycling to the producers. In Oregon, the cost of processing and marketing, rural drop-off collection, contamination management, education and outreach, and other one-time infrastructure costs are part of the EPR program covered by producers.

The discussion of recycling costs above concerns curbside programs, which are not universally available to households. When households have access only to drop-off programs, the on-budget costs of the programs are probably much lower, although estimates are not available. However, households’ time and effort costs are much higher for drop-off programs than for curbside recycling, so the overall costs of collection under these programs may be higher and participation lower.

Recycling costs fluctuate over time and vary over space for many reasons, including the cost of infrastructure, labor, and fuel, and variations in housing density and transportation distances. In addition, different municipalities offer different services and impose varying participation requirements, that also generate heterogeneity in costs. The regulatory environment may also be an important source of variation in costs, because some cities keep recycling costs low while burdening disposal with fees. Expanding household participation in recycling can help reduce the costs per ton of material recycled and thus help make recycling more competitive with landfilling.

While the data presented in this chapter thus far display recent, contemporary, and potential near-term costs of recycling programs, it is important to note potential future changes (such as developments in renewable energy seen in Box 4-2) that could have implications for direct costs of recycling and overall waste management systems.

BOX 4-2

Waste and Recycling Streams from Renewable Energy Technologies

Some installments of renewable energy technology have already reached the end of their useful life, which comes with attendant waste that largely ends up in landfills. The projected scale of waste from solar and wind energy entering landfills will be on the order of 10 million tons in the United States by 2050 (Cooperman et al., 2021; Duran et al., 2021). This waste may have ancillary economic impacts on future municipal solid waste management as it may affect the capacity and operating costs of landfills.

Solar panels contain materials (e.g., silver) that can be valuable but are present in relatively low concentrations. Some of these components can be toxic and problematic in landfills but may also be problematic for recycling. Life cycle assessments that can evaluate the environmental benefits of recycling versus landfilling and accounting for several different factors and scenarios (Smith et al., 2024).

While some materials in wind turbines can be recovered relatively easily, the blades are made of composite materials that are not currently easily recycled. They can be used as filler in concrete but are otherwise burned or landfilled. In landfills, the turbine blades can cause other complications, as their size and rigidity make them difficult to pack efficiently.

To increase the recovery of materials from renewable energy technology waste streams, more infrastructure is needed for recycling; incentives or bans are needed to prevent landfilling; and, more broadly, proactive planning is needed for end of life when developing a renewable energy installation (Duran et al., 2021).

4.2 TRADITIONAL FINANCING APPROACHES

Financing of the recycling system in the United States comes from both private and public sources. Typically, local governments, households, and commercial establishments pay for recycling collection and processing. MRFs and other recycling processors receive revenue from end markets for recycled materials and from gate tipping fees (fee per ton paid for processing by governments and collectors). This section discusses traditional financing approaches to cover the costs of recycling collection and processing that exceed the money earned from end markets, which covers only a small share of the total costs of recycling and processing.

4.2.1 Public Financing

Almost all government financing of residential recycling in the United States comes from local governments (cities, towns, and counties), with at most small contributions from higher levels of government. Some local governments use a “general fund” approach, where recycling does not have a dedicated revenue source and is funded along with other categories of expenditure. Other municipalities rely on an “enterprise fund” approach, whereby the municipality collects fees for recycling and garbage collection, perhaps as an item on property tax bills or utility bills or as an explicit charge for businesses. For residential recycling, the general fund approach is more common than the enterprise fund approach (Sheahan, 2024). Governments may use general funds for residential collection but collect fees from commercial establishments.

Local governments pay for recycling at all stages of the process. For recycling collection, they may use their own employees or contract with a recycling collector. They pay gate tip fees for processing the recyclables they collect and implicitly or explicitly pay these fees as part of their contract with a recycling collector. In addition, when recycling drop-off programs are available, either in place of or as supplement to curbside collection, they are likely to be funded by local governments. Recent data are lacking, but in 1995, governments funded the programs in 77 percent of communities with drop-off services (Walls et al., 2003). Finally, about 20 percent of MRFs were publicly owned in 2020, often by county governments (Anshassi and Townsend, 2024). These public MRFs often collect processing fees from private collectors and other governments that use their services. However, the governments that own them may use general funds to cover some costs.

In the United States, state and the federal government provide little financial support for recycling. For all solid waste management, average state spending in 2021, was $4 per capita compared with $86 per capita for local government spending (U.S. Census Bureau, 2024). Figures for recycling specifically are not available but are likely to have a similar breakdown. Recent years have seen some of the first significant federal expenditures on recycling (see Box 4-3).

4.2.2 Private Financing

Commercial establishments and households may also pay privately to have their waste collected and processed. This private funding for recycling collection falls into two categories: (1) With a “franchise” provision, the municipality requires households or establishments to subscribe directly with private firms that provide recycling services at rates and service characteristics that follow a contract with the government. Household participation in these services may be mandatory or voluntary (subscription), depending on city policy. (2) In other communities, some households may subscribe to private recycling services independently, without a publicly negotiated contract. In 2015–2016, 19 percent of residences with curbside collection had subscription-based services, which could include franchise or individually contracted services (Sustainable Package Coalition, 2016).4 Walls and colleagues (2005) found that residential private collection arrangements become much less common as population density rises.

BOX 4-3

U.S. Environmental Protection Agency Grant Programs

In 2020, Congress appropriated to the U.S. Environmental Protection Agency (EPA) $350 million for fiscal years 2022–2026 to improve waste management infrastructure and recycling (in the authorized Save Our Seas 2.0 Act of 2020 [Pub. L. 116-224] and the Infrastructure Investment and Jobs Act [i.e., Bipartisan Infrastructure Law, Pub. L. 117-58]). These funds were administered in two grant programs and one program to improve safe handling of used batteries (EPA, 2022):

- Solid Waste Infrastructure for Recycling (SWIFR) Grant Program ($275 million)

- Recycling Education and Outreach (REO) Grant Program ($75 million)

- Battery Collection Best Practices and Voluntary Battery Labeling Guidelines ($25 million)

The SWIFR grant program entails separate funding opportunities for states and territories; communities; and tribes and intertribal consortia. These grants are intended to support implementation of the National Recycling Strategy “to improve post-consumer materials management and infrastructure; support improvements to local post-consumer materials management and recycling programs; and assist local waste management authorities in making improvements to local waste management systems” (EPA, 2025b, para. 4). Awards to tribes and intertribal consortia can improve municipal solid waste management, including recycling management, and have mostly been used for materials recovery facility infrastructure (EPA, 2025a). Examples of infrastructure projects funded through SWIFR include $4 million awarded to Baltimore, Maryland, for a solar-powered compost facility and $3.3 million to Durham Country, North Carolina, for redesign of a drop-off station. States and territories receive funding to develop or improve on data collection or plan management rather than for specific investments or operational expenses.

The two other programs address social and behavioral considerations. The REO program focuses on reduction of food waste; expansion of the market for compost; and education and outreach to households. The program addressing collection of batteries primarily entails working sessions to develop best practices and guidelines (EPA, 2024).

Private collection arrangements are much more common for commercial establishments than for residences. In 1995, 47 percent of communities relied on private recycling arrangements for commercial establishments and another 6 percent had franchise arrangements (Walls et al., 2003). Commercial waste

___________________

4 73 percent of residences had curbside collection and 14 percent overall had subscription services.

makes up an estimated 55 percent of generated municipal solid waste (MSW) (EPA, 2013). Thus, private payment for recycling as a service probably contributes well over one-third of revenue for collection and processing of MSW recycling in the United States.

4.3 EVALUATING TRADITIONAL FINANCING FOR RECYCLING

The mix of financing for collection and processing of recycling (local government and private expenditures by households and firms) emerged as an extension of traditional garbage collection rather than as an active policy choice. Policymakers who seek improvements to the recycling system need to consider the strengths and weaknesses of this financial approach. This section discusses four considerations: incentives for recycling, cost control, risk management, and the distribution of financial burdens.

4.3.1 Incentives for Recycling

The current system for financing recycling both aligns and misaligns incentives with the social and environmental values of recycling. Incentives are aligned in that many of the benefits and costs of recycling vary by geographic location (see Chapter 3). Thus, if a local government receives greater benefits from recycling, it may be willing to bear higher financial costs. In contrast, financing recycling at a more centralized level, such as through the alternative financing approaches discussed later in this chapter, can reduce local control over this decision and reduce variability by community.

For example, a major benefit of recycling is avoiding the cost of disposal by landfill and incineration. Communities across the country face vastly different costs for disposal. The Northeast region had the highest waste disposal costs, with average tipping fees of $84 per ton in 2023, whereas the regional average in the Southeast was only $42 per ton (EREF, 2024). Thus, a government in the Northeast might be willing to spend twice as much on recycling (to avoid disposal costs) as would a government in the Southeast. In addition, communities vary in the value they attach to recycling (see Chapter 6); with locally organized and financed recycling, local governments can respond to the strength of local demand for recycling service.

On the other hand, many other benefits of recycling fall outside the horizon of a local government. These benefits include any gains from avoiding external costs, such as virgin material mining and production and global and regional pollution (e.g., methane from landfilling and air emissions of dioxins from incineration) (see Chapter 3). Local governments have limited direct interest in avoiding external costs because their populations are a small share of those affected. Thus, reducing external costs may not motivate local governments to offer recycling or to make it easy or extensive.

The concerns about alignment of incentives are even stronger for private financing of recycling. A commercial establishment that is paying privately for waste collection has only the incentive to sign up for recycling to reduce its own costs. Some public policy would be needed to give both local governments and private parties incentives to consider broader environmental benefits of recycling. Alternative financing approaches such as deposit-return systems, as discussed later in this chapter, can help fill in some of these missing incentives.

4.3.2 Cost Control

The current financing system provides opportunities for control of recycling costs. Almost half of local governments provide recycling collection services themselves, but 52 percent of local governments in 2017 contracted with private firms to provide recycling collection (ICMA, 2019). Because they pay for the recycling services either way, local governments have strong incentives to choose the lowest-cost options available for their circumstances. To meet local needs, they can make trade-offs regarding other features of the contract on which the local government is well informed (e.g., reliability, frequency of collection, materials collected). Private payers, such as households and commercial establishments, also apply pressure to keep costs down.

4.3.3 Management of Risk

The volatility of market prices for recyclables presents challenges for all approaches to funding recycling. MRF and other recycling processing facilities sell sorted recyclables for prices that vary dramatically over time. As discussed above, sometimes the recovered material revenue may cover MRF processing costs; at other times, it falls short.

Sometimes MRFs share this risk with municipalities. Contracts between municipalities and MRFs include provisions for sharing of revenues from the sorted materials (The Recycling Partnership, 2020b). A revenue-sharing component is typically combined with base processing fees or may enter the contract through a processing fee with a sliding scale that depends on prices (Anshassi and Townsend, 2024). Local governments typically enter into contracts of 3, 5, 7, or even 10 years with MRF owners to process and market recyclables. These contracts vary in scope and requirements but generally specify contamination rate limits, cost allocation for rejected loads, processing fees paid by the government, and share of revenue from recyclables paid to local governments after processing fees are paid. In Florida, for example, the current trend is toward higher processing fees paid by local governments and lower revenue shares to local governments (Anshassi and Townsend, 2024). Historically, MRFs charged about $50–$60 per ton to local governments, although sometimes no fee was assessed. Now, fees can reach up to $210 per ton, with an average of $107 per ton for Florida communities (Anshassi and Townsend, 2024).

Key parameters in these contracts include contamination levels and market values of materials (Anshassi and Townsend, 2024). Some contracts include minimum values for per-ton market revenue; if revenue from end markets falls below the minimum, the local government may make supplemental payments to the MRF. Lower fees are typically found when the materials are processed by a municipally owned MRF instead of a privately owned facility. In Florida, for example, MRF contracts rarely use a fixed processing fee; instead, fees (and sometimes revenue shares) are adjusted based on the fluctuating value of materials (Anshassi and Townsend, 2024). Outside of Florida, new MRF contracts sometimes have a flat tipping fee (that includes profit and annual escalators) that ensures that MRFs cover their cost and/or turn a profit. Then, in a separate agreement, the MRF might share with the municipality a portion of the end-market revenue from sale of materials (“revenue-sharing”).

When a municipality agrees to greater revenue-sharing, it accepts more of the price risk and thus may reduce average overall costs (fees less revenues). Large municipalities may be able to manage these risks by dipping into contingency funds or by reordering immediate spending. They may also have good access to credit because of favorable tax treatment of municipal bonds, which eases the difficulty of covering short-term shortfalls. When states allow municipalities to engage in short-term borrowing, residents are less likely to have to pay privately for recycling (Walls et al., 2005). However, even large governments may sacrifice other priorities when recycling markets are unfavorable, and smaller municipalities have even more trouble managing this variability without cuts to services. Thus, imposing these risks on cities and towns may be a substantial disadvantage of the U.S. traditional system for funding recycling.

These risks probably raise the prices paid by customers for private recycling services and may reduce reliability. Residential subscription services pricing does not depend on commodity revenue, so private parties that collect and process the recyclables must bear the risk of commodity price movement. They likely charge higher prices on average to compensate for the risks, raising costs for households relative to a situation in which the government accepts some of the risk. Private companies offering subscription services may also be vulnerable to closure when markets are unfavorable and may be difficult to restart once closed.

4.3.4 Distribution of Financial Burdens

Funding approaches share the costs of recycling in different ways. In particular, public financing can reduce costs for vulnerable households. When a government uses general funds for recycling, it can take advantage of revenue sources such as property taxes that impose more burden on higher-income households. Alternatively, with subscription services or an enterprise fund, every household typically pays the

same amount for the service, so low-income households pay a larger share of their income for recycling than higher-income households. Public payment for services may thus be more equitable than private funding.

However, reliance on local government financing limits the ability of the system to distribute costs across regions, because local governments can only seek revenue within their boundaries. Recycling programs may be especially expensive in rural areas, because of transportation costs and lack of access to end markets. Local governments in rural areas may also have few high-income households or large firms to tax. This combination of high costs and limited revenue opportunities may make financial burdens of recycling much higher in these areas. Relying more on state or national funding or on alternative models (e.g., extended producer responsibility, deposit-return systems) might help alleviate some of these disparities.

4.4 ALTERNATIVE FINANCING: RECYCLING PROGRAMS

In the early 1990s, European policymakers actively explored strategies for promoting environmentally responsible product design. These initiatives sought to reduce packaging, simplify recycling, and minimize waste directed to landfills. A central concept emerging from this period was extended producer responsibility (EPR), introduced by Thomas Lindhqvist (1990) in reports to the Swedish government. EPR asserts that producers should be accountable for the entire life cycle of their products and packaging. The approach aims to incorporate environmental costs into product pricing and shift the responsibility for end-of-life product management from municipalities to producers and consumers. EPR principle underpins Germany’s “Green Dot” program, launched in 1991, as well as the European Union’s 1994 Packaging Directive. The principle gained further recognition in a 2001 report by the Organization for Economic Cooperation and Development 2001), which described it as a policy framework that assigns end-of-life responsibility to producers. This approach is intended to encourage manufacturers to consider environmental impacts during the design phase (p. 9).

The concept of EPR is most directly embodied in individual—or “take-back”—policies, where manufacturers are required to reclaim product packaging, and eventually the product itself, once it has reached the end of its useful life. By imposing responsibility for disposal on the producer, these policies incentivize firms to design products and packaging with recycling and disposal costs in mind. Fullerton and Wu’s (1998) economic model captures these incentives by demonstrating how market equilibrium—achieved when firms’ production choices align with consumers’ purchasing and disposal decisions—can drive optimal product design, output, and packaging choices, accounting for external disposal costs.

The model suggests three policies that can achieve socially optimal outcomes:

- The traditional economic solution places a tax per unit of consumer disposal at a rate equal to the marginal external damage (MED). If consumers have to pay both the private marginal cost (PMC) of disposal and the MED, they will choose to buy products with the optimal designs (less packaging and easier recycling).

- A general deposit-return system applies to bottles and lead-acid batteries, which are the most commonly collected materials in these systems. Instead it would collect a tax or deposit upon sale of every product, at a rate equal to the social marginal cost (SMC) of landfill disposal, and it would provide a refund upon proper recycling. To avoid paying a higher deposit, consumers would want goods with less packaging; to receive more refund, they would want to buy products that can be recycled more easily.

- An EPR policy requires the individual firm to take back the packaging and product and pay the full social marginal cost of disposal (equal to the PMC plus MED). This policy leaves the consumer with no direct disposal costs, but they must pay a higher equilibrium break-even price for the product, because firms must cover all production costs and disposal costs.

The outcomes are equivalent: either the consumers must pay social costs of disposal, and so they demand products with less packaging and with product designs that minimize disposal costs (see Chapter 6), or the firms must pay social costs of disposal and thus design products to require less packaging and easier recycling. Thus, a “perfect” individual EPR policy would achieve the socially optimal decisions about product designs, packaging, and consumer recycling decisions.

From the very beginning of EPR rules in the 1990s, however, European countries quickly realized that the perfect individual EPR policy would not be practical. It would require each firm to collect its own packaging and keep track of each product for years until the final consumer is done with it. Having many individual firms collect their waste in disparate locations is unnecessarily expensive relative to having one hauler collect waste at every house along each street. To address these collective EPR policies take advantage of these economies of scale in collection by having a “producer responsibility organization” (PRO) can collect all packaging and used products for disposal and then charge each firm for the weight of its waste collected.

A collective EPR policy, however, is very different from the ideal individual EPR. The collective EPR forces each producer to raise their sales price to cover the cost of disposal, so it effectively becomes a different policy called an “advance disposal fee,” a charge for the purchase of a product that will ultimately require recycling or disposal. But it does not encourage the firm to increase recyclability, nor the consumer to recycle. The fee collects significant revenue, which replaces local government financing of recycling collection.

Thus, a collective EPR suffers from two significant problems not found in the “perfect” individual EPR policy. First, private firms pay the PRO’s marginal costs of collection but not the external damages from waste disposal. Thus, incentives do not necessarily align the full costs of recycling with its benefits. For example, the extent of recycling is not sensitive to whether full direct and indirect (external) local disposal costs are high (i.e., where recycling is beneficial). Second, private firms pay the cost of collecting their own total waste (i.e., average cost per ton), but this payment is based only on weight and not on recyclability. The firm therefore has some incentive to reduce the total weight but not to design for recyclability. In only rare cases does the PRO’s fee vary based on the recyclability of the materials it collects (i.e., “eco-modulation).

The economic impact of EPR varies depending on the scope of the law. For example, Canada’s first packaging EPR policy was implemented in the province of Ontario and was established as a “shared responsibility” law, where producers and municipalities share the cost of recycling programs. However, the law resulted in financing disputes and lawsuits, with the system ultimately transitioning to a packaging EPR policy in 2019 with full responsibility on producers (with full implementation by 2025).

EPR policies may have both advantages and disadvantages in the way they redistribute the burden of paying for recycling. On the one hand, the need to pay producer responsibility organization fees will likely raise certain product prices, although prices may not rise by the full amount of PRO fees. These price increase pass along the costs of recycling to consumers and perhaps discourage consumption of these goods (source reduction of MSW that might be desirable). On the other hand, low-income households spend a larger share of their income on goods and thus may end up shouldering more of the burdens of recycling than they would if recycling were financed by local property tax, which can be designed to fall more on higher income households. Thus, the fact that an EPR follows a “polluter pays” principle does not necessarily make it fairer, because lower-income households may end up more burdened than they did under local government finance.

4.4.1 EPR Policies Outside the United States

Since the 1991 German “Green Dot” program, use of EPR policies has extended throughout the globe. EPR as a policy lever has grown, from voluntary programs and lightly enforced laws in Southeast Asian countries, to shared responsibility programs in the Canadian provinces of Manitoba and Saskatchewan, and to far-reaching producer responsibility programs in British Columbia and Quebec.

Empirical research supports the concern that collective EPR policies do not create the desired effect on product design. Joltreau (2022) studied the effects of European EPR policies, using data on the annual cost to comply with EPR from the organization PRO Europe (Packaging Recovery Organisation Europe) for 25 European countries and four packaging materials over 18 years (1998–2015). EPR rules vary in their stringency about the percentage of each firm’s total cost that must be paid and what materials can be recycled. Joltreau (2022) argues that compliance cost is an effective overall measure of stringency and scope and observes the causal effects of EPR stringency on the amount of packaging and on substitution between packaging materials. Joltreau (2022) found that European EPR rules have a statistically significant but very small effect on the weight of packaging and no effect on substitution toward a type of material that could more easily be recycled.

What can be done to reestablish the original goal of using EPR policies to create incentives for recyclability? A recent innovation of EPR legislation in the European Union and North America is the development of “eco-modulation” of fees on producers. Eco-modulated fees vary by product characteristics, and they reward firms that design products to be more recyclable or to be more environmentally friendly. Lifset and colleagues (2023) discuss ideas for restoring the incentives for eco-design by using eco-modulation within EPR systems; they considered choices around products to be included in the fee structure, objectives to be pursued, criteria to be employed, differentiation within the structure of fees, and the amount of each fee to be charged. These choices all depend on the goal of the EPR system, such as (1) to achieve selected policy targets for eco-design, for recycling, or for all product-life management, including product durability and the ability to repair or to reuse it; (2) to account for the presence and toxicity of hazardous substances; (3) to charge for external costs of disposal and thus achieve socially optimal disposal; or, more comprehensively, (4) to cover external costs of production (Lifset et al., 2023).

Ultimately, Lifset and colleagues (2023) propose a fee structure based on each product’s impact on the environment as measured through a life cycle assessment. They also recommended requiring better data from PROs about product characteristics and better use of those data for ex post policy evaluation. However, even eco-modulated charges do not vary with all the dimensions of heterogeneity in cost of recycling by location and over time, so they fall short of the ideal of imposing a tax that reflects the external costs of disposal for specific material types—a tax that would provide incentives for consumers to demand products with optimal durability, eco-design for reusability, and recyclability.

4.4.2 EPR for Packaging in the United States

For over 2 decades, many states have used EPR policies to fund and manage “hard to handle” materials. According to the Product Stewardship Institute (2025), 33 states and the District of Columbia have enacted 141 laws across 20 product categories. These policies have mostly addressed electronics, mercury thermostats, batteries, pharmaceuticals, paint, fluorescent lighting, and mattresses. What is more, the U.S. Environmental Protection Agency (2024) has published guidance on EPR policies for preventing plastic pollution (see Box 4-4).

Responsibility for waste and recycling management is decentralized in the United States, with authority delegated to individual states. This structure complicates efforts to implement federal recycling legislation, resulting in a patchwork of state and local recycling policies. Maine led the United States in passing a packaging EPR policy in 2021, followed by Oregon in 2021, Colorado and California in 2022, and Minnesota in 2024. Each has different financing and regulatory requirements (see Box 4-5). These states have used the policy as an opportunity to address other related packaging and recycling goals, as the new laws included regulatory requirements that are not part of the EPR policies themselves. In each of these five states, the enacted EPR legislation for packaging reflects the varying recycling gaps and perceived needs for that state. California and Oregon’s bills were born of frustration about the growing use of plastic packaging and its low recycling rates, while Colorado’s legislation (see Box 4-6) was driven by the high cost of recycling and low recycling rate. The need for economic support is also clear in the structure of Maine’s law, while Minnesota is looking for future increases in its recycling program investments.

BOX 4-4

EPA National Strategy to Prevent Plastic Pollution: EPR Framework

In November 2024, the U.S. Environmental Protection Agency (EPA) (2024) finalized its National Strategy to Prevent Plastic Pollution, a comprehensive plan aimed at eliminating plastic waste from the environment by 2040. A cornerstone of the strategy is the proposed development of a national extended producer responsibility (EPR) framework, which would assign greater accountability for managing plastic waste to producers and manufacturers rather than municipalities. This policy aligns with international practices that require producers to take responsibility for the end-of-life management of their products, fostering a more circular economy. The strategy is organized around six objectives: reducing pollution from plastic production, encouraging innovation in sustainable material design, minimizing waste generation, enhancing waste management systems, improving plastic capture and removal, and reducing impacts on waterways and oceans (EPA, 2024).

The EPR framework is currently in its conceptual stage, with significant stakeholder engagement and policy development needed to translate it into a functional national program. Existing EPR programs in states such as Oregon, Maine, and California provide valuable insights and precedents, but aligning these diverse approaches into a cohesive federal framework remains a challenge. A national EPR system could standardize recycling and reuse targets, streamline efforts, and reduce inefficiencies. However, concerns have been raised regarding the potential economic impacts of implementing such a framework. These include increased operational costs for producers and the possibility of manufacturing activities relocating overseas. Successfully addressing these challenges may require collaboration among producers, policymakers, and environmental organizations to design a system that balances economic viability with the overarching goals of reducing plastic waste, improving resource efficiency, and advancing sustainability.

SOURCE: EPA, 2024.

BOX 4-5

Case Studies: State-Level Packaging and Postconsumer Recycled Content Legislation

Several states address packaging waste using extended producer responsibility (EPR) and postconsumer recycled content policies. These policies can improve recycling systems, reduce environmental impacts, and advance sustainable materials management through regulatory and market-driven mechanisms.

Maine (LD 1541)

In 2021, Maine became the first state to enact an extended producer responsibility (EPR) law for packaging. The legislation requires producers to fund recycling programs through producer responsibility organizations (PROs), which oversee the collection and recycling of packaging materials. This law primarily focuses on financing recycling systems, transferring cost burdens from municipalities to producers.

Oregon (Senate Bill 582)

Oregon’s EPR law establishes a comprehensive framework for managing single-stream recyclables. It includes eco-modulated producer fees, life cycle assessment requirements, and recycling capture rate targets. The state’s Department of Environmental Quality plays an integral regulatory role, particularly in addressing greenhouse gas impacts of recycling. Implementation is scheduled for 2025, excluding curbside collection costs already covered in urban and suburban areas.

Colorado (HB 1355)

Colorado’s EPR law, passed in 2022, is one of the most comprehensive in the United States, requiring producers to cover all recycling system costs, including collection, processing, and market risk. The legislation mandates postconsumer content standards and provides funding for both traditional and compostable packaging management. The program will be operational by 2029, with a PRO responsible for implementation and performance monitoring.

California (SB 54)

California’s SB 54 requires substantial packaging reductions and recycling improvements, including a 25 percent reduction in single-use plastics and a 65 percent recycling rate by 2032. Noncompliant packaging will be prohibited from sale in the state. The law also includes robust enforcement mechanisms, annual payments to environmental programs, and detailed reporting requirements for producers.

Minnesota (HF 3911)

Minnesota’s EPR law incorporates a shared responsibility model, where producers reimburse municipalities for recycling costs, gradually increasing their financial contributions to 90 percent by 2031. Municipalities retaining operational control will receive funding to offset program expenses, while a PRO oversees operations in areas without municipal programs.

U.S. producers have lobbied for shared responsibility programs in several states. The result is a partial funding system in Oregon5 and a phased-in fee approach in Minnesota.6 Colorado’s program7 is a full producer responsibility program, where producers cover 100 percent of the costs and have broad program oversight. Full funding requirements come with the expectation of control by the producers, which is contentious in the United States because of existing public and privately funded systems.

EPR policies often have a basic fee structure, with specific discounts or penalties for products with specific characteristics. Eco-modulated fees have been built into programs in France and Canada, as well as some state programs in the United States. For example, California requires that producer responsibility organizations differentiate fees to reflect the presence of recycled content (CalRecycle, 2021). The State of Oregon has one of the more advanced eco-modulation systems, as described in Box 4-7.

With the exception of Maine’s law, which serves primarily as a funding mechanism for recycling, the legislation includes specific requirements for producers to use postconsumer content in packaging, to achieve recyclability requirements, and to reduce waste. These requirements are all in addition to the producers’ financial obligations to fund varying aspects of the state’s recycling programs. Since producers must achieve the specified regulatory goals in order to sell their products in each state, the linkage between the financing requirements and the additional regulatory requirements creates an enhanced element of pressure on producers.

The Circular Action Alliance (CAA) is a 501(c)(3) nonprofit entity governed by a board of directors initially comprised of leaders from 20 corporations. The organization has established a national “umbrella” organization to respond to state EPR laws in the U.S. CAA works with producers that pay fees based on the specific requirements of each state’s EPR program. CAA then establishes state-specific nonprofit organizations to manage the individual state EPR programs.

In the European Union, recycling packaging requirements are separate laws as part of the EU Waste Directive and are not built into the EPR funding laws. Conversely, U.S. state packaging requirements are built into the EPR policies, so they raise the stakes for packaging performance tied directly to providing the service in each state. In the United States, PROs manage compliance with state-specific EPR laws, coordinating services such as the collection, processing, and recycling of packaging materials, often in collaboration with municipalities or private service providers. EPR is being layered onto existing waste management and recycling programs in the United States (rather than creating new programs as in other countries). Thus, some companies within the U.S. recycling industry view EPR as a significant risk to their business invest-

___________________

5 Oregon State Legislature. Senate Bill 582: Plastic Pollution and Recycling Modernization Act. 2021 Regular Session. https://olis.oregonlegislature.gov/liz/2021R1/Measures/Overview/SB582.

6 Minnesota Statutes §§ 115A.144–115A.1463 (2024).

7 Colorado General Assembly. House Bill 22-1355: Producer Responsibility Program for Recycling. 2022. https://leg.colorado.gov/bills/hb22-1355.

ments. To mitigate this concern, legislative negotiations in states with EPR policies have included requirements to prioritize the use of existing recycling facilities and to allow cities to continue to provide their own service or to contract with private service providers. Additionally, needs assessments can help states create effective EPR policies (Box 4-8).

BOX 4-6

Case Study: Colorado’s Extended Producer Responsibility Policy

The State of Colorado is in the process of implementing an extended producer responsibility law requiring the producers to cover all of the costs of the State’s residential recycling programs, as well as recycling programs for small and hospitality commercial business, and government entities.

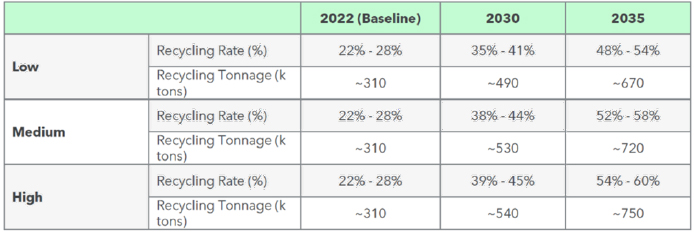

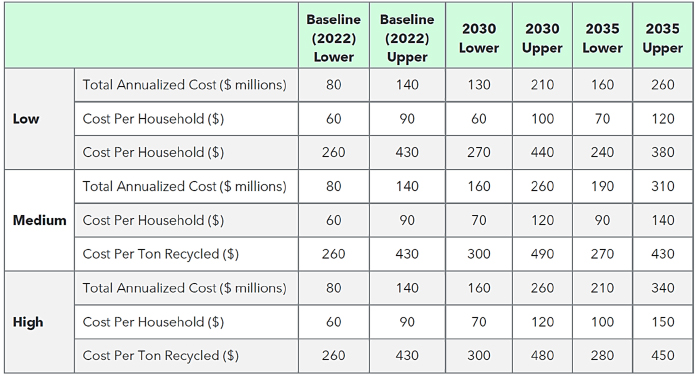

As part of that process, the producer responsibility organization for the state, Circular Action Alliance, conducted a needs assessment of services available—and gaps that remain to evaluate the revenue it will need to charge to producers to achieve the requirements of the statute (see Table 4-2).

TABLE 4-2 Colorado Needs Assessment – Estimated Recycling Outcomes per Scenario

SOURCE: Adapted from tables provided by CAA, 2024.

The state approved the medium scenario, requiring significant investments in infrastructure throughout the state, resulting in the estimated costs shown in Table 4-3, ranging from the baseline costs (2022) to the cost of the program when it is fully implemented in 2035.

TABLE 4-3 Colorado Needs Assessment – Estimated Costs er Scenario

SOURCE: Adapted from tables provided by CAA, 2024.

The medium cost is estimated to be $90/household/per year in 2022, growing to $140/household/year in 2035 when the program is fully implemented and all residents in the state will be able to recycle a long list of materials. The projected future costs in Colorado track more closely to the costs in Washington and California, since they reflect higher levels of service and greater participation (more trucks on the street and more material to manage as recyclable).

SOURCE: CAA, 2024.

BOX 4-7

Case Study: Oregon’s EPR Policy

The State of Oregon’s extended producer responsibility (EPR) policy mandates that producer responsibility organizations (PROs) adjust fees to provide incentives for actions that reduce the environmental and human health impacts of covered products (e.g., changes in the design, production, and distribution of products (ORS 459A.884[4]). The PRO must propose criteria for adjusting fees and for the magnitude of the adjustments. The Oregon Department of Environmental Quality (ODEQ) plays an important role in developing the fees by providing formulas for the PRO to use in evaluating fee-setting for eco-modulation.

Impacts of concern related to packaging include climate change, toxicity, and microplastic pollution. These factors contribute to two of six “planetary boundaries” for climate and novel entities (i.e., toxic and long-lived substances released to the environment).

In 2024, ODEQ (n.d.) recommended that PROs develop eco-modulation formulas that:

- Incorporate ODEQ’s rules for life cycle evaluation. The approach should verifiably deliver environmental benefits based on the normalized and weighted results calculated following ODEQ’s rules of life cycle evaluation.

- Grant at least as many malus fees (penalties) as bonus fees, rather than emphasizing bonuses over maluses, to communicate adequate urgency for system change.

- Increase the magnitude of fee adjustments over time to maximize their effect.

While some producers view EPR as a regulatory burden, others see it as an opportunity to gain greater control over packaging standards and materials, aligning compliance efforts with their sustainability goals. To achieve high recycling rates, producers need households to recycle more, resulting in more recyclable feedstock.

4.4.3 Deposit-Return Systems

In a deposit-return (or deposit-refund) systems (DRSs), consumers pay a small amount when buying a product—often beverages in single-use cans and bottles. This amount is reimbursed to them when they bring the empty beverage container to a collection point with a vending machine or manual handheld scanning readers.

BOX 4-8

Case Studies: State-Specific Needs Assessment Laws

Several states have enacted laws to evaluate existing recycling systems and identify gaps in infrastructure, capacity, and costs. These needs assessment laws are foundational steps toward the development of comprehensive recycling and EPR programs, offering insights to guide future legislative and programmatic actions.

Illinois (Public Act 103-0383): This law directs the state to conduct a comprehensive statewide recycling needs assessment to identify service gaps, evaluate current infrastructure capacity, and analyze costs associated with packaging and paper recycling.

Maryland (SB 222): Maryland’s legislation requires an assessment of both traditional recycling and organics processing capacity. The findings will inform the establishment of a producer responsibility program for packaging materials, with recommendations developed by a designated advisory council.

A DRS replaces the local government as the party responsible for funding and managing the recycling of the items it covers. The collection or redemption center manages their collection and is usually funded from the DRS. This system can encourage consumers to recycle containers rather than dispose of

them in the regular waste stream, and it penalizes the person who buys the container if they do not recycle it. As discussed in Box 3-3 in Chapter 3, an idealized version of a DRS could fully internalize the external costs of waste disposal without creating incentives for illegal disposal (Fullerton and Kinnaman, 1995). Moreover, a DRS can be generalized to apply not just to containers or batteries, but to help reduce pollution from any kind of material (Fullerton and Wolverton, 2000).

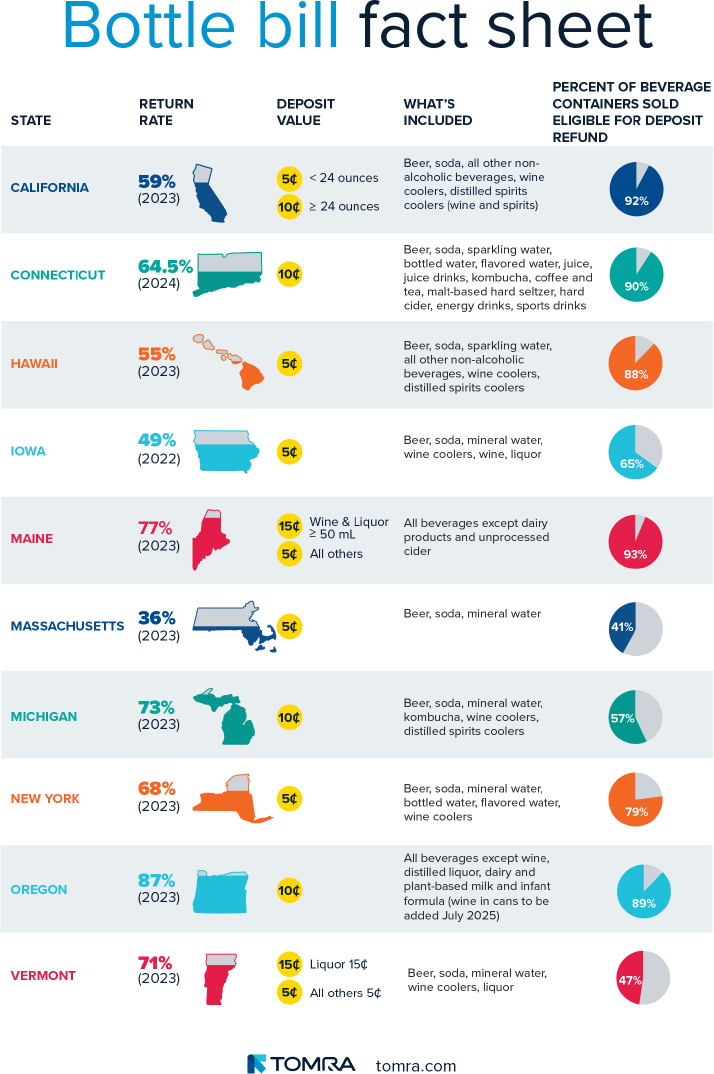

In the United States, ten states have deposit-return policies requiring fees on the sale of beverage containers. The process typically involves a network of collection points where consumers can return their containers; these may be located in supermarkets, recycling centers, or stand-alone automated machines. Once the containers are returned, they are sorted, cleaned, and prepared for recycling. This system is also commonly used for hazardous household wastes, because it can promote recycling and remove these materials from the ordinary solid waste stream. For example, DRSs in U.S. states and several other countries include collections for lead-acid batteries, motor oil, and tires (Sigman 2020).

NCSL (2020) also summarized DRS legislation in these ten states (see Table 4-4).8 Notably, not much meaningful policy variation has occurred in the last 15 years. Exceptions include Oregon, which added products to the program as recently as 2018, and California, which expanded its DRS in 2024. See Box 4-9 for a case study on California’s DRS.

TABLE 4-4 Deposit-Return Programs in the United States

| State | Statute | Year | Summary Deposit Amount | Summary Beverages Covered |

|---|---|---|---|---|

| California | Cal. Public Resources Code §§14501–14599 | 1986 | 5¢ (<24 oz.) 10¢ (≥24 oz.) |

Beer, malt, wine, and distilled spirit coolers; all non-alcoholic beverages, except milk |

| Connecticut | Conn. Gen. Stat. §§22a-243–22a-246 | 1978 | 5¢ | Beer, malt, carbonated soft drinks (including mineral and soda water and any type of other flavored water), bottled water (bottled water covered starting in 2009) |

| Hawaii | Hawaii Rev. Stat. §§342G-101–342G-122 | 2002 | 5¢ | Beer, malt, mixed spirits and wine; all non-alcoholic drinks |

| Iowa | Iowa Code §455C.1–455C.17 | 1978 | 5¢ | Beer, wine coolers, wine, liquor, carbonated soft drinks, mineral water |

| Maine | Me. Rev. Stat. Ann. tit. 38, §§3101–3118 | 1976 | 15¢ (wine/liquor) 5¢ (all others) |

All beverages |

| Massachusetts | Mass. Gen. Laws Ann. ch. 94, §§321–327 | 1981 | 5¢ | Beer, malt, carbonated soft drinks, mineral water |

| Michigan | Mich. Comp. Laws §§445.571–445.576 | 1976 | 10¢ | Beer, wine coolers, canned cocktails, soft drinks, carbonated and mineral water |

| New York | N.Y. Environmental Conservation Law §§27-1001–27-1019 (Amended 2013 SB 2608) | 1982 | 5¢ | Beer, malt, wine coolers, carbonated soft drinks, soda water, and water not containing sugar |

| Oregon | Or. Rev. Stat. §§459A.700–459A.740 | 1971 | 10¢ 2¢ (standard refillable) |

Beer, malt, carbonated soft drinks, bottled water (will cover all beverages except wine, distilled liquor, milk, milk substitutes and infant formula by 2018) |

| Vermont | Vt. Stat. Ann. tit. 10, §§1521–1529 | 1972 | 15¢ (liquor) 5¢ (all others) |

Beer, malt, mixed wine, liquor, carbonated soft drinks |

| Guam | Guam Code tit. 10, §§44101–44119 | 2010 | 5¢ | Beer, ale, malt, mixed spirits, mixed wine, and all non-alcoholic beverages |

SOURCE: NCSL, 2020.

___________________

8 See https://www.ncsl.org/environment-and-natural-resources/state-beverage-container-deposit-laws.

BOX 4-9

California’s DRS Programs: A Redemption Value Case Study

California established a deposit-refund system (DRS) in the AB2020 Act, which requires consumers to pay a redemption value for each eligible beverage container. The retailer charges consumers the California Redemption Value (CRV) at the point of purchase. When the container is empty, the consumer can take it to a certified drop-off recycling center and receive a refund of the same CRV amount.

Heterogeneous Responses to the Refund Program

Berck and colleagues (2021) focused on the demand side of the recycling system and summarized some of the evidence around the efficacy of the California Department of Recycling (CalRecycle) deposit-refund recycling program in conjunction with other recycling alternatives, such as curbside recycling pick-up—in providing convenient recycling options to consumers.

Using a representative sample of 1,000 Californian adults, Berck and colleagues (2021) found that 23 percent of respondents used drop-off recycling centers. Respondents seem to find recycling generally convenient and worth their time. About 32 percent of respondents reported using curbside recycling, and 5 percent reported recycling at a business or place of worship outside their home. Notably, those who reported using the latter two options were wealthier and more educated than those who report using drop-off recycling centers. Less affluent households had lower opportunity costs of time and hence were more likely to find it worth their time and energy to redeem their CRV at the drop-off recycling centers instead of using curbside recycling.

Black and Hispanic respondents were less likely to use curbside programs than others, and more likely to return material through drop-off recycling centers (Berck et al., 2021). Berck and colleagues (2021) asked survey respondents whether a change in the CRV would encourage them to return containers to drop-off recycling centers. The number of people who said they would redeem their containers at a drop-off recycling center increased with the CRV. Of the people who said that they were currently throwing their beverage containers in the trash, it took an increase in the CRV from 5 cents to 15 cents before more than half said they would start taking containers to a drop-off recycling center. Among those currently using trash for disposal, only 11 percent said they would redeem at a drop-off center if the rate were increased to 7 cents. The survey respondents who use curbside were much more responsive to a potential increase in CRV than those who threw out their containers. The same increase of CRV to 7 cents would lead to a 34 percent reallocation of recycling from curbside to drop-off recycling centers (Berck et al., 2021).

Counterfactual Policy Effects

In a follow-up study, Berck and colleagues (2024) simulated whether an increase in the CRV amount would (1) increase the overall recycling rate, (2) simply induce a switch in recycling methods, or (3) have no effect at all. The answer was not clear ex-ante; the authors found that those who currently recycled but did not redeem their CRV (e.g., through curbside recycling) and those who use trash disposal may or may not be sensitive to small changes in the CRV amount.

Berck and colleagues (2024) found that doubling the CRV amount would induce only a modest increase in overall recycling (and the benefits of this policy would mostly accrue to wealthier individuals). Hence, an increase in the CRV amount may not be the optimal policy to increase recycling. Berck and colleagues (2024) consider the effect of reducing or eliminating the state’s subsidy for handling fee centers. A 2008 policy change that reduced handling fee payments for some centers caused many of these centers to close. In addition, many drop-off recycling centers throughout California have closed in response to China’s 2017 decision to restrict imports of recyclable materials (i.e., the National Sword Policy), further limiting drop-off recycling center options for consumers. This development affected all drop-off recycling centers, not just handling fee centers, but it has further reduced the ability of handling fee centers to operate without a state subsidy. Berck and colleagues (2024) use the model estimates to predict recycling options under counterfactual hypothetical closures of nearby convenient handling fee centers. They find that handling fee center users would generally just switch to using processing fee centers. Hence, the fear of consumers not having convenient recycling options without handling fee centers is likely unfounded.

4.4.4 Benefits of Deposit-Return Systems

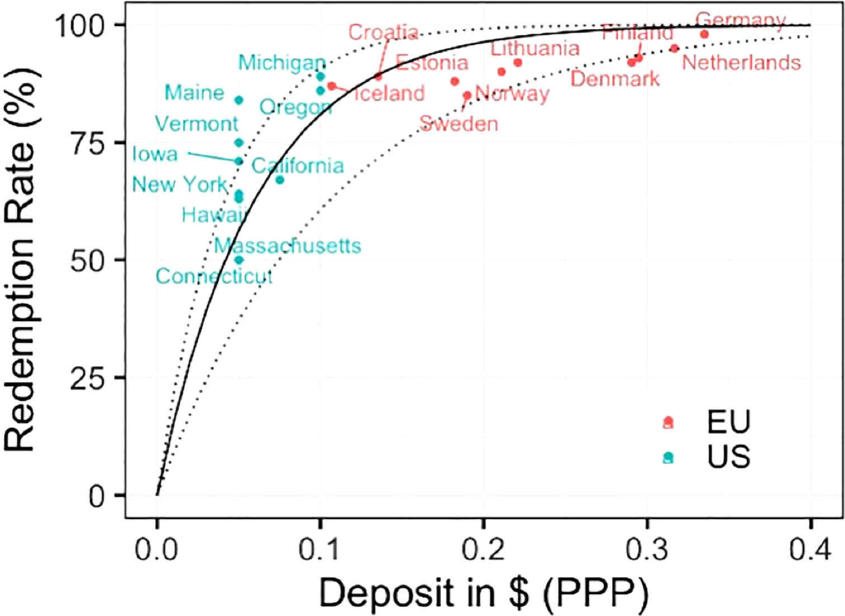

A unique feature of DRSs is that they provide incentives directly to consumer and commercial establishments to return their containers for recycling. Not surprisingly, recycling rates of these containers are much higher with a DRS than without one. For example, states that implemented a DRS for polyethylene terephthalate (PET) bottles saw a 56 percent recycling rate, compared with 18 percent in states with no such system (Container Recycling Institute, 2024). Globally, recycling rates exhibit a strong positive association with the deposit fee and refund amounts, (see Figure 4-4).

To determine the causal effect of DRSs and to address place-based selection bias, Viscusi and colleagues (2012) conducted a difference-in-difference analysis, comparing the change over time in two states that extended their DRS to include plastic bottles with changes in states that did not. After the extension, the number of households that recycled increased by a statistically significant 8.5 percent. Likewise, Ashenmiller (2009) assessed the material brought in for rebates to California recycling centers and concluded that 36–51 percent of the material would not otherwise have been collected. In 2017, Oregon increased its deposit from 5 cents to10 cents, because of a provision that increases the deposit when the recycling rate falls below a certain threshold, and saw an immediate increase in the recycling rate of the bottles covered in its program from 64 percent to 81 percent. Their recycling rate for covered bottles is estimated at 90.5 percent for 2023, according to the Oregon Beverage Recycling Cooperative (2023).

DRSs may have other benefits as well. First, given the high degree of sorting involved in returning beverage containers to recycling systems, a DRS can provide a cleaner recycling supply stream with less contamination relative to material collected at the curbside. This source-separated waste has higher value for end uses and is less likely to be diverted to landfill.

NOTE: PPP = purchasing power parity.

SOURCE: Basuhi et al., 2024. CC-BY-NC-ND.

Second, the initial justification for using these systems for beverage containers included litter reduction; empirical research finds that they have been successful in this area. Levitt and Leventhal (1986) observed that New York’s bottle bill reduced litter near highway exits and railways by a statistically significant 44 percent. And, using data from the United States and Australia, Schlyer and colleagues (2018) found that containers constitute a 40 percent lower share of coastal debris surveys in states with container DRSs. Similarly, Critchell and colleagues (2023) found that adopting a DRS significantly reduced plastic marine debris in Australia.

Third, these policies may have broader social benefits. Ashenmiller (2009) found that the beverage container DRS provide a significant source of income for a group of very-low-income “professional” recyclers. Extending this logic, she found that adopting beverage container DRS reduces petty crime by 11 percent (Ashenmiller, 2010).

4.4.5 Disadvantages of Deposit-Return Systems

Despite their many demonstrated advantages, deposit-return systems may have important disadvantages as well. First, while these programs increase the recycling of beverage containers through monetary incentives, they also remove high-value materials such as aluminum and PET bottles from the curbside stream. Studies have shown that aluminum and PET bottles are a small percentage of the recycling stream by weight but contribute disproportionately to MRF revenue because of their higher market value (Container Recycling Institute, 2022). Diverting these materials from the curbside stream reduces revenue for MRFs and could negatively impact the financial sustainability of curbside programs (unless MRFs were to receive some of the net revenue from the DRS). In fact, curbside recycling programs sometimes need to enforce against theft of containers from curbside bins (Lange, 2012).